On the occasion of the 29th anniversary of the bank’s founding, Mr. Ta Kieu Hung, CEO of NCB, shared the journey of the bank’s “swimming against the tide.”

NCB offers many promotions for customers on the occasion of its 29th anniversary.

|

NCB today is very different from what it was two years ago.

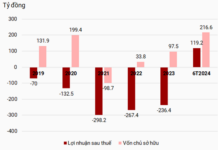

Mr. Hung shared that the past two years have marked many important milestones for NCB after a period of internal stability and building a foundation for a new development journey. NCB is in the process of completing the procedures to increase its charter capital from VND 5,601 billion to over VND 11,800 billion and is expected to complete the capital increase in Q4/2024. According to the roadmap, NCB will continue to increase capital, and the expected scale of charter capital will reach over VND 29,000 billion by 2028.

NCB also inaugurated its new headquarter in one of the prime locations in Hanoi and rearranged its network and upgraded facilities across the system. Through this, NCB expects to bring new experiences to customers and better working conditions for its employees.

The most important milestone is that NCB has worked with the world’s leading strategic consulting partners to develop a new strategy for the bank and has been determined to implement it since the beginning of 2024 with all resources.

Up to now, NCB has been investing heavily in digital transformation to enhance customer experience and build solid trust in the community, recognized by a series of prestigious awards and positive growth figures, especially in total assets, customer growth, capital mobilization, and service activities in the context of many challenges in the market and the restructuring process.

NCB has set new goals beyond the restructuring story that the market has known so far.

The CEO of NCB shared that bank restructuring is a journey that requires determination, perseverance, and many efforts. The past year was also a period of new progress for NCB in the restructuring process. With the companionship of reputable consulting units that are leading in the world and in Vietnam in the field of bank restructuring, NCB has built a Restructuring Plan with a vision towards 2030. Up to now, NCB is the first credit institution in Vietnam to be considered and approved by the State Bank and competent authorities for its Restructuring Plan.

NCB has started implementing the plan urgently and determinedly according to the roadmap since Q2 and aims to complete it by 2029, making NCB become one of the reputable, healthy, and efficient banks.

“However, focusing on resolving the backlog and comprehensively overcoming the existing problems does not mean that we stop developing and renewing ourselves. As I have shared, NCB is still vigorously implementing the new strategy with the highest determination of the entire system and strong investment from all resources. We choose the right path to become a bank that provides beloved financial services and solutions in the market. We call this period the ‘journey of soaring’ towards new standards to contribute more to society’s development,” expressed Mr. Hung.

Building products in the field of wealth management is NCB’s long-term strategy.

NCB has chosen for itself a development strategy with a long-term vision to bring new experiences in the banking field through innovative, creative, and pioneering thinking in developing products and services on advanced technology platforms, aiming to become a socially responsible bank that contributes to the sustainable development of the community it serves.

In the next five years, NCB will develop products in the field of wealth management through technology to provide to the mass customer segment when the demand for professional and long-term financial investment of this segment is expected to grow strongly in the future. However, this is also a market with many challenges because it is a new and challenging field for the mass segment to participate in long-term and professional investment. NCB will strive to bring innovative products with the support of technology to provide customers with financial management solutions similar to those in international markets with simple and modern experiences.

NCB is “small but powerful.”

In the context of the post-COVID and economic crisis, the economy, in general, and the banking industry, in particular, face many difficulties and obstacles, but NCB chooses to take on a more challenging task.

As a small bank, NCB faces many challenges. But even in the most challenging moments, NCB is fortunate to have the unity and high determination of the entire system, which is the determination to turn challenges into opportunities. Opportunities for comprehensive transformation, opportunities for a superior transformation, and opportunities for those who choose to “go through the eye of a needle” to achieve different success.

What the market considers a disadvantage, NCB perceives as an advantage. “Many people call us a ‘small’ bank, and I would like to use a different term to motivate ourselves, a bank that is ‘small but powerful.’ And this small feature helps us be more flexible and adaptable while also having a correct long-term vision. NCB can implement new solutions, models, and technologies more quickly, effectively, compactly, and conveniently. At the same time, we choose to ‘stand on the shoulders of giants’ with the companionship of large and reputable partners worldwide and regionally, such as GCP, E&Y, KPMG, CMC Telecom, and LUMIQ, Zoho Corporation, etc. They provide us with knowledge and technology advantages to realize our ‘soaring journey,’ affirmed Mr. Hung.

Especially, NCB has also received the support and close direction of the management agencies for the phase of implementing the Restructuring Plan. That is an essential foundation for NCB to confidently move on the path of financial transparency.

Where is NCB in its journey?

The NCB ship has started its journey with the unity of the entire system. Resources in capital, infrastructure and technology solutions, management capabilities, and human resources have been strongly promoted by NCB to meet the demands of comprehensive digital transformation and build a new NCB according to the strategy.

Last year, NCB signed and implemented a series of solutions, such as Cloud Computing and Data Lake Platform on the Google Cloud platform, Customer Relationship Management (CRM) Platform, Artificial Intelligence and Machine Learning (AI/ML) Platform, Decision Engine Project, etc., with leading global technology partners. In addition, NCB also worked with KPMG to implement projects to perfect the internal control system suitable for the bank’s development strategy in the next five years.

“We have the participation of many senior personnel who are talented and experienced domestic and foreign experts to help NCB implement the transformation roadmap. The bank is also urgently deploying to be ready to launch a new brand identity and Mobile App with a new interface and truly unique features next year,” emphasized the CEO of NCB.

“Phú Mỹ Fertilizer Plant: 2 Decades of Bountiful Harvests”

The decision to build the Phu My Fertilizer Plant was a bold move by Petrovietnam, and it has proven to be an incredibly wise one. For over two decades, the plant has been a stable and efficient producer of fertilizer, playing a crucial role in the growth of Petrovietnam and Vietnamese agriculture.

Sure, I can assist with that.

One Vision, Two Pillars, Three Strategic Breakthroughs, Four ‘Nos’, and Five Enhancements: The Path to Excellence in Online Public Services

“Prime Minister Pham Minh Chinh emphasized the significant role of digital transformation, stating that it contributes to changing the methods of leadership and instruction to suit new circumstances, thereby enhancing policy responsiveness. He outlined a clear vision for the future of online public services, encompassing 1 goal, 2 pillars, 3 breakthroughs, 4 non-negotiables, and 5 areas for strengthened action.”