Liquidity this morning also recorded a good improvement, with the VN-Index matching volume reaching over 302 million units, equivalent to a value of more than 7.7 trillion VND, up nearly 64% from the previous low. The HNX-Index recorded a matching volume of more than 30 million units with a value of nearly 505 billion VND.

Source: VietstockFinance

|

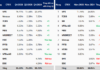

VCB, CTG, and BID are currently the three main pillars positively influencing the market, helping the VN-Index gain more than 4 points. On the other hand, the stocks with the most negative impact include BCM, NAB, and KDH, but their impact is negligible.

All sectors are currently painted with positive green. Notably, the telecommunications group stands out with a 7.79% increase. Large-cap stocks in this group are witnessing a strong breakout, including VGI (+9.76%), CTR (+6.98%), FOX (+2.14%), and VNZ (+4.31%).

Following closely are the information technology and healthcare sectors, with gains of 1.54% and 1.27%, respectively. Notable mentions in these two groups are FPT (+1.43%), CMG (+3.93%); IMP and FIT hitting the ceiling price, LDP (+8.81%), DAN (+9.28%), DVN (+2.72%), and DTP (+1.81%).

In the financial sector, most securities stocks are recording outstanding gains, typically HCM (+5.86%), VDS (+4.65%), VFS (+3.76%), MBS (+3.64%), SHS (+3.33%), and SSI (+3.06%). In addition, most of the “king” stocks are also covered in green, making a significant contribution to the rise of the general index, such as VCB (+1.44%), BID (+1.13%), CTG (+3.58%), TCB (+1.32%), STB (+1.68%), SSB (+1.62%),… However, quite a few insurance stocks are experiencing unfavorable performance, typically BIC (-1.29%), PVI (-0.44%), PTI (-2.05%), and AIC (-1.72%). Meanwhile, BVH, MIG, and BMI rose slightly by less than 1%.

Foreign investors continued to net buy this morning, with a value of more than 200 billion VND on the HOSE exchange. Among them, FPT is still the stock favored by foreign investors, net buying the most with a value of more than 88 billion. In contrast, VPB and KDH are the two codes that are being sold the most by this group (more than 50 billion).

10:30 am: Investor sentiment continues to improve

Investors’ optimistic sentiment was maintained after the previous good increase, helping the main indices maintain a positive green. The VN-Index increased by 5.53 points, trading around 1,264 points. HNX-Index increased by 0.63 points, trading around 232 points.

The breadth of stocks in the VN30 basket mostly rebounded well. Notably, VHM, FPT, SSB, and MWG contributed 0.99 points, 0.69 points, 0.38 points, and 0.35 points to the VN30 index, respectively. On the other hand, HDB, ACB, HPG, and SHB are the stocks still under selling pressure, but their impact on the index is insignificant.

Source: VietstockFinance

|

Telecommunications stocks were in positive territory from the start of the session. Specifically, VGI rose 5.37%, CTR rose 4.74%, FOC rose 1.69%, and ELC rose 1.47%… In addition, this industry currently has outperformed the VN-Index since the beginning of the year. Although there has been a significant decline from July 2024 to the present, it is still the group with the best performance among the industries in the market.

Source: VietstockFinance

|

Following that, the healthcare sector also contributed to the market’s overall gain, although the performance was still polarized. Specifically, on the recovery side, IMP rose 6.93%, DCL rose 1.12%, DBD rose 0.95%, and DVN rose 1.95%… Meanwhile, NDC, PMC, TRA, and DMC remained unchanged, while some codes still faced selling pressure, such as DP3 falling 0.78%, DTG falling 2.02%, and TNH falling 0.23%…

Compared to the opening, the buying side still has the upper hand. The number of gainers was 362, while the number of losers was 173.

Source: VietstockFinance

|

Opening: Caution from the start of the session

At the start of the September 18 session, as of 9:30 am, the VN-Index fluctuated around the reference level, reaching 1,258.09 points. Meanwhile, the HNX-Index edged higher to 232.56 points.

The government has just issued Resolution No. 143/NQ-CP dated September 17, 2024, on key tasks and solutions to urgently overcome the consequences of Storm No. 3 (Yagi), quickly stabilize the situation of the people, promote the restoration of production and business, actively boost economic growth, and control inflation.

The resolution estimates the total property damage caused by Storm No. 3 at over 50,000 billion VND. It is predicted that it could reduce the GDP growth rate for the whole year by about 0.15% compared to the growth scenario of 6.8-7%. The economic growth rate of many localities such as Hai Phong, Quang Ninh, Thai Nguyen, Lao Cai… may decrease by more than 0.5%.

As of 9:30 am, large-cap stocks such as GVR, VHM, and GAS led the index gainers, with an increase of nearly 1 point. On the other hand, stocks such as VCB, ACB, and VPB are weighing down the market, with a total decrease of more than 0.5 points.

The Vietnamese Stock Market Surges as the Top Performer in Asia on Mid-Autumn Festival

The VN-Index surged by 20 points, marking the strongest gain in over a month. With a 1.59% increase, Vietnam’s stock market boasted the best performance in Asia on September 17th.

The Ultimate Headline:

“Shareholders Await the Biggest Deal in Vietnam’s Stock Market History: When Will Vinhomes Buy Back its Shares?”

“Shares of Vinhomes, trading as VHM on the stock exchange, have surged by approximately 27% since the company first announced its plan to purchase treasury stocks in early August.”