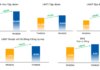

Technical Signals of VN-Index

In the trading session on the morning of 09/18/2024, the VN-Index surged with trading volume spiking in the morning session, indicating investors’ optimistic sentiment. The writer predicts that it will surpass the 20-day average by the end of the session.

At the moment, the VN-Index is heading upwards and testing the Middle Bollinger Band. The Stochastic Oscillator indicator suggests a buy signal. If the index surpasses and cuts above this line, the short-term bullish scenario may return in the upcoming sessions.

Technical Signals of HNX-Index

On 09/18/2024, the HNX-Index increased with a significant rise in trading volume in the morning session. It is expected to exceed the 20-day average, indicating a return to optimistic sentiment.

Additionally, the HNX-Index is testing the 23.6% Fibonacci Projection threshold (equivalent to the 226-230 point region) while the Stochastic Oscillator indicator suggests a buy signal. If the index rebounds, a recovery scenario is possible in the upcoming sessions.

CTR – Viettel Engineering Corporation

On the morning of 09/18/2024, CTR hit the ceiling with the emergence of a White Marubozu pattern and liquidity exceeding the 20-session average, indicating dynamic trading by investors.

Furthermore, the stock price rebounded and broke above the Middle Bollinger Band. The MACD indicator is narrowing the gap with the Signal line after previously signaling a sell-off. If a buy signal reappears, the strength of the short-term recovery trend will be reinforced.

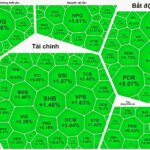

HCM – Ho Chi Minh City Securities Corporation

On 09/18/2024, HCM witnessed a sharp rise and formed a Rising Window candlestick pattern with trading volume surpassing the 20-session average, reflecting investors’ optimism.

Additionally, the stock surged and established a new 52-week high while the Stochastic Oscillator indicator signaled a buy signal, indicating the presence of long-term optimistic prospects.

Technical Analysis Department, Vietstock Consulting