With a range of +/- 5%, today’s ceiling exchange rate is 25,348 VND/USD, and the floor rate is 22,933 VND/USD.

This morning, the State Bank of Vietnam’s Trading Centre posted the buying and selling rates of USD at 23,400 – 25,308 VND/USD, keeping the buying rate unchanged and increasing the selling rate by 20 VND compared to the session on September 18th.

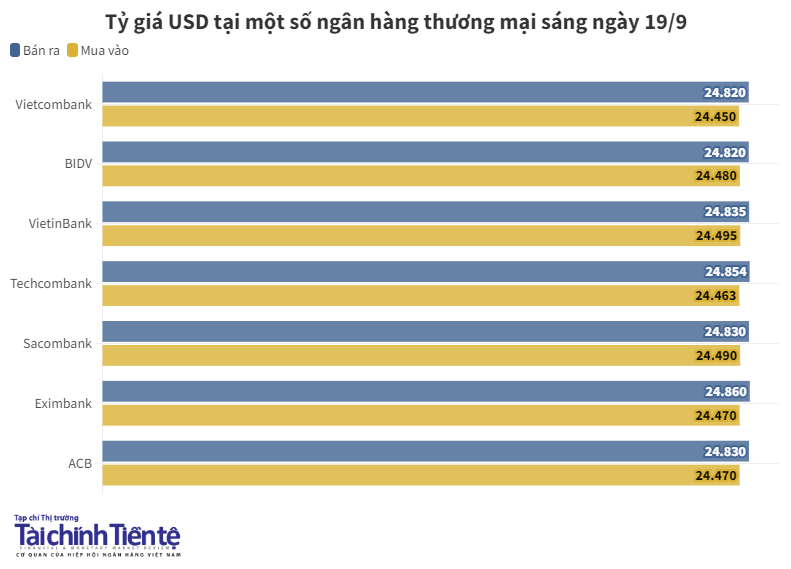

Meanwhile, the buying and selling rates of the greenback at many commercial banks were adjusted upwards, fluctuating within a range of 10 – 65 VND compared to the previous session’s closing price (September 18th).

Specifically, at 9:50 am this morning, Vietcombank listed the buying and selling rates of USD at 24,450 – 24,820 VND/USD, an increase of 10 VND in both buying and selling rates compared to the previous session’s closing price.

BIDV listed the buying and selling rates of USD at 24,480 – 24,820 VND/USD, an increase of 10 VND in both rates compared to the previous session’s closing price.

According to our survey, LPBank is offering the lowest buying rate at 24,210 VND/USD, while Hong Leong Bank is offering the highest buying rate at 24,955 VND/USD. In terms of selling, Viet A Bank is offering the lowest selling rate at 24,710 VND/USD, while Hong Leong Bank is offering the highest selling rate at 25,315 VND/USD.

In the unofficial market, USD exchange rates in Hanoi are being traded at 24,950 – 25,050 VND/USD (buying – selling), an increase of 30 VND in both buying and selling rates compared to the previous session.

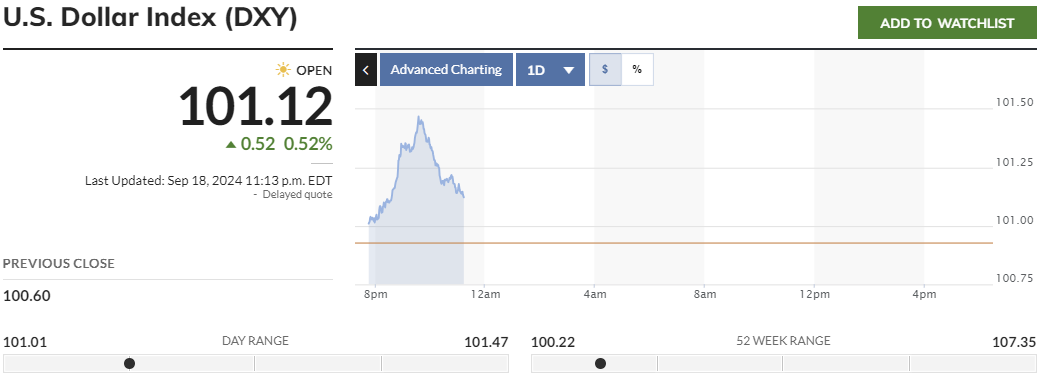

At the same time, in the global market, the US Dollar Index (DXY) – which measures the strength of the US dollar against a basket of major currencies – stood at 101.12 points, down 0.52% from the previous session.

Source: MarketWatch

The DXY index rebounded from its lowest level in 14 months as investors reacted to the statement made by the Chairman of the Federal Reserve System (Fed) Jerome Powell following the central bank’s super-large interest rate cut.

Yesterday, the Fed cut interest rates by 50 basis points for the first time since the early days of the COVID-19 pandemic. The central bank expressed confidence that inflation is heading towards its 2% target and took action to prevent a downturn in the labor market.

Meanwhile, Mr. Powell said that the central bank is not in a hurry to loosen its policies and that the 0.5% cut does not indicate a “new pace”. He also stated that he does not want the era of low interest rates in the US to return and that the neutral interest rate is likely to be significantly higher than before.

The Greenback Takes a Tumble: Will the State Bank Step In to Buy?

The recent loosening of monetary policy by the State Bank of Vietnam (SBV) in the context of a sharp decline in exchange rates has led to speculation that the central bank may buy USD at a higher price at the Trading Center to boost foreign exchange reserves. This move is expected to enhance the liquidity of VND in the commercial banking system, ensuring a more stable and robust financial environment.