According to the Vietnam Real Estate Brokers Association, the experience of other countries shows that credit policy is one of the essential tools for governments to regulate the real estate market. Many of the policies successfully implemented by other countries can be referenced, learned from, and applied in Vietnam.

Based on the lessons learned from these countries, the Brokers Association proposes several credit policy solutions to regulate the market when there is a fluctuation of more than 20% in three months or when there are other real estate market fluctuations that impact socio-economic stability without affecting the demand for housing from citizens.

Real estate prices are soaring. |

The Association proposes tightening credit policies for speculators. Specifically, to reduce the number of people borrowing for speculative purposes or using excessive leverage, credit institutions can adjust loan limits by changing the loan-to-value ratio, requiring a higher proportion of self-funded payments, or applying higher interest rates for second-home buyers and beyond.

Secondly, enhance credit monitoring and management. As per the Association’s proposal, the government can impose regulations on credit quality control, requiring banks to provide more detailed reports on real estate-related loans, thereby enhancing risk oversight. Establish a credit mechanism for social housing projects, prioritizing capital allocation for projects developing affordable and social housing to address the housing needs of low-income earners.

Additionally, the state should also have a credit relaxation policy, including reducing interest rates and providing long-term loans with preferential rates for first-time home buyers or other priority groups to maintain social stability, such as newly married couples.

To ensure the accuracy and effectiveness of the policies, the Association believes that the state needs to develop a large, accurate, and up-to-date database to distinguish between genuine homebuyers and those engaging in speculative activities.

Expediting the publication of real estate transaction price indices and some influencing criteria is essential to determine when the state needs to intervene, especially with the current concerns about rising real estate prices.

For a more comprehensive regulation of the real estate market, credit policies should be combined with the application of real estate transfer taxes or property taxes. Moreover, when implementing regulatory policies, flexibility must be considered to ensure stability in the real estate market and minimize risks.

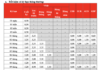

In the last two years, condo prices in Hanoi have risen rapidly and substantially. The price gap between Hanoi and Ho Chi Minh City’s condo markets has narrowed (in 2019, the primary price gap between the two markets was 30%; by 2024, the gap ranged between 5-7%).

As of the second quarter of 2024, according to surveys and reports from major provinces and cities like Hanoi and Ho Chi Minh City, condo prices had increased by an average of 5-6.5% quarterly and 25% annually, depending on the area and location.

According to the Ministry of Construction, the increase in condo prices in some major localities like Hanoi and Ho Chi Minh City is due to the continued limited new supply and the small number of new projects on the market. The scarcity of mid-range and affordable housing inventory has contributed to the rising prices in these projects.

Ngoc Mai