Gold prices surged during the afternoon of October 22nd, with gold rings nearing the 88 million VND/tael mark.

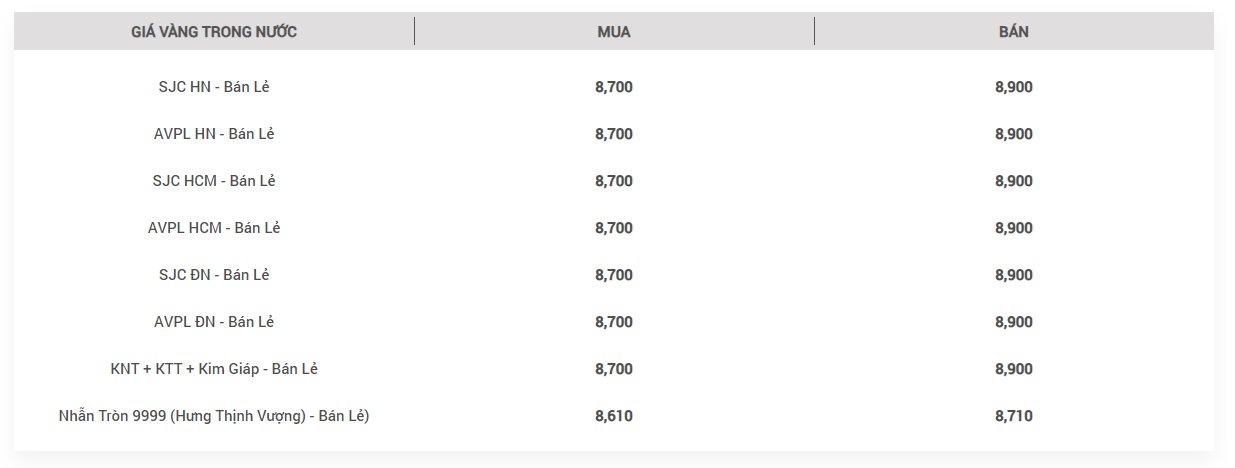

Specifically, DOJI Group raised the price of this type of gold to 86.6-87.6 million VND/tael. Similarly, Bao Tin Minh Chau also adjusted their gold prices to 86.2-87.6 million VND/tael.

SJC and PNJ listed their prices lower, at 85.7-87.1 million VND/tael and 86.1-87.1 million VND/tael, respectively.

—————————–

At the beginning of the day, SJC gold prices rose by 1 million VND/tael, while gold ring prices increased by about 500 thousand VND/tael.

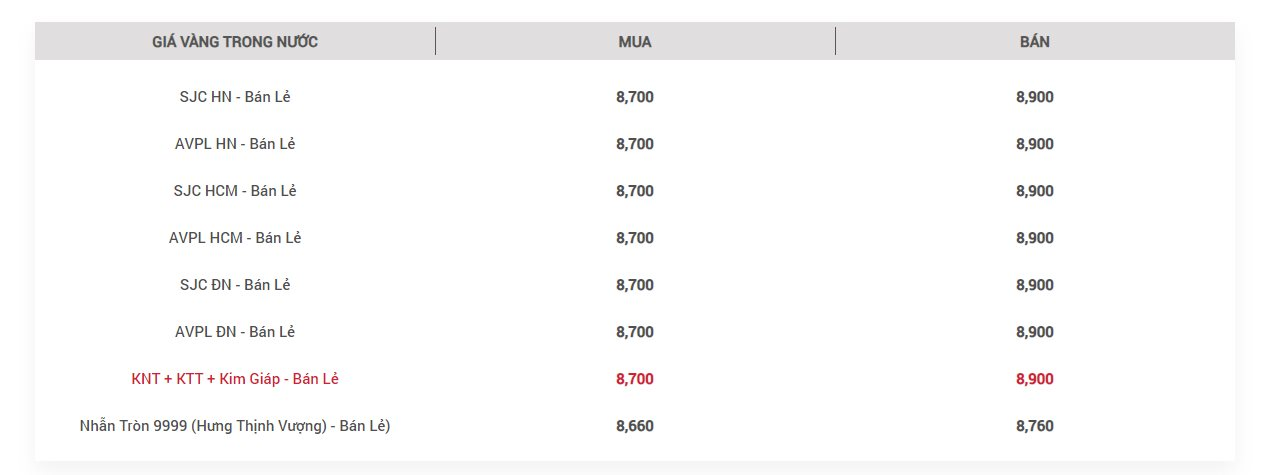

Currently, major businesses list the selling price of SJC gold bars at 87.0-89.0 million VND/tael.

Notably, the price of gold rings reached an all-time high, surpassing the 87 million VND/tael mark. DOJI Group announced their buying and selling prices at 86.10-87.10 million VND/tael, while Bao Tin Minh Chau adjusted their prices to 86.08-87.08 million VND/tael.

SJC Company is listing prices at 85.1-86.5 million VND/tael, while PNJ is offering gold rings at 85.8-86.75 million VND/tael.

In the international market, the spot gold price once again set a new high of 2,740 USD/ounce, the highest in history. The precious metal then adjusted downwards, standing at 2,730 USD/ounce at 9:00 am on October 22nd (Vietnam time).

Converting according to the current VND/USD exchange rate, the world gold price is equivalent to about 84 million VND/tael, excluding taxes and fees.

The excitement in the gold market has been unstoppable in recent weeks, driven by factors such as geopolitical tensions and economic instability. The slight adjustment in gold prices after reaching a record high may be due to a slight increase in the US dollar index and US Treasury bond yields, along with short-term traders taking profit.

The recent rise in gold and silver prices coincides with Russia’s BRIC summit on Tuesday, attended by Chinese President Xi Jinping and officials from developing countries. President Putin aims to establish a new global financial payment system to counter the dominance of the US dollar. About 58% of central banks’ foreign exchange reserves are currently dollar-denominated assets. Gold could benefit from the “de-dollarization” efforts of BRICS and other countries.

Gold Rings Surge 25 Million VND per Tael since the Start of the Year

The price of plain gold rings has been on a remarkable upward trajectory, with a consecutive 10-day increase. Compared to the beginning of the year, gold ring prices have soared by 25 million VND per tael, representing an impressive 40% performance.

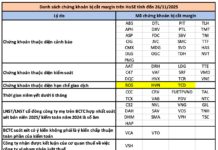

“The State Bank’s Strategy to Control the Price Differential of Domestic Gold Bars and Global Prices”

On October 22, the SBV announced the direct sale of SJC gold bars to four state-owned joint-stock commercial banks and the Saigon Jewelry Company Limited at a price of VND 88,000,000 per tael.