On December 4th, the Board of Directors of Masan Group Joint Stock Company (HOSE: MSN) resolved to approve additional capital contribution of up to VND 510 billion to the charter capital of its subsidiary, The Sherpa, to acquire shares of Nyobolt.

The Board authorized Chairman Nguyen Dang Quang or CEO Danny Le to decide on the specific amount and timing of capital contribution, as well as all other matters related to MSN‘s capital increase in The Sherpa. They are also responsible for completing the necessary procedures to finalize the capital increase in accordance with the law, the Company’s Charter, and The Sherpa’s Charter.

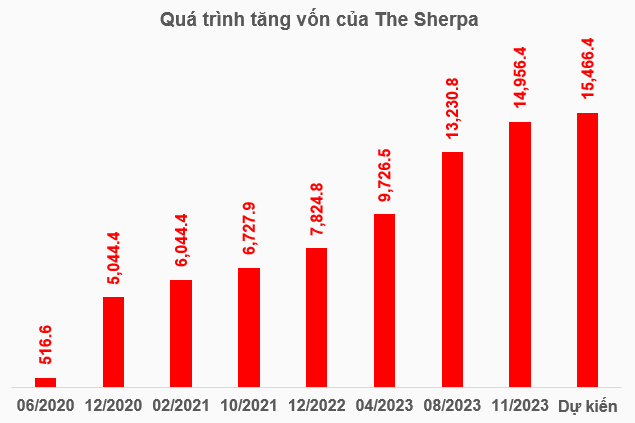

The Sherpa Limited Company was established on June 12, 2020, with its head office located on the 8th floor, Central Plaza building, No. 17 Le Duan, Ben Nghe Ward, District 1, Ho Chi Minh City. The company mainly operates in the field of management consulting (excluding financial, accounting, and legal consulting).

The initial charter capital of the Company was VND 516.6 billion, almost entirely owned by the Masan Group, with Mr. Tran Phuong Bac holding only VND 1 million. At that time, Mr. Truong Cong Thang was the Chairman of the Members’ Council of The Sherpa, which was later transferred to Danny Le in May 2022.

Since then, the Masan Group has injected additional capital into the company several times, especially in 2023, to increase its charter capital to over VND 14,956 billion. If MSN successfully contributes the planned VND 510 billion in the coming time, The Sherpa’s charter capital will increase to over VND 15,466 billion.

Source: Author’s compilation

|

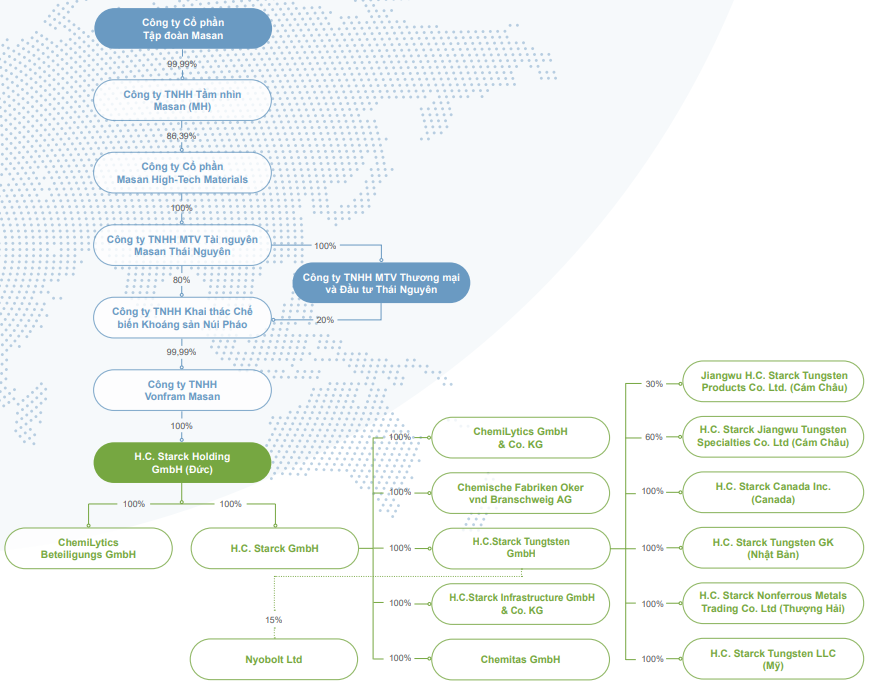

Regarding the objective of acquiring shares in Nyobolt, the Masan Group has actually been present in this company for several years through its member, Masan High-Tech Materials Joint Stock Company (MSR: UPCoM).

MSR started owning shares in Nyobolt from July 2022 when its subsidiary, H.C. Starck Tungsten GmbH, announced an investment agreement to purchase 15% of Nyobolt’s equity on a fully diluted basis for £45 million.

At that time, the collaboration was expected to boost H.C. Starck Tungsten GmbH’s position as a supplier of high-tech industrial materials, bringing added value to customers by developing new tungsten applications essential for future innovations.

Nyobolt is currently in the process of expanding its operations and commercializing its products. In July 2023, the company successfully launched an electric vehicle concept with a charging time of just 6 minutes and has signed principle agreements with two major commercial customers. The Masan Group stands to gain potential profits when Nyobolt’s fast-charging battery technology, utilizing tungsten and niobium in the anode, is widely commercialized.

In May 2024, MSR reached a framework agreement to sell 100% of its capital in H.C. Starck Holding GmbH, the owner of H.C. Starck Tungsten GmbH, to the Mitsubishi Materials Corporation Group (MMC Group) for $134.5 million. However, Masan retained its shareholding in Nyobolt.

According to the Masan Group, the proceeds from this transaction will help reduce MSR‘s debt and contribute to the Group’s goal of reducing net debt/EBITDA to below 3.5x. The Group expects to record a one-time profit of approximately $40 million from this transaction and benefit from an additional $20-30 million in long-term net profit after tax.

As of September 30, 2024, MSR accounted for an investment of over 755,000 shares of Nyobolt, with a book value of nearly VND 1,440 billion, representing 21.5% of equity ownership or 15% on a fully diluted basis.

|

Nyobolt within the Masan Group ecosystem

Source: MSR‘s 2023 Annual Report

|

The Top Techcombank Stockholders: Unveiling the Key Players with Over 1% Ownership

Techcombank has revealed that 6 individual shareholders and 7 organizations own 1.84 billion TCB shares, representing a substantial 52.265% stake in the bank. This significant ownership showcases a strong commitment to the bank’s future prospects and highlights the confidence of these stakeholders in Techcombank’s performance and potential.