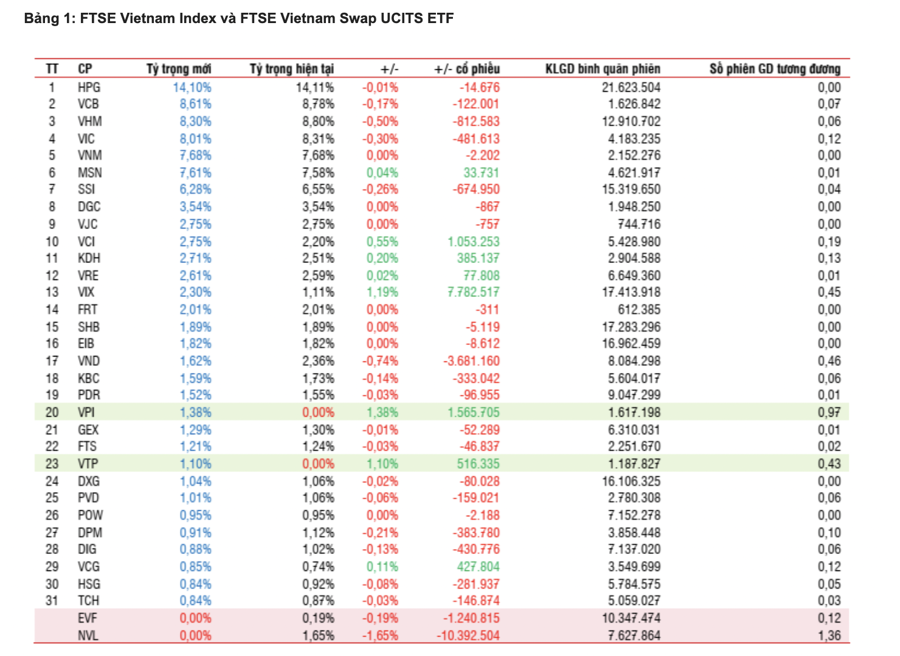

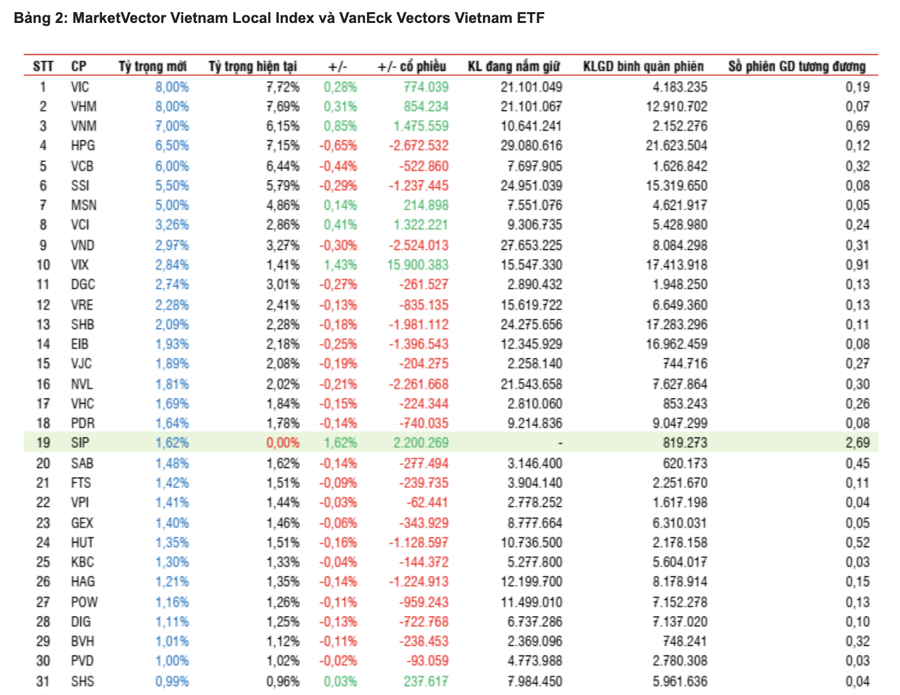

As reported by VnEconomy, FTSE Russell and MVIS recently announced the results of their new index portfolios. It’s important to note that the new portfolios will take effect on December 23, meaning that related ETFs will need to complete their portfolio restructuring by Friday, December 20.

According to the announcement, the FTSE Vietnam Index will add VPI and VTP while removing EVF and NVL. On the other hand, the FTSE Vietnam All-share Index will add VTP and remove EVF, NVL, and VIB. However, as there are no ETFs directly using this index, these changes will not impact the stocks.

The FTSE Vietnam Swap UCITS ETF has a total asset value of $258.8 million as of December 13, 2024. Specifically, the fund’s total assets have decreased by 27% since the beginning of the year, with a net capital outflow of $68.4 million and a 3% decrease in NAV since the start of the year.

Based on the new index portfolio results, SSI Research estimates that the fund will purchase approximately 1.5 million VPI shares (a weight of 1.38%) and 516,000 VTP shares (a weight of 1.10%). Other stocks to be purchased include VIX with an additional 7.78 million shares and VCI with 1.05 million shares. Conversely, the fund is expected to sell approximately 1.2 million EVF shares (a weight of 0.19%) and 10.3 million NVL shares (a weight of 1.65%).

Additionally, the fund is also estimated to buy VIX (7 million shares) and VCI (1 million shares), while significantly selling VND shares (3.6 million shares).

The MarketVector Vietnam Local Index has added SIP to its portfolio and has not removed any stocks. The index now includes 45 stocks.

The VanEck Vectors Vietnam ETF has a total asset value of $439.7 million as of December 12, 2024. Specifically, the fund’s total assets have decreased by 16.6% since the beginning of the year, with a net capital outflow of $45.6 million and an 8% decrease in NAV.

Based on the new index portfolio results, SSI Research estimates that the fund will purchase approximately 2.2 million SIP shares (a weight of 1.62%). Additionally, the fund is expected to buy VIX (15.9 million shares), VNM (1.4 million shares), and VCI (1.3 million shares). Conversely, the fund may sell a large number of shares in HPG (2.6 million shares), VND (2.5 million shares), NVL (2.2 million shares), SHB (1.9 million shares), and EIB (1.3 million shares).

Previously, SSI Research made fairly accurate predictions regarding the potential inclusion of VTP and VPI in the FTSE Vietnam Index. Specifically, VTP’s stock price has increased significantly by 77% compared to its price on August 30, 2024, meeting the criteria for capitalization and free-float capitalization accumulation. Additionally, VPI has met the liquidity criteria this time, compared to the previous period.

On the other hand, EVF and NVL are likely to be removed from the index. EVF fails to meet the requirements for the free-float ratio and free-float capitalization. As for NVL, the stock has been on the warning list since September 23, 2024.

SSI Research predicts the following for the MarketVector Vietnam Local Index: SIP and VTP may be added as they are in the top 85% of free-float capitalization accumulation among eligible stocks. No stocks are expected to be removed. However, SSI’s prediction regarding VTP’s inclusion in this index turned out to be incorrect.

What Stocks Will the VNM ETF and FTSE ETF Seek in the 4th Quarter Restructuring of 2024?

The VTP stock is anticipated to be included in two stock index baskets: the FTSE Vietnam Index and the MarketVector Vietnam Local. This inclusion is expected to boost the stock’s visibility and liquidity, attracting more investors and potentially leading to increased trading volume and enhanced market presence. With this development, the VTP stock is poised to gain traction and prominence in the Vietnamese market and beyond.

What Stocks Will Be Removed From the FTSE ETF and VNM ETF in the Q4 Review?

According to the latest report by SSI Research, the foreign ETF portfolio will undergo significant changes in the Q4 2024 reconstitution. The upcoming adjustments include the addition of promising new stocks and the rebalancing of existing holdings, setting the stage for an exciting quarter ahead.