HDBank Shares Surge to All-Time High, Masan Consumer Becomes Vietnam’s Largest Food and Beverage Company

HDBank’s share price surged to a historic high on December 30, 2023, closing at 26,650 VND per share, a 6.81% increase from the previous session. The trading volume reached nearly 10.6 million units, marking the fourth consecutive session of gains for HDBank.

This upward momentum has pushed the bank’s market capitalization to over 93.143 trillion VND. Since the beginning of the year, HDBank’s share price has climbed an impressive 77%.

The rising share price has positively impacted the wealth of its shareholders. Notably, billionaire Nguyen Thi Phuong Thao’s holdings in HDBank are now valued at nearly 3.485 trillion VND, reflecting an increase of over 222 billion VND in a single day.

Additionally, Sovico Holdings owns more than 501 million HDBank shares.

HDBank’s strong financial performance has been a key driver of its share price appreciation. According to its financial reports, the bank’s pre-tax profit for the third quarter of 2023 reached 4.490 trillion VND, a 42.7% increase compared to the same period in 2022. For the first nine months of the year, HDBank’s pre-tax profit totaled 12.655 trillion VND, a 46.6% increase, and achieved 79.8% of the full-year profit plan.

Masan Consumer’s Stock Surges, Making It Vietnam’s Largest Food and Beverage Company

In a remarkable display of financial prowess, Masan Consumer, a subsidiary of Masan Group, has seen its market capitalization soar to over 188.4 trillion VND (approximately 7.4 billion USD), surpassing that of Vinamilk, Vietnam’s leading dairy company.

This achievement solidifies Masan Consumer’s position as the largest company in the food and beverage industry on the Vietnamese stock market.

At the Masan Group’s 2024 Annual General Meeting, billionaire Nguyen Dang Quang, Chairman of the Board, likened Masan Consumer to a family heirloom diamond.

Nguyen Dang Quang personally holds 30,417 MCH shares, valued at over 7.9 billion VND.

Masan Consumer’s stock has been on a remarkable upward trajectory since the beginning of November, fueled by news of exceptionally high dividend payouts. The company has also announced plans to list on the Ho Chi Minh Stock Exchange (HoSE) in 2025, further boosting investor confidence.

In 2023, Masan Consumer distributed approximately 19 trillion VND in cash dividends, representing a staggering payout ratio of 268%. Additionally, the company intends to raise 3.268 trillion VND by offering 326.8 million shares to existing shareholders at a price of 10,000 VND per share, with the majority of the proceeds going towards debt repayment. This move is expected to increase the company’s charter capital to 10.623 trillion VND.

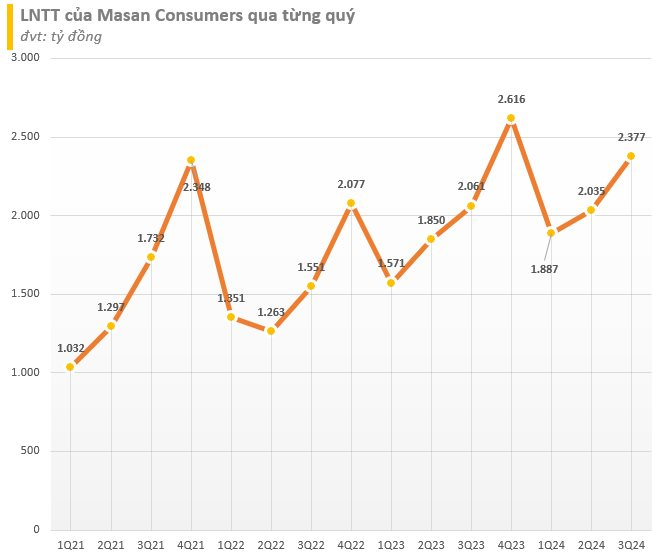

Masan Consumer’s impressive third-quarter financial results further bolstered its stock performance. The company reported a 10% year-over-year increase in revenue, reaching 7.987 trillion VND. Net income after tax surpassed 2.094 trillion VND, a 14% increase compared to the previous year. For the first nine months of 2024, revenue and net income after tax reached 21.955 trillion VND and 5.553 trillion VND, respectively, reflecting an 11% and 14% year-over-year increase.