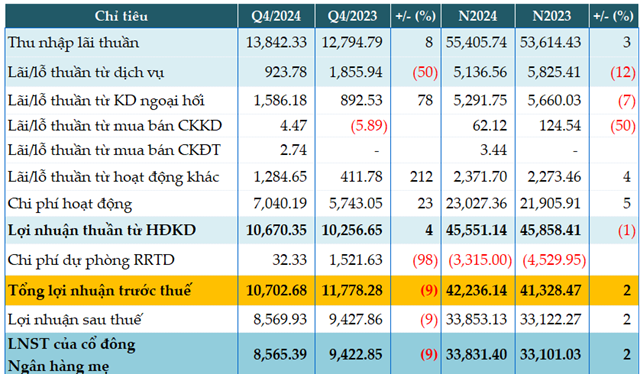

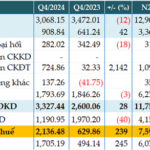

In Q4 2024 alone, VCB’s net interest income reached over VND 13,842 billion, an 8% increase compared to the same period last year. Service income decreased by 50%, to just under VND 924 billion.

Meanwhile, foreign exchange trading activities yielded a profit of more than VND 1,586 billion, a 78% increase. Other business activities also brought in nearly VND 1,285 billion in profit, triple that of the previous year.

As a result, the bank’s net profit from business operations increased by only 4% to VND 10,670 billion. During the quarter, the bank reversed over VND 32 billion in provisioning expenses. However, VCB’s pre-tax profit decreased by 9% to nearly VND 10,703 billion.

For the full year 2024, VCB’s pre-tax profit was over VND 42,236 billion, a slight 2% increase compared to 2023.

|

VCB’s Q4 and 2024 business results. Unit: Billion VND

Source: VietstockFinance

|

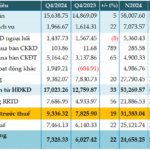

The bank’s total assets as of Q4 2024 increased by 14% from the beginning of the year to over VND 2 quadrillion. Customer loans increased by 14% to nearly VND 1.45 quadrillion.

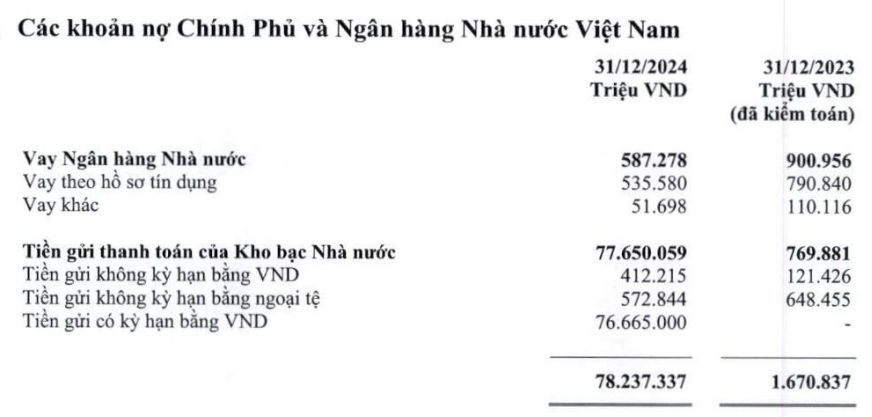

In terms of capital sources, customer deposits increased by only 9% from the beginning of the year to over VND 1.51 quadrillion. Notably, term deposits from the State Treasury (KBNN) at the end of the year stood at VND 76,665 billion, while there were none at the beginning of the year.

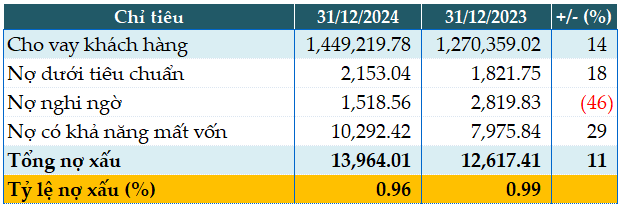

As of December 31, 2024, VCB’s total non-performing loans increased by 11% from the beginning of the year to VND 13,964 billion. The non-performing loan ratio slightly decreased from 0.99% to 0.96%.

|

VCB’s loan quality as of December 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

– 22:05 24/01/2025

Borrowing Over VND 2,000 Billion from the State Bank, Eximbank Targets a 54% Surge in Pre-Tax Profit by 2024

“Eximbank’s consolidated financial statements reveal a remarkable performance in 2024, with a profit before tax of over VND 4,188 billion, reflecting a significant 54% year-on-year increase. This impressive growth was achieved despite a substantial rise in provisions for potential risks.”

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.

“A Revenue Boost: BIDV’s Pre-Tax Profit Surges by 19% in Q4”

The recently released consolidated financial statements for the fourth quarter of 2024 reveal that the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) recorded a remarkable performance. With a pre-tax profit of over VND 9,336 billion, BIDV witnessed a 19% increase compared to the same period last year. This impressive growth is attributed to the bank’s successful diversification strategy, with a focus on bolstering non-interest income sources.