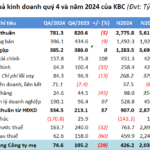

**TPC Returns to Profitability in 2024 but Remains Modest**

| TPC turned a modest profit in 2024, marking a turnaround from previous years. |

The plastics company witnessed a relatively efficient year of production despite facing numerous challenges in both domestic and international markets. According to TPC’s leadership, global economic and geopolitical fluctuations significantly impacted their operations in 2024.

Particularly, businesses in the plastics industry, like TPC, are facing a unique challenge presented by the global shift towards eco-friendly alternatives and the reduction of single-use plastics. The implementation of bans on certain plastic products by countries in the EU, the US, and Japan has affected the export demands of the plastic bag packaging sector, forcing them to adapt and transition to environmentally sustainable products.

In 2024, TPC’s production volume reached approximately 11,500 tons, surpassing its target by 39%. However, this volume still fell short of their achievements in 2023. Consequently, their revenue for the year stood at VND 436 billion, exceeding the target by 43% but representing the lowest figure in the last decade.

A positive highlight was the company’s return to profitability, generating nearly VND 12 billion in profits. This success can be attributed to the effective management of borrowing costs by TPC’s leadership, despite complex fluctuations in interest rates and exchange rates.

Based on this improved financial performance, TPC allocated over VND 7 billion in bonuses for its 562 employees as of December 2024, including 13th-month salaries and bonuses for long-term service and innovative initiatives.

Source: TPC

|

Looking ahead, TPC’s business plan for 2025 remains cautiously optimistic, with a slight reduction in production volume. Consequently, their revenue and net profit targets are set at VND 428 billion and VND 8.8 billion, respectively. To achieve these goals, the company intends to focus on marketing activities, technological improvements, production optimization, and enhanced cash flow and inventory management.

Following a significant loss in the previous year, TPC underwent a comprehensive restructuring process, which included workforce downsizing and the potential sale of their factory in Duc Hoa Ha Industrial Cluster, Long An, with the condition of leasing it back to generate working capital for their operations. However, the profit earned in 2024 was not sufficient to cover the accumulated losses reflected in their financial statements, which means that the company’s stock is likely to remain on the warning list.

– 08:33 25/01/2025

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.

The Billionaire’s Stock Surge: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Unexpected End-of-Year Rally to New Heights

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.