Hai Phat Investment Joint Stock Company (stock code: HPX) has approved a plan to convert its receivables at Hoang Quan Commercial Trading Services Real Estate Joint Stock Company (stock code: HQC) into shares.

Accordingly, HPX will convert VND 212 billion of debt into 21.2 million HQC shares and authorize the Chairman of Hai Phat’s Board of Management to decide on the timing of the conversion. The converted shares will be restricted from transfer for one year from the date of issuance.

Notably, as of August 1, HQC shares traded around VND 3,800 per share, implying a market value of VND 80.56 billion for the 21.2 million HQC shares. Therefore, if the conversion is successful, at the current market price, Hai Phat Investment will incur an immediate loss of 62% compared to the debt value, equivalent to a loss of over VND 131 billion.

Previously, HPX had collaborated with Hoang Quan on the 198-hectare Ham Tien project (in the former Binh Thuan province) with a total investment of VND 9,831 billion. The project was expected to be completed between 2018 and 2024, with revenue recognition starting in 2020 at VND 1,800 billion.

At that time, HPX’s leadership considered this a first step in the joint venture with Hoang Quan and anticipated further cooperation with the inclusion of HPX representatives in HQC’s Board of Management.

Hoang Quan Commercial Trading Services Real Estate Joint Stock Company will have HPX convert VND 212 billion of debt into 21.2 million shares.

However, at the recent shareholder meeting, Mr. Truong Anh Tuan, Chairman of HQC’s Board of Management, announced that Hoang Quan and Hai Phat have agreed to temporarily halt the implementation of this project. Nonetheless, the two parties will maintain their partnership and seek new cooperation opportunities in the future.

In the second quarter of this year, HQC recorded revenue from sales and services of over VND 22 billion but had negative revenue of nearly VND 33 billion. As a result, Hoang Quan Real Estate recorded a negative gross revenue of VND 10.83 billion, a decrease of VND 15.86 billion compared to the same period last year, and a profit after tax of VND 4.9 billion, a decrease of nearly 54% over the same period.

Explaining the decrease in revenue, Hoang Quan Real Estate attributed it to some customers’ inability to pay for subsequent installments. As a result, the company agreed to repurchase and resell the properties to other customers at higher prices.

In addition to selling below cost, Hoang Quan Real Estate also recorded financial revenue that was insufficient to cover financial expenses, selling expenses, and administrative expenses. The company only avoided losses due to a significant increase in other income.

In the first half of this year, Hoang Quan Real Estate recorded revenue of over VND 38 billion (up 4.6% over the same period) and profit after tax of over VND 10 billion (down nearly 35% over the same period).

As of June 30, Hoang Quan Real Estate’s total assets decreased by 2.2% from the beginning of the year to VND 9,875 billion. The company’s short-term and long-term borrowings decreased by 0.9% from the beginning of the year to nearly VND 1,730 billion, equivalent to 32% of equity.

Meanwhile, Hai Phat Investment set a target of nearly VND 2,330 billion in total revenue and VND 137 billion in profit after tax for this year. In the second quarter, HPX achieved a profit after tax of over VND 35 billion, an increase of 13% over the same period. According to HPX’s explanation, the increase in profit after tax in the second quarter was due to the rise in revenue from its subsidiaries.

The Ultimate Guide to Leadership: Mastering the Art of Influence and Decision-making in the Digital Age

The trading statistics for the week of July 28 to August 1, 2025, reveal interesting insights into the trading activities of insiders and major shareholders. While there were no significant large-scale transactions, the gradual buying of DC4 and BWE stocks by insiders stood out. Conversely, a notable development was observed on the registration side, as a major shareholder of STH sought to offload over 44% of their holdings, indicating a substantial sell-off move.

Vietnam Airlines Soars to New Heights with a Record-Breaking Net Profit of VND 6,883 Billion in 2024, Coupled with a Significant Reduction in Debt.

Vietnam Airlines (HOSE: HVN) has soared to new heights, closing out 2024 with record-breaking revenue and net profits.

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

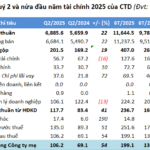

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.