MBS Joint Stock Securities Company (MBS code) has just announced that August 20th will be the record date for a cash dividend payment for the year 2024, with a ratio of 12% per share (1 share receives 1,200 VND). The expected payment date is September 19, 2025.

With nearly 573 million shares circulating, MBS Securities plans to distribute approximately VND 687 billion for this dividend. In the shareholder structure, Military Commercial Joint Stock Bank (MB) is the largest shareholder, owning more than 76% of the capital and is expected to receive more than VND 520 billion.

In the market, MBS shares closed at VND 35,200 per share on August 1st, up 23% since the beginning of the year.

In 2025, MBS plans to offer 68.7 million shares at a price of VND 10,000 per share. The entitlement ratio is 100:12 (for every 100 shares held, the shareholder is entitled to buy 12 new shares).

At the same time, this securities company also plans to issue 17.18 million shares to increase charter capital from equity (bonus shares). The entitlement ratio is 100:3, meaning that for every 100 shares held, the shareholder will receive 03 new shares.

In addition, MBS also plans to issue 8.59 million shares under the Employee Stock Ownership Plan (ESOP) at a price of VND 10,000 per share.

This issuance will be implemented after MBS completes the offering of shares to existing shareholders and the issuance of bonus shares.

If all three issuances mentioned above are completed, MBS Securities will increase the number of circulating shares from 572.78 million units to 667.29 million units, equivalent to a charter capital of VND 6,672.9 billion.

In terms of business results , in Q2/2025 alone, MBS recorded a 10% decrease in operating revenue compared to the same period, reaching VND 792 billion. As a result, pre-tax profit for Q2 reached VND 273 billion, up 1% over the same period in 2024. Net profit was VND 221 billion, up 2% over Q2/2024 but down 18% from the profit recorded in Q1 of this year.

Accumulated in the first half of 2025, MBS’s operating revenue reached VND 1,461 billion, down 6% over the same period last year. However, good cost control helped to increase pre-tax profit by 22% to VND 611 billion.

In 2025, the company targets a total revenue of VND 3,370 billion and a pre-tax profit of VND 1,300 billion, up 8% and 40% respectively compared to the previous year. Thus, after 6 months, MBS has completed 47% of the yearly profit plan.

Record-Breaking Profits for Rubber Group Since 2012

The rubber price remained high in Q4, enabling the Vietnam Rubber Group (HOSE: GVR) to achieve its highest revenue and profits in over a decade.

The Captivating Craft of Words:

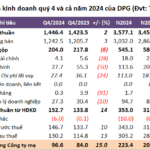

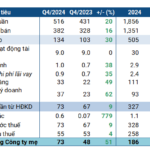

“Dat Phuong’s Profitable Prowess: A Stellar Fourth Quarter with nearly 100 Billion VND in Profit.”

The Joint Stock Commercial Bank for Foreign Trade of Vietnam, or Vietcombank, has announced its fourth-quarter 2024 financial statements, reporting a net profit of VND 97 billion, the highest in the past seven quarters. This figure represents a 15% increase compared to the same period last year, yet Vietcombank has only achieved 88% of its annual profit plan.

The Magic Formula for Success: Unlocking the Secrets to a Booming Business

The fourth-quarter profit surge propelled the Southern Basic Chemicals Corporation (HOSE: CSV) to a successful year, surpassing the targets approved by the 2024 Annual General Meeting.