QCG Returns to Profitability

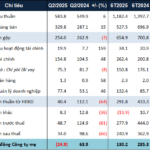

According to the consolidated financial statements for the second quarter of 2025, QCG, listed on the Ho Chi Minh Stock Exchange (HoSE), reported a remarkable five-fold increase in revenue compared to the same period last year, amounting to VND 131 billion.

This growth is primarily driven by the real estate sector, which contributed nearly VND 98 billion in revenue, a staggering 47-fold increase year-over-year.

After deducting the cost of goods sold, the company achieved a gross profit of nearly VND 50 billion, contrasting a gross loss of nearly VND 6 billion in the previous year’s second quarter.

Despite a surge in expenses and other losses compared to the same period last year, QCG recorded a positive after-tax profit of VND 2.5 billion, a significant improvement from the VND 17.2 billion loss in the corresponding period.

For the first six months of 2025, QCG’s cumulative revenue stood at VND 243 billion, with a pre-tax profit of VND 21 billion and a net profit of nearly VND 11 billion.

Looking ahead, QCG has set ambitious targets for 2025, aiming for a revenue of VND 2,000 billion and a pre-tax profit of VND 300 billion. These goals represent significant growth of 274% and 306%, respectively, compared to the previous year. The projected revenue marks an all-time high for the company, while the pre-tax profit target falls just shy of the figures achieved in 2010 and 2017.

As of June 30, 2025, QCG’s total assets amounted to VND 9,485 billion, reflecting a 6.7% increase from the beginning of the year. However, cash and cash equivalents decreased to VND 55 billion, and inventory witnessed a slight decline to over VND 1,200 billion.

Additional Borrowings of Nearly VND 240 Billion from Two Individuals

Notably, the report for this period shows a reduction in the amount received from Sunny for the Phuoc Kien project, decreasing from VND 2,882.8 billion to VND 2,782.8 billion, indicating a VND 100 billion decrease since the beginning of the year.

It is likely that QCG has started fulfilling its obligation to repay the debt to CTCP Investment Sunny Island to regain control of the Phuoc Kien project, as dictated by the ruling in the Van Thinh Phat case.

Meanwhile, in the long-term work-in-progress assets section, the cost associated with the Phuoc Kien project increased from VND 5,360.8 billion to VND 5,426.5 billion during the first six months of the year.

Another noteworthy change is the significant drop in the amount of payable to third parties, decreasing to VND 176.8 billion, a reduction of over VND 290 billion compared to the start of the year.

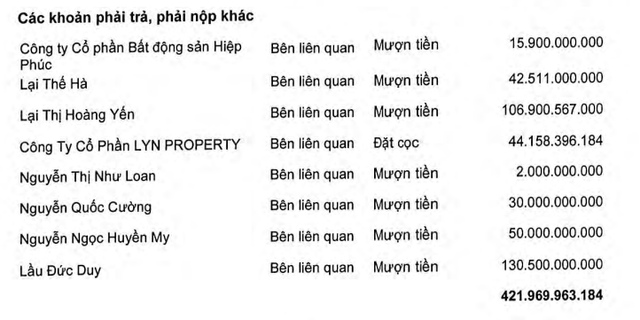

In contrast, the amount payable to related parties witnessed a sharp increase from VND 180 billion to VND 422 billion, mainly due to new borrowings incurred during this quarter.

The notes to the financial statements reveal that a loan of VND 130.5 billion from Mr. Lau Duc Duy was taken out during this quarter. Additionally, the loan from Ms. Lai Thi Hoang Yen increased significantly from VND 6.5 billion at the end of March to VND 106.9 billion as of June 30, 2025.

Source: QCG’s Consolidated Financial Statements for Q2 2025

In total, these two individuals have extended nearly VND 240 billion in additional borrowings to QCG. Mr. Lau Duc Duy is the husband of Ms. Nguyen Ngoc Huyen My, the daughter of former CEO Nguyen Thi Nhu Loan. Ms. My also serves as the legal representative of LYN Property Joint Stock Company. As for Ms. Lai Thi Hoang Yen, she is the daughter of Mr. Lai The Ha, the Chairman of QCG’s Board of Directors.

QCG has also acknowledged multiple borrowings from the company’s leadership and their relatives.

The Debt Swap Deal Could Cost Hai Phat a Whopping Sum

“Oceanic Realty is set to undergo a significant debt-to-equity swap, exchanging 212 billion VND in loans for 21.2 million HQC shares of Hoang Quan Real Estate. However, with HQC shares currently trading at just 3,800 VND per share, the swap could result in a substantial loss for Hai Phat Investment. If the swap were to go through at the current market price, Hai Phat Investment would face an immediate 62% loss on the loan value, amounting to 131.44 billion VND.”

Record-Breaking Profits for Rubber Group Since 2012

The rubber price remained high in Q4, enabling the Vietnam Rubber Group (HOSE: GVR) to achieve its highest revenue and profits in over a decade.