In a recent share, Mr. Q, a long-time broker and investor in the Nhon Trach market (Dong Nai), revealed that from the end of 2024 to the beginning of 2025, there was a notable increase in Northern investors seeking land in the area. Right after the Tet holiday, Nhon Trach brokers took many investment clients on property viewings, including some from Northern Vietnam. Several land transactions took place on the 5th and 6th days of the new year.

According to Mr. Q, some Northern investors had been researching the area before Tet and asked to put down deposits after the holiday once they had chosen an auspicious day. The products they invested in were reasonably priced residential land in areas with potential infrastructure development in the future. The Northern investors were particularly interested in plots that were priced slightly lower than the market rate at the end of 2021, often by around 10%. “Typically, the Northern investors are keen on well-priced land in good locations near major roads, and transactions with them tend to be swift,” said Mr. Q.

In the former District 9 area (now Thu Duc City, Ho Chi Minh City), Hanoi investors are still “hoarding” well-priced townhouses within urban areas. Along with this, newly divided residential land plots near major roads that are advertised at good prices are also quickly snapped up. According to brokers, before the Tet holiday, a group of Northern investors appeared in the area, putting down deposits and planning to complete the paperwork after Tet. They mostly buy and hold, waiting for future price increases.

It is observed that the southward movement of Northern investors, which began in the second half of 2024, has brought about a positive impact on the real estate market in some southern regions. Unlike the previous period, investors are now more cautious in their choices. They are primarily interested in areas with clear infrastructure and planning development orientations or those that have recently been upgraded to towns or cities.

At the same time, instead of focusing solely on Ho Chi Minh City, Northern investors are now aggressively moving into neighboring provinces, where prices are more affordable and future infrastructure development is expected. Real estate in Dong Nai, Binh Duong, and Long An provinces is currently attracting a significant number of Northern investors. Projects located near existing or upcoming major transportation infrastructure have particularly seen increased demand.

Given the high prices and reduced investment profit margins in Ho Chi Minh City’s real estate market, it is understandable that Hanoi investors are looking elsewhere. The two most popular types of real estate among Northern investors are apartments and land plots, with a preference for the latter in terms of investment capital.

However, according to industry experts, land plots have the disadvantage of not generating a steady cash flow like apartments, and investors have to “hold” onto them. Therefore, if land prices do not increase by at least 7% within a year, investors who “hold” will incur losses, as the cost of capital is at least 7%. As a result, investing in land plots is now a more challenging proposition than in the previous period.

Moreover, with the government’s policies and objectives aimed at stabilizing the market rather than facilitating speculation, the potential for high profit margins, as seen in the previous period, is now more difficult to achieve for investors.

Nonetheless, Northern investors typically have readily available investment capital (with minimal borrowing) and a medium to long-term investment horizon. Most of their investments are held for 3-5 years, resulting in attractive profit margins.

Bình Dương’s Thirst for Luxury Condos: Owning a Unit at 45-50 Million VND per Square Meter, or Renting a 2-Bedroom Apartment for 15 Million VND per Month, Still Results in an Impressive 90% Occupancy Rate.

In Binh Duong, apartments priced at 45 – 50 million VND per square meter are now considered luxury, with an impressive 80-90% occupancy rate for rentals. These apartments command a monthly rental price of approximately 15 million VND for a two-bedroom unit, offering a compelling proposition for investors and renters alike.

The Profit Update for Q4 2024: A Market Surge with Real Estate Leading the Charge

In Q4 2024, the market’s after-tax profit rose by 20.9% year-over-year, marking the fourth consecutive quarter of steady growth. Several industries witnessed remarkable growth spurts during this period, notably Real Estate and Retail, which significantly contributed to the overall positive performance.

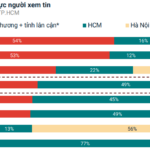

Where Do Binh Duong Province’s Property Buyers Come From?

The real estate market in Binh Duong Province has experienced a robust recovery in 2024 compared to 2023, with significant growth across all areas and most property types. In particular, Di An and Thuan An continue to stand out, attracting considerable investor attention due to their proximity to Ho Chi Minh City and their strong development potential in the future, according to Batdongsan.