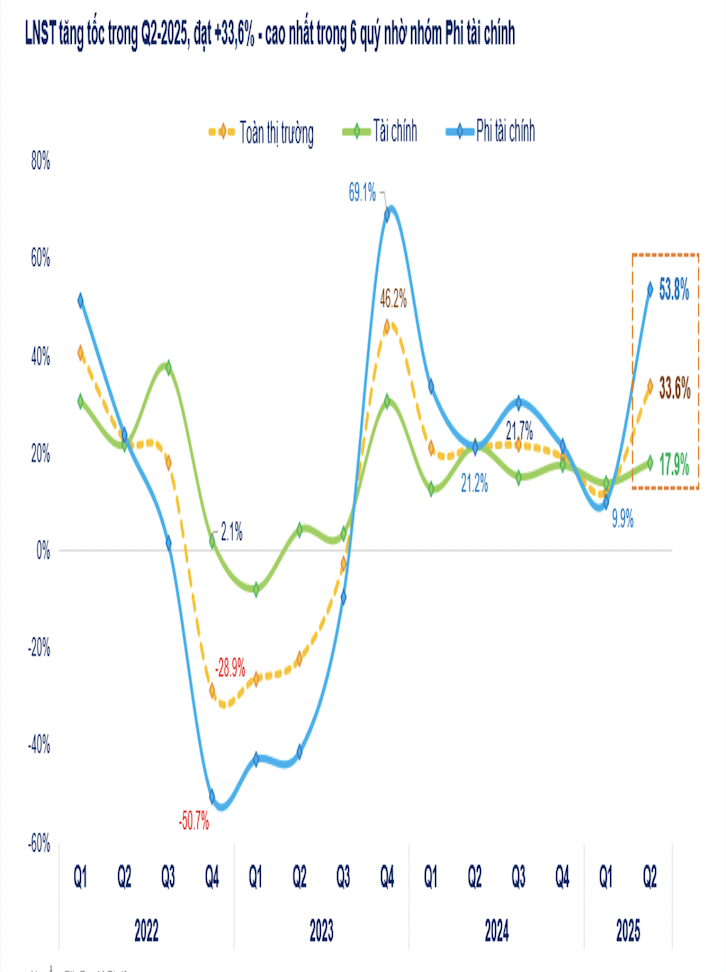

As of July 31, 2025, 970 listed companies, representing 97.1% of the total market capitalization, have published their financial reports for Q2 2025, with remarkable year-over-year profit growth of 33.6%.

This is the highest growth rate in the past six quarters, mainly driven by the outstanding performance of the Non-Financial sector, which saw a 53.8% surge in profits. This marks a significant turnaround from the previous quarter’s modest 9.9% growth. Meanwhile, the Financial sector recorded a more moderate growth rate of 17.9% year-over-year, as the banking industry’s profit growth stabilized at 17.5%.

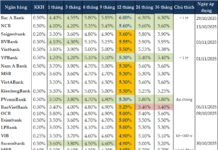

Among the top three banks, VCB, BID, and CTG, witnessed modest growth in net interest income, with NIM continuing to narrow amid stagnant credit growth. However, CTG stood out with an impressive 80.2% year-over-year surge in profit after tax, attributed to non-interest income and reversal of provisions.

The trend was similar in the private banking sector, with notable profit growth observed in VPB (+35.6%), VIB (+23.4%), STB (+32.9%), and SHB (+57.8%). This growth was largely driven by strong credit expansion. In contrast, TCB (+1.2%) remained almost stagnant, while MBB and LPB experienced slight declines of 1.6% and 1.1%, respectively.

In the Non-Financial sector, Q2 2025 profit growth was led by the Real Estate, Utilities (Electricity), Retail, Aviation, and select Commodity sectors, including Rubber, Fertilizers, and Mining. Conversely, the Dairy, Beer, and Sugar sectors witnessed profit declines.

Commenting on the overall business landscape for Q2 2025, Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities (VPBankS), noted that while profit growth varies significantly across industries, the general trend indicates a substantial recovery compared to 2024.

VPBank and ACB were the standout performers in the banking sector, with VPB reporting nearly VND 5,000 billion in profit after tax for Q2, a 36% year-over-year increase. ACB, on the other hand, posted profits of nearly VND 4,900 billion, representing a 9% growth. Both banks exhibited a decreasing trend in non-performing loans. Smaller banks, such as KLB, VAB, and PGB, also demonstrated high profit growth rates, albeit from a lower base.

The insurance sector surprised with strong year-over-year profit growth in Q2, despite challenges posed by declining interest rates and the impact of Typhoon Yagi. For instance, PVI’s profit after tax for Q2 reached VND 437 billion, a 52% increase, while MIG reported a profit of VND 84 billion, nearly a 50% jump.

The Financial Services sector was among the few industries to disclose relatively comprehensive financial results. The total profit after tax for Q2 in this sector, including listed companies, amounted to approximately VND 4,250 billion, reflecting a remarkable 43% year-over-year increase. For the first half of the year, the industry’s profit reached VND 7,500 billion, a 20% growth—a rather impressive figure.

Upon further analysis, two key observations emerged. Firstly, margin income served as the primary growth driver, with remarkable performances from VIX, SSI, SHS, VND, MBS, HCM, and VCI. Additionally, there were significant contributions from fair value gains on financial assets (FVTPL). VIX, SHS, and VCI, in particular, benefited substantially from their investment portfolios during Q2.

Moreover, with the current stock market boom, securities companies are poised for excellent results in Q3. Brokerage activities are expected to rebound in the second half of 2025, as liquidity surges, leading to a potential recovery in brokerage gross profit margins to levels comparable to 2018 or 2021.

In the Personal and Household Goods sector, the textile industry is off to a good start this year. HTG and TNG have reported positive results, possibly driven by exporters’ efforts to front-load shipments and avoid potential tariff changes.

In the building materials sector, plastic stocks are benefiting from the trend of infrastructure investment. BMP and NTP have reported impressive profit growth, with BMP’s profit increasing by 18% year-over-year and NTP’s by 35%. VGC, a prominent player in the industry, announced a profit after tax of VND 540 billion for Q2, representing a remarkable 216% surge. For the first half of the year, VGC’s profit reached VND 861 billion, a 111% increase, primarily driven by industrial real estate.

In conclusion, despite the varying performances across industries and stocks, the overall profit growth outlook for the market remains promising.

Introducing Techcombank Private Exclusive: The Powerful Duo of Debit & Credit Cards for a Prestigious Position

On January 29th, 2024, Techcombank officially launched its duo of international payment cards, the Techcombank Private card and the Techcombank Private Visa Infinite credit card, exclusively tailored for a select few elite members. With exceptional privileges, these two cards are guaranteed to deliver a luxurious experience befitting their esteemed owners.