VN-Index sets a new record high

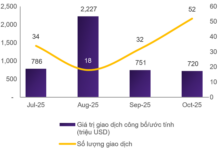

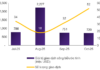

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 1.4 billion shares, equivalent to a value of more than 35.9 trillion VND; HNX-Index reached over 163 million shares, equivalent to a value of more than 3.1 trillion VND.

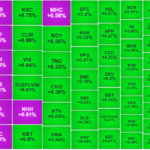

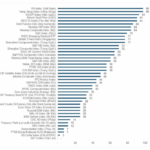

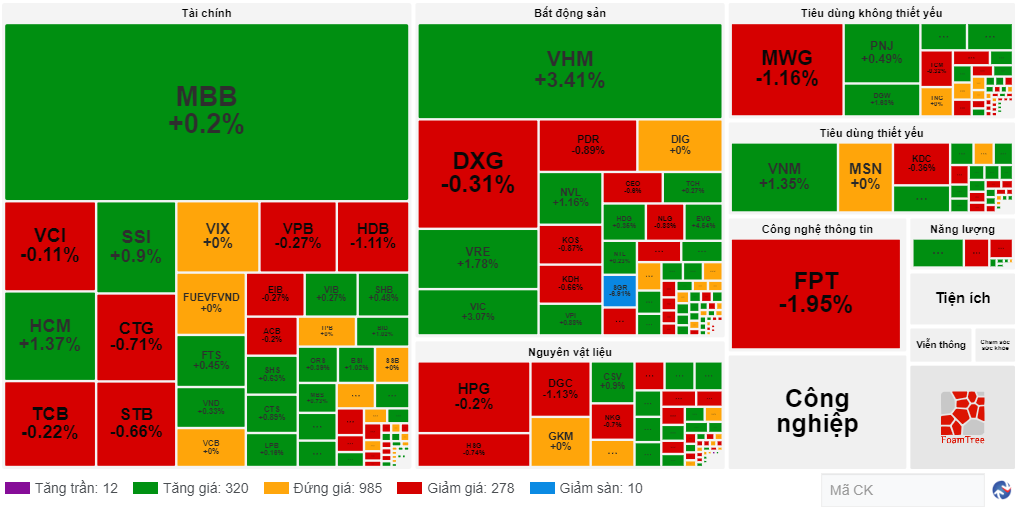

VN-Index opened the afternoon session on a positive note, with continuous buying pressure pushing the index higher despite selling pressure reappearing towards the end of the session. However, the VN-Index only experienced mild fluctuations and closed in optimistic green. In terms of impact, VHM, VJC, VPB, and SSI were the codes with the most positive influence on the VN-Index, contributing 4.7 points. On the other hand, VIC, GVR, VNM, and GAS were the codes still under selling pressure, taking away more than 2.5 points from the overall index.

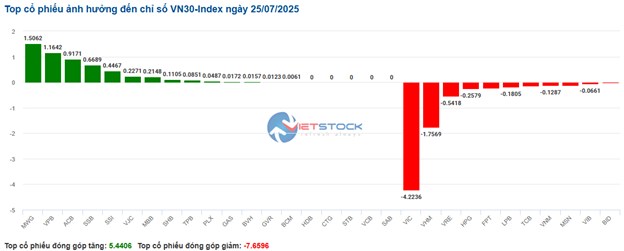

| Top 10 stocks with the most significant impact on the VN-Index on July 25, 2025 |

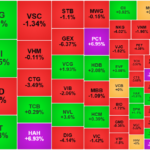

Similarly, the HNX-Index also witnessed a fairly positive performance, influenced by the gains in MBS (+6.67%), SHS (+4.49%), DHT (+5.7%), and BAB (+3.25%)…

|

Source: VietstockFinance

|

At the close, green dominated most industry groups. The media services sector was the best-performing group in the market, up 2.13%, mainly driven by VGI (+3.21%), CTR (+0.3%), YEG (+2.21%), and VTK (+0.88%). Following the recovery were the industrial and financial sectors, with increases of 1.52% and 0.97%, respectively. On the other hand, the information technology sector was the only group to record a decline in the market, falling by -0.34%, mainly due to FPT (-0.36%), CMG (-0.93%), POT (-7.41%), and SMT (-1.14%).

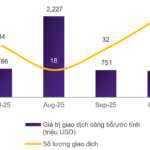

In terms of foreign trading, foreigners continued to sell a net amount of more than 78 billion VND on the HOSE exchange, focusing on HPG (457 billion VND), FPT (222.28 billion VND), MSN (124.98 billion VND), and VHC (112.79 billion VND). On the HNX exchange, foreigners bought a net amount of more than 20 billion VND, focusing on CEO (22.3 billion VND), MBS (7.34 billion VND), NTP (6.17 billion VND), and HUT (4.96 billion VND).

| Foreign trading buy-sell dynamics |

Morning session: Maintaining the green

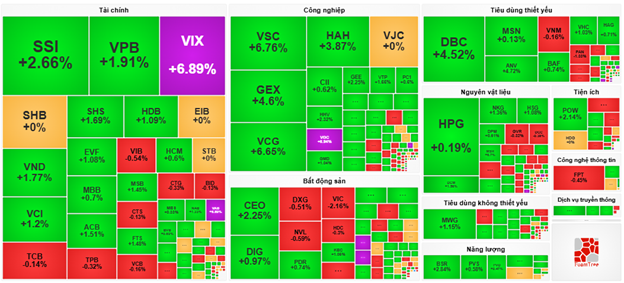

The green color continued to dominate until the end of the morning session, although the upward momentum eased slightly. At the midday break, the VN-Index gained 2.26 points (+0.15%), climbing to 1,523.28 points; the HNX-Index rose 0.64%, reaching 252.27 points. The market breadth was positive, with 436 gainers, 276 losers, and 835 unchanged stocks.

Liquidity this morning remained high. The trading value exceeded 18 trillion VND on the HOSE exchange, roughly the same as the same period in the previous session. HNX also recorded a volume of 75 million units, equivalent to 1.4 trillion VND.

Within the top 10 stocks influencing the VN-Index, VIC and VHM were the two codes with the most negative impact, taking away 2.2 points and 1.6 points from the index, respectively. Conversely, VPB had the most positive contribution, adding 0.8 points to the overall index.

In terms of industry groups, the green color prevailed in most stock groups. The media services sector temporarily led the market in the morning session, driven by stocks such as VGI (+3.07%), CTR (+0.61%), YEG (+1.84%), VTK (+1.59%), and MFS (+0.86%).

Additionally, the industrial and financial sectors also traded positively as buying interest focused on stocks like VGC, which hit the ceiling price, VSC (+6.76%), GEX (+4.6%), VCG (+6.65%), HAH (+3.87%), GEE (+2.25%); SSI (+2.66%), VPB (+1.91%), VND (+1.77%), VCI (+1.2%), SHS (+1.69%), and VIX and VAB, which also hit the ceiling price.

On the other hand, the real estate and information technology sectors struggled to recover as selling pressure dominated the large-cap stocks in these industries, including VIC (-2.16%), VHM (-1.85%), VRE (-1.85%), NVL (-0.59%); and FPT (-0.45%), respectively. In the utilities group, although the sector index managed to stay in positive territory thanks to gains in stocks like PGD, which hit the ceiling price, POW (+2.14%), GEG (+2.03%), and NS2 (+14.01%), several stocks experienced corrections towards the end of the morning session, including GAS (-0.29%), VSH (-1.61%), HND (+0.84%), BGE (-1.72%), and DNP (-7.61%).

Source: VietstockFinance

|

Foreigners continued to sell a net amount of 154 billion VND across all three exchanges, focusing their sales on HPG with a value of 188.84 billion VND, far surpassing the buying interest in other stocks. Meanwhile, SSI led the net buying list with a value of 225.71 billion VND.

| Top 10 stocks with the strongest net buying and selling in the morning session of July 25, 2025 |

10:30 am: Financial and industrial sectors continue to lead the market

As of 10:30 am, the market maintained its positive momentum, with the VN-Index climbing more than 4 points to trade above 1,525 points. The HNX-Index rose over 2.4 points to reach 253 points. The financial, real estate, and industrial sectors continued to be the main drivers of the market’s upward trend.

The breadth within the VN30-Index basket was somewhat mixed. Notably, on the positive side, MWG, VPB, ACB, and SSB contributed 1.5 points, 1.16 points, 0.91 points, and 0.66 points to the VN30 index, respectively. Conversely, only a few stocks, including VIC, VHM, VRE, and HPG, faced selling pressure, resulting in a loss of more than 6.7 points from the overall index.

Source: VietstockFinance

|

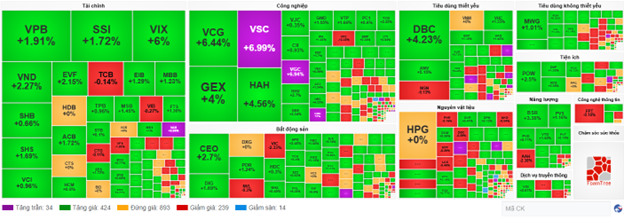

The financial sector continued to attract strong buying interest, with most stocks in this group posting solid gains, including VIX (+6.44%), SSI (+1.72%), VPB (+2.13%), VND (+2.02%), EVF (+2.15%), SHS (+2.25%), and EIB (+0.92%)…

The industrial sector also witnessed a positive performance, with leading stocks in the group recording gains. Specifically, VCG and VSC hit the ceiling price, followed by VCG, GEX, and HAH, which rose by 6.24%, 4%, and 4.43%, respectively.

Moreover, stocks in the real estate sector also contributed significantly to the index’s gains, including CEO (+2.7%), DIG (+1.93%), PDR (+1.24%), and HDC (+0.3%)…

In contrast, the healthcare and information technology sectors were among the few industries that recorded losses, with selling pressure outweighing buying interest. Specifically, selling pressure was concentrated in FPT, which fell by 0.18%, CMG down by 0.12%, IMP losing 0.38%, and DTP declining by 4.76%…

Compared to the opening, buying interest remained strong. There were 424 gainers and 239 losers.

Source: VietstockFinance

|

Opening: Positive momentum prevails at the start of the session

Following the recovery in the previous session, the VN-Index opened the morning session in positive territory, with the number of gaining stocks far exceeding the number of declining stocks. The financial and industrial sectors made the most significant contributions to the market’s positive performance, with green dominating most stocks in these groups.

Financial stocks continued to lead the overall market higher. Within this group, VND rose by 2.27%, VIX climbed by 3.78%, ACB advanced by 1.72%, and EVF gained 2.87%…

Additionally, the industrial sector also contributed positively to the market, with green dominating most stocks in this group. Specifically, HAH increased by 4.15%, VSC surged by 5.13%, GEX rose by 4.8%, and HBC climbed by 5.63%…

On the other hand, the healthcare sector was the only group that opened on a negative note. IMP, DHT, DBD, and DTP all traded lower, while the remaining stocks in this group posted modest gains.

Overall, the market opened on a positive note, with green dominating most industry groups, including energy, utilities, media services, and materials…

– 15:20 25/07/2025

Stock Market Week of July 21-25, 2025: Setting a New Historic High with a Six-Week Winning Streak

The VN-Index has been on a remarkable six-week streak of consecutive gains, accompanied by record-breaking liquidity. The persistent flow of funds and the unwavering confidence of investors have laid a solid foundation for the market’s upward trajectory. However, with the index reaching new historic highs, the recent selling spree by foreign investors and profit-taking at these elevated levels could trigger some technical fluctuations in the short term.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

The Power of Differentiation: Small and Mid-Cap Stocks Make a Striking Comeback

While the blue-chip stocks dragged the broader index down, the mid and small-cap stocks surged. 21 stocks hit the roof, and nearly 100 others gained over 1%, an unusual phenomenon as the VN-Index dipped.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.