Ben Thanh TSC has just announced its 2024 cash dividend plan with a ratio of 30%, equivalent to VND 3,000 per share. With over 13.5 million shares outstanding, the total amount the company expects to pay out is VND 40.5 billion.

The ex-dividend date is August 21. The first tranche will be paid on September 10 and the second on January 2, with each tranche representing 15% of the total dividend. This dividend ratio is only second to the record 33.5% in 2023 and significantly higher than the 7-20% range in the pre-2022 years.

From 2009 to the present, BTT has consistently paid annual dividends. Benthanh Group, the largest shareholder with a 41.39% stake, will benefit significantly from this payout.

Retaining profits to focus on the “diamond” project

Despite the high dividend for 2024, Ben Thanh TSC announced that it would not pay cash dividends in 2025, the first time in over a decade. All profits for 2025 will be retained to prepare financial resources for the hotel project located at 220-226 Le Thanh Ton, District 1, Ho Chi Minh City. This project is considered to have a “diamond” location but has been stalled due to prolonged legal entanglements since 2020.

The company’s leadership shared that despite having plans to work with the district and ward, changes in administrative organizations have led to an indefinite waiting period due to the upcoming merger of the district’s People’s Committee. The General Director of BTT stated that while issuing share dividends is still under consideration, there will be no cash dividend payout next year.

Business premises at 220 – 226 Le Thanh Ton, Ben Thanh Ward, District 1, Ho Chi Minh City. Photo: Tu Kinh

|

Q2 profit increases despite slight revenue dip

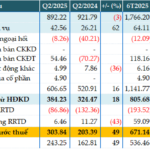

In Q2 2025, the company recorded a revenue of over VND 60 billion, a 14% decrease compared to the same period last year, but net profit increased by 17%, reaching over VND 14 billion. This was attributed to the growth in financial income (up 45%) and lower financial expenses due to the reversal of investment provisions.

| BTT’s quarterly financial results from 2022 to 2025 |

For the first half of the year, revenue reached VND 139 billion and net profit was nearly VND 29 billion, up 2% and 17% respectively over the same period last year. The company achieved 24% of its revenue target but met 60% of its profit target for the year after just six months.

In the stock market, BTT shares have had almost no liquidity, remaining stagnant at VND 40,000 per share for nearly a month. However, the stock has gained nearly 28% over the past year, with an average daily trading volume of 361 shares.

| BTT share price movement since the beginning of 2025 |

– 13:00 04/08/2025

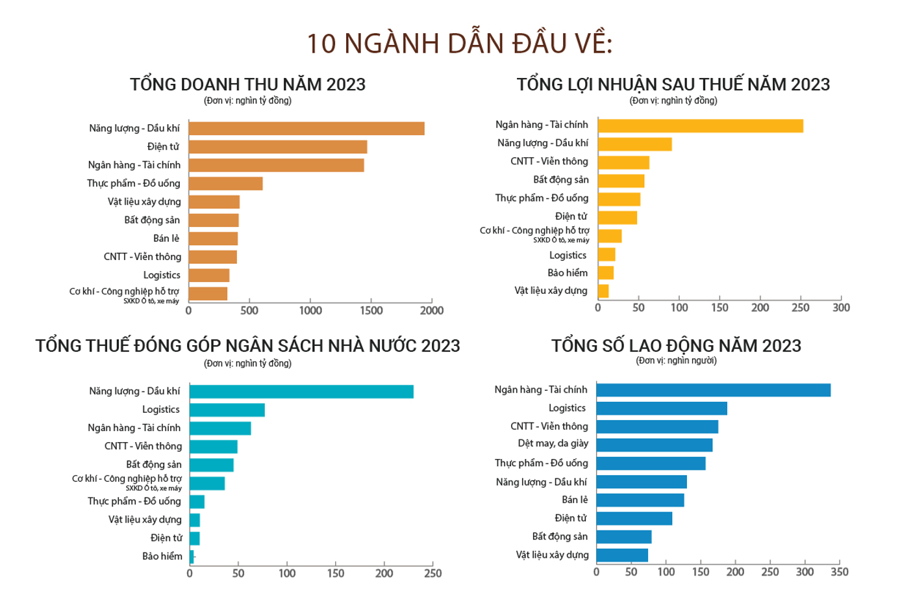

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

Sacombank has been recognized by Vietnam Report and VietNamNet Newspaper as one of the Top 10 most reputable commercial banks in Vietnam for 2025. This prestigious accolade further cements Sacombank’s position as a leading private joint-stock commercial bank in the country. Additionally, Sacombank has also made significant strides, climbing into the Top 5 most reputable private banks and securing a spot in the Top 50 public companies for efficiency and reputation (VIX50).

KienlongBank Announces Q2 2025 Financial Results: Multiple Business Indicators Achieve Over 90% of Targets

KienlongBank (UPCoM: KLB) has announced its Q2 2025 financial results, boasting impressive performance. The bank’s consolidated pre-tax profit reached VND 565 billion, with key business indicators such as total assets, mobilized capital, and credit outstanding achieving over 90% of the year’s set plan.

Reverse Engineering Profits: Unraveling Bac A Bank’s Strategy for a 49% Surge in Pre-Tax Profits

“Bac A Bank (HNX: BAB) announced a remarkable 49% year-over-year increase in its second-quarter 2025 consolidated profit, amounting to nearly VND 304 billion. This impressive performance is attributed to the bank’s successful diversification strategy, evident in the growth of non-interest income, coupled with a prudent reduction in credit risk provisions.”

Profiting from Services: OCB Records an 11% Rise in Q2 Profit

The recently released consolidated financial statements for the second quarter of 2025 reveal that Orient Commercial Joint Stock Bank (HOSE: OCB) has achieved remarkable financial performance. The bank reported a remarkable pre-tax profit of over VND 999 billion, reflecting an 11% increase compared to the same period last year. This impressive growth is attributed to the bank’s strategic focus on core income growth and a robust performance in its services division.