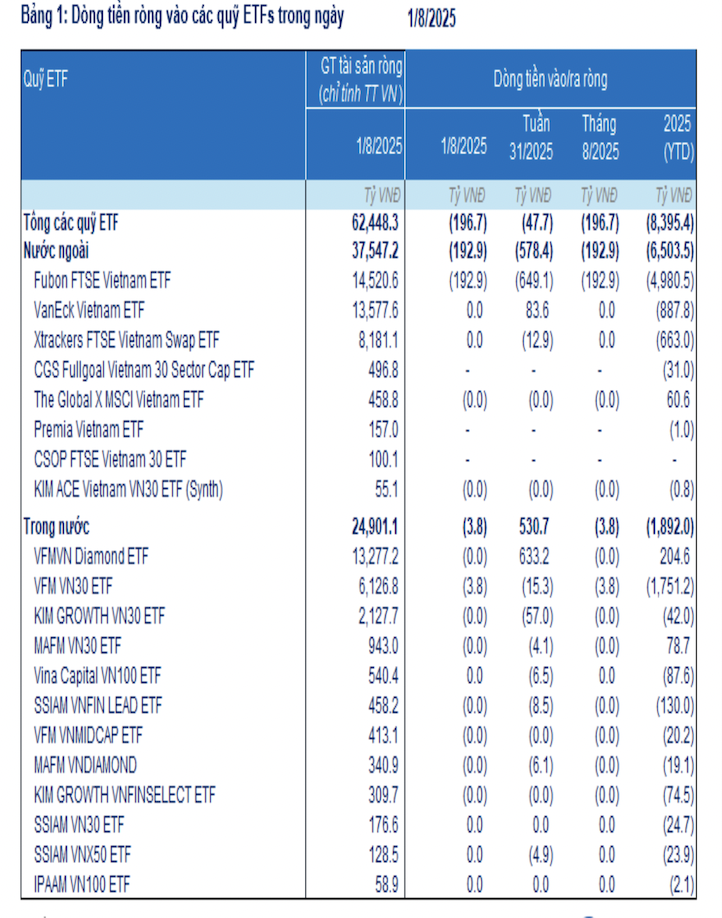

For the week of July 28 – August 1, 2025, Vietnam’s stock market witnessed a net outflow of nearly VND 48 billion through ETF funds.

The outflow occurred in 13 out of 20 funds, notably the foreign-owned Fubon FTSE Vietnam ETF. Foreign ETFs led the outflow with a value of over VND 578 billion, solely from the Fubon FTSE Vietnam ETF (-VND 649 billion). The top stocks sold off were VIC, VHM, HPG, MSN, and VCB. In contrast, the VanEck Vietnam ETF attracted a net inflow of nearly VND 84 billion.

On the contrary, domestic ETF funds recorded a net inflow of over VND 530 billion, mainly into the VFM VNDiamond ETF with VND 633 billion. Conversely, the Kim Growth VN30 ETF experienced a net outflow of VND 57 billion.

Thai investors sold a net of 100,000 certificates of deposit in the VFM VNDiamond ETF (FUEVFVND01), equivalent to VND 3.5 billion. They also offloaded 1.8 million certificates of deposit in the VFM VN30 ETF (E1VFVN3001), valued at VND 50.2 billion.

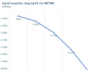

In July 2025, ETFs experienced a net outflow of over VND 196 billion, bringing the total net outflow since the beginning of 2025 to nearly VND 8.4 trillion, lower than the VND 21.8 trillion recorded in 2024. As of August 1, 2025, the total net asset value of ETFs investing in Vietnam stood at VND 62.4 trillion, an 8.9% increase from the end of 2024.

In June 2025, passive ETF funds experienced a net outflow of over VND 1,100 billion, nearly three times the previous month’s figure, mainly driven by foreign capital outflows. Fubon FTSE Vietnam ETF topped the list with an outflow of nearly VND 458 billion (+85.5% MoM), followed by DCVFMVN30, Xtrackers FTSE Vietnam, and DCVFMVN Diamond.

Fubon ETF has seen net outflows of nearly VND 5,000 billion in the first seven months of the year, despite its outstanding performance relative to the broader market.

In the first half of 2025, only 16 out of 63 equity funds outperformed their 2024 counterparts, mainly foreign passive funds such as VanEck Vietnam ETF and Fubon FTSE Vietnam ETF, benefiting significantly from the strong appreciation of the VND/USD exchange rate. Fubon ETF recorded a 21.6% return during this period.

On August 4, the latest update showed that the Fubon FTSE Vietnam ETF experienced a significant net outflow of nearly VND 134 billion. The fund continued to sell off stocks, estimated at over VND 127 billion. The top sold-off stocks were HPG (-455,000 shares, -VND 11.4 billion), SSI (-234,000 shares, -VND 7.8 billion), SHB (-208,000 shares, -VND 3.6 billion), VHM (-186,000 shares, -VND 16.7 billion), and VIC (-166,000 shares, -VND 17.3 billion). Meanwhile, the VFM VN30 ETF recorded a net inflow of nearly VND 4 billion, while the VFM VNDiamond ETF saw no significant net flow changes.

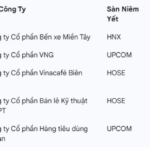

10 Non-Financial Large Cap Companies Nominated for IR Awards 2025

FPT, GMD, HSG, MSN, MWG, PNJ, VHM, VIC, VNM, and VRE are the top 10 non-financial large-cap enterprises that have made it to the IR Awards 2025 semifinals. These prestigious companies will compete against each other from August 1st to 14th, 2025, showcasing their excellence and striving to be the best in their field.

“F88’s Imminent IPO: Foreign Shareholders Hold Majority Stake, with Shares Predicted to Soar on Opening Day”

With a potential intraday trading range of up to ±40% from the reference price, F88’s share price could soar to 888,860 VND per share if it hits the upper circuit breaker.

Vote for IR Awards 2025: Why Wait to ‘Hunt’ the Whirlpool WIO3T133P Dishwasher and Xiaomi X20 Pro Robot Vacuum?

“The IR Awards 2025 has witnessed an overwhelming response from individual investors across the nation during the two-day open nomination period for the finalist selection round. This enthusiastic participation highlights the growing importance that the investment community attaches to the quality of information disclosure and financial transparency among listed companies.”

The Billionaire’s Stock Surge: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Unexpected End-of-Year Rally to New Heights

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.