Vietnamese Stock Market Ends Week on a Positive Note, Led by Technology and Insurance Sectors

The Vietnamese stock market closed the week on a positive note on November 29th, with a strong performance from technology and insurance sector stocks. The VN-Index ended the day up 8.35 points at 1,250.46. Trading volume remained low, with a value of nearly VND13,500 billion on the HOSE.

Foreign investors continued their buying streak for the sixth consecutive session, with a net buy value of VND363 billion across all markets.

On the HOSE, foreign investors net bought VND334 billion.

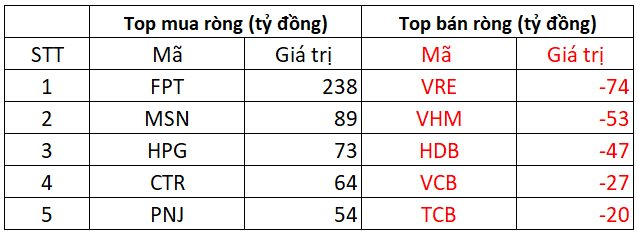

Figure 1: Foreign investors’ net buying and selling on the HOSE on November 29th, 2024 (Source: CafeF)

FPT was the most purchased stock by foreign investors on the HOSE, with a value of over VND238 billion. MSN and HPG followed, with net buys of VND89 billion and VND73 billion, respectively. CTR and PNJ were also bought, with values of VND64 billion and VND54 billion, respectively.

On the other hand, VRE faced the strongest selling pressure from foreign investors, with a net sell value of VND74 billion. VHM and HDB were also among the top sold stocks, with net sell values of VND53 billion and VND47 billion, respectively.

On the HNX, foreign investors net bought VND15 billion.

Figure 2: Foreign investors’ net buying and selling on the HNX on November 29th, 2024 (Source: CafeF)

MBS was the most purchased stock by foreign investors on the HNX, with a net buy value of VND8 billion. IDC followed closely, with a net buy value of VND5 billion. Foreign investors also net bought PVS, DTD, and TIG, among others.

On the selling side, TNG faced the highest net sell value of VND4 billion. IDV, VGS, and VC3 were also among the top sold stocks by foreign investors on the HNX during the session.

On the UPCOM, foreign investors net bought VND15 billion.

Figure 3: Foreign investors’ net buying and selling on the UPCOM on November 29th, 2024 (Source: CafeF)

MCH was the most purchased stock by foreign investors on the UPCOM, with a value of VND12 billion. HPP, MPC, and QNS also saw net buying by foreign investors.

Conversely, VGI faced net selling pressure of VND500 million from foreign investors. WSB, AAS, and BSR were also among the top sold stocks by foreign investors on the UPCOM.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

The Market Beat, February 18th: A Sea of Green, With a Hint of Differentiation

The VN-Index managed to stay in the green at the end of a volatile and tug-of-war afternoon session. While the market opened with a broad rally, it turned slightly “redder” as the session drew to a close.

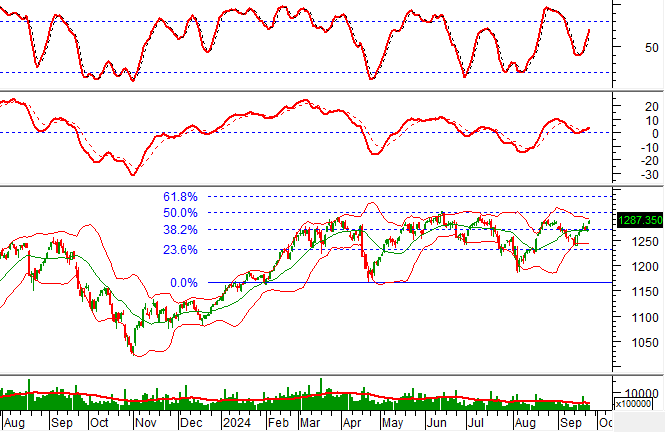

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the outlook turns decidedly bearish. However, the Stochastic Oscillator remains in bullish territory, and the MACD mirrors this sentiment, even hinting at a potential rise above the zero threshold. Should this materialize, it would alleviate the short-term downside risk.

The Power of Positive Thinking

The VN-Index surged after a period of consolidation around the 200-day SMA. Accompanied by a solid trading volume above the 20-day average, this indicates a positive shift in market sentiment. The Stochastic Oscillator and MACD are both generating buy signals, with the latter crossing above zero, suggesting a further boost to the already optimistic short-term outlook.

The Ultimate Trader’s Journal: Aiming for the December 2024 Peak

The VN-Index extended its upward momentum from the previous session, with trading volume surpassing the 20-day average. A more robust participation of funds in the upcoming sessions could propel the index towards its old peak of December 2024 (1,270-1,280 points). The Stochastic Oscillator and MACD indicators remain bullish, suggesting continued optimism in the short term.