The market opened with a positive bias this morning, but the gains were modest due to a lack of support from large-cap stocks. After a lackluster first half, the market surged in the afternoon, with strong buying interest in blue-chip stocks, resulting in a broad-based rally. However, trading volume remained subdued.

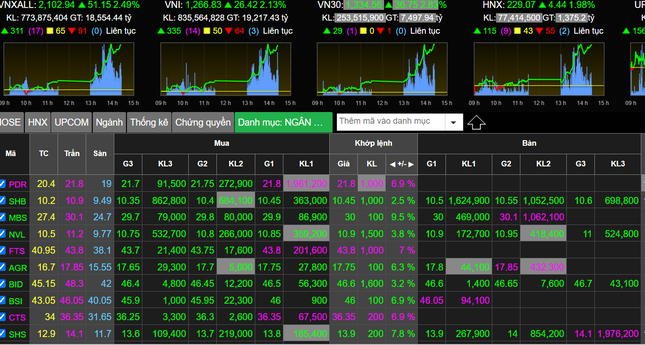

While the morning session was relatively quiet, the market came alive in the afternoon with a surge in both indices and trading volume. Money flowed into most sectors, turning around several stocks that were in the red during the morning session. The three key sectors of banking, real estate, and securities led the charge, with numerous securities stocks hitting the daily limit-up, including SSI, VIX, HCM, FTS, VCI, ORS, CTS, and BSI.

Market breadth was positive, with 16 out of 19 sectors ending in the green, except for telecommunications, healthcare, and tourism & entertainment. The large-cap VN30 index took the lead, with all stocks but BVH, which fell slightly by 0.19%, closing in positive territory on strong volumes. SSI hit the daily limit-up, while 12 stocks gained over 3%, led by MWG (4.99%), STB (4.78%), HPG (4.31%), BCM (4.29%), and TPB (4.11%).

Stocks surged higher, painted in purple, during the trading session on December 5th. Photo: Q.Thanh.

HPG, FPT, and CTG were the top three contributors to the overall index, adding a combined total of 5 points. On the other hand, HVN, VTP, and CTR were the biggest laggards, with VTP plunging to the floor price, HVN falling by 3.15%, and CTR dropping by 3.3%.

Trading volume picked up significantly, marking the highest daily turnover in the past two months. The combined trading value of the three exchanges reached nearly VND 23,230 billion.

Foreign investors joined local investors in net buying, ending a three-day net selling streak, with a net buy value of over VND 676 billion across all markets. They focused their purchases on HPG, MSN, and FPT, while offloading VCB, HSG, and VTP.

The VN-Index closed the day up 27.12 points (+2.19%) at 1,267.53, with 347 gainers and 55 losers. This was the strongest daily gain for the index in over three months since August 16th. Total trading volume reached 908.4 million shares, and value came in at VND 21,041 billion, a decrease of 58% and 51%, respectively, compared to the previous session. Block trades contributed over 68.4 million shares, valued at VND 1,847 billion.

The HNX-Index climbed 4.98 points (+2.22%) to close at 229.60, with 119 gainers and 49 losers. Trading volume and value increased by 67% and 68%, respectively, with over 87.9 million shares changing hands, worth VND 1,554 billion. Block trades added another 5.2 million shares, valued at VND 215 billion.

The UPCoM-Index rose 0.51 points (+0.55%) to 92.95, with 181 gainers and 95 losers. Trading volume and value increased by 51% and 6%, respectively, with over 49.1 million shares traded, worth VND 633 billion. Block trades contributed an additional 6.2 million shares, valued at VND 112 billion.

Market Beat: Green Dominance, VN-Index Nears 1,270 Points

The market ended the session on a positive note, with the VN-Index climbing 4.93 points (0.39%) to reach 1,269.61; the HNX-Index also rose, by 1.37 points (0.6%), closing at 227.98. The market breadth tilted slightly in favor of the bulls, with 451 gainers against 255 decliners. The VN30 basket saw a relatively balanced performance, with 15 gainers, 14 losers, and 1 stock finishing unchanged.

Market Beat on Feb 24th: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, as the VN-Index rose by 7.81 points (+0.6%), finishing at 1,304.56; while the HNX-Index climbed 0.92 points (+0.39%) to close at 238.49. The market breadth was relatively balanced, with 377 gainers and 373 losers. The large-cap stocks in the VN30 basket painted a positive picture, as 21 stocks advanced, 6 declined, and 3 remained unchanged, tilting the basket towards a green close.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

Is the Uptrend Supported?

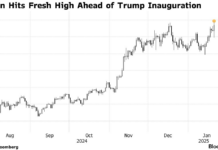

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.