The latest data from the General Statistics Office (Ministry of Finance) released on August 6 showed that the consumer price index (CPI) in July increased by 0.11% compared to the previous month. The main reason for this was the increase in the prices of housing materials, food, and dining out.

Compared to December 2024, CPI in July increased by 2.13% and by 3.19% compared to the same period last year. On average, in the first seven months of 2025, CPI increased by 3.26% compared to the same period.

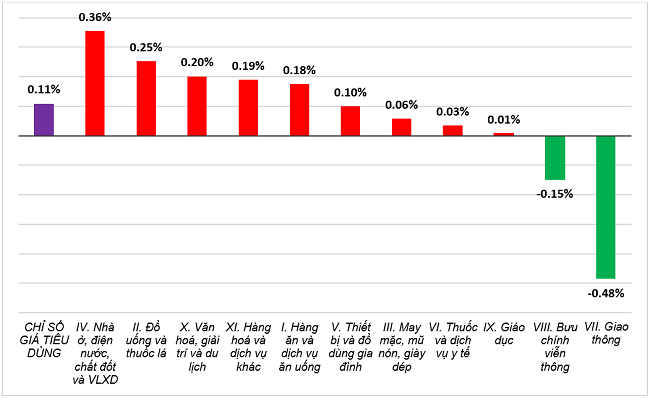

Out of the 0.11% increase in CPI in July compared to the previous month, there were nine groups of goods and services with increasing price indices and two groups with decreasing price indices.

Among the nine groups of goods and services with increasing price indices, the group of housing, electricity, water, fuel, and building materials recorded the highest increase of 0.36%, contributing to a 0.07 percentage point increase in the overall CPI.

This was mainly due to a 1.96% increase in the prices of housing maintenance materials, such as bricks, sand, and stones, as a result of scarce supply, increased production and transportation costs, and high construction demand. There was also a 1.82% rise in electricity prices for household use due to increased electricity demand during the prolonged hot weather in many regions, especially in the North and Central regions. Additionally, from May 10, 2025, the Vietnam Electricity Group (EVN) increased electricity tariffs for household use. The price of kerosene also went up by 2.64% due to adjustments made during the month.

Following this, the group of beverages and tobacco saw a 0.25% increase due to higher consumer demand during the summer and increased production costs. Specifically, the prices of bottled, canned, and boxed energy drinks increased by 0.52%, beer by 0.35%, cigarettes by 0.30%, carbonated soft drinks by 0.16%, and mineral water and liquor by 0.15% each.

Similarly, the group of culture, entertainment, and tourism experienced a 0.20% increase, with a 0.34% rise in sports facility rental fees, a 0.32% increase in television and internet fees, a 0.27% rise in book prices, and an 0.84% increase in package tour prices.

The group of food and dining services saw a 0.18% increase, impacting a 0.06 percentage point rise in the overall CPI. The group of household appliances and utensils also increased by 0.10%…

The two groups of goods and services that witnessed a decrease in their price indices were postal services, which fell by 0.15%, and transportation, which dropped by 0.48%, leading to a 0.05 percentage point decrease in the overall CPI. Within the transportation group, gasoline prices decreased by 1.50% due to adjustments in domestic gasoline and oil prices following global market trends. Additionally, there was a 0.45% drop in the prices of used cars, and new cars and motorcycles both decreased by 0.10% as businesses offered promotional programs and consumer support.

According to the released data, core inflation in July increased by 0.21% compared to the previous month and by 3.3% compared to the same period last year. On average, in the first seven months of 2025, core inflation increased by 3.18% compared to the same period last year, lower than the 3.26% increase in the overall CPI average.

The main reason for this, according to the General Statistics Office, is that food, electricity, healthcare services, and education services, which are included in the CPI calculation, were excluded from the core inflation calculation.

As of July 31, 2025, the average world gold price was at 3,369 USD/ounce, a slight decrease of 0.02% compared to June 2025.

Domestically, the gold price index in July increased by 1.02% compared to June due to the low circulation of gold bars in the market. It also increased by 49.7% compared to the same period last year, by 34.9% compared to December 2024, and on average, by 39.09% in the first seven months of 2025.

The US dollar price moved in the opposite direction, with the international US dollar index reaching 97.61 points as of July 31, 2025, a decrease of 1.0% compared to the previous month, as the market anticipated the Federal Reserve would soon loosen monetary policy to support economic growth, reducing the appeal of the US dollar.

In Vietnam, the US dollar price index increased by 0.37% compared to the previous month, by 3.39% compared to the same period last year, by 3.3% compared to December 2024, and on average, by 3.32% in the first seven months of 2025.

The Golden Rush: Prices Soar to Record Highs

This afternoon (August 5th), the SJC gold bar price surged to 123.8 million dong per tael, just 200,000 dong shy of the historical peak on April 22nd. The State Bank of Vietnam has announced that it will continue to coordinate with ministries and sectors to ensure transparency and take strict action against speculation and market manipulation in the gold market.

The Vice-Premier: Clampdown on Unreasonable Price Gouging

Vice Prime Minister Ho Duc Phoc emphasizes the importance of effective implementation and monitoring of pricing policies, including price declaration, listing, and transparency. He also underscores the need to address unreasonable price hikes that disrupt market stability with appropriate measures.

The CPI for the first seven months is estimated to increase by 3.2-3.3%.

The Ministry of Finance reports that the consumer price index (CPI) for the first seven months of the year is estimated to have increased by 3.2-3.3% compared to the same period last year. This is an appropriate level that supports economic growth, especially as resources are being focused on achieving the highest possible economic expansion. Vietnam’s inflation is being carefully managed within the target range set by the National Assembly and the Government of 4.5-5%, contributing to macroeconomic stability.

Trump’s Statement Sends Gold Prices Soaring to Near-Record Highs

The catalyst for this rally was a weakening U.S. dollar, which came under pressure after U.S. President Donald Trump declared that he would demand “lower interest rates immediately.”