2-Day Trading

3-Day Trading

4-Day Trading

5-Day Trading

High-Volume Trading

– 06:58, March 19, 2025

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

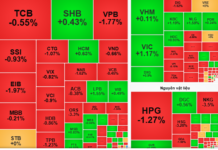

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

The Cautious Mindset Returns

The VN-Index retreated with below-average trading volume, indicating investor caution as the index nears its December 2024 peak (1,270-1,280 points). Additionally, the Stochastic Oscillator has signaled a sell-off in overbought territory, suggesting heightened short-term adjustment risks if the indicator falls from these levels.

Is Hesitation Creeping In?

The VN-Index edged higher, forming a Doji candlestick pattern. This reflects investors’ indecision as the index retests the old peak of December 2024 (1,270-1,280 points). However, trading volume remained above the 20-day average, indicating positive market participation. The Stochastic Oscillator and MACD remain upward-trending, providing buy signals. If this momentum persists, the outlook will turn increasingly optimistic.

The Critical Bottleneck: Indochina Capital Chairman’s Emphatic Message on Unlocking Vietnam’s Real Estate Market Potential

Peter Ryder, Executive Chairman of Indochina Capital and Board Member of Indochina Kajima, firmly believes that infrastructure is the foundation for Vietnam’s future growth, both in the real estate sector and the economy as a whole. He emphasizes that infrastructure is also the most critical bottleneck currently restraining the industry’s development.