In a recently announced partnership, AIG has acquired a strategic stake of over 52.8% in GC Food, Vietnam’s leading producer of aloe vera and coconut jelly. This move solidifies AIG’s position in the deep-processed agricultural product sector and underscores its commitment to making Vietnam a global leader in high-quality agricultural product processing and exports.

BOOSTING VIETNAM’S AGRICULTURAL SECTOR WITH HIGH-QUALITY PRODUCTS

AIG, led by Mr. Nguyen Thien Truc, the group’s founder and chairman, is a vanguard in deep-processing and global supply of Vietnamese agricultural products. The group consistently invests in and develops a diverse ecosystem of deep-processed agricultural products, sourced from Vietnam’s abundant agricultural regions.

AIG dominates the market for coconut-based products, such as Vico Fresh boxed coconut water, dried coconut meat, coconut milk powder, and coconut cream, produced by ACP. The group is also renowned for its diverse range of purees, fresh fruit juices, and IQF frozen fruits manufactured by MDG. AIG also invests in essential oils and natural fragrances derived from unique ingredients like cinnamon, anise, and basil, produced by ASI in Hung Yen. Additionally, AIG’s AHS is a leading manufacturer and processor of cassava-based products, including tapioca starch, dried cassava residue, and liquid glucose syrup, in Nghe An.

GC Food, driven by a passion for clean agriculture, excels in aloe vera and coconut jelly processing and is a leader in other key agricultural products. They prioritize establishing stable raw material sources and stringent production processes to ensure the highest quality and safety standards, meeting the ever-increasing market demands.

Sharing a vision for efficient utilization of Vietnam’s agricultural potential and developing high-quality products, AIG’s investment in GC Food will enhance the value of Vietnamese agriculture. The combination of GC Food’s expertise in aloe vera and AIG’s leadership in deep-processed agricultural products will optimize the value chain, diversify offerings, and expand opportunities for Vietnamese agricultural products in international markets.

Moreover, AIG will further diversify its raw material sources and product portfolio with GC Food’s large-scale, integrated production process. This will promote sustainable agriculture and provide stable livelihoods for hundreds of farmers, improving the lives of local communities.

LEADING THE WAY FOR VIETNAMESE AGRICULTURAL PRODUCTS GLOBALLY

Global demand for agricultural products is shifting towards deep-processed, clean, and sustainable options. OECD-FAO projections indicate a 13% increase in global agricultural consumption by 2034. Retail chains and FDI enterprises prioritize suppliers with standardized raw materials, digital technology integration, and transparent quality management. This presents both opportunities and challenges for Vietnamese businesses aiming to enter the global agricultural market.

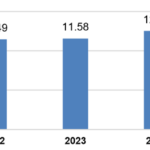

According to the Ministry of Agriculture and Environment, in the first seven months of 2025, the export turnover of agricultural products maintained its leading position, reaching 21.49 billion USD, a 17% increase compared to the same period last year. Vietnam is gradually establishing itself as an influential agricultural exporter on the world stage, leveraging its natural advantages, government support, and entrepreneurial drive.

The Asia Ingredients Group (AIG) is a pioneer in investing in and developing Vietnam’s agricultural potential. With its closed-loop ecosystem, from raw material development to product research, processing, and distribution, AIG is setting trends in producing high-value-added agricultural products. The group aims to build a national agricultural brand with distinct identity and global competitiveness.

AIG consistently invests in modern processing plants that meet international standards, including ISO 9001:2015, HACCP, FSSC 22000, ISO 22000, SQF, IFS, and HALAL. They develop a diverse range of refined products from Vietnamese agricultural resources, catering to premium markets such as the EU, the US, Japan, and South Korea. AIG also emphasizes research and development by establishing centers led by top experts. These centers innovate and diversify high-value-added products that align with market trends and tailor offerings to partners and customers. Additionally, AIG promotes sustainable consumption trends by investing in the development of clean raw material sources and efficient business cooperation models within the export chain.

AIG actively promotes and participates in global trade promotion activities, showcasing Vietnam’s deep-processed agricultural products in prominent food exhibitions like Anuga Food Fair (Germany), Foodex Japan, Thaifex Anuga Asia (Thailand), SIAL Shanghai (China), and Seoul Food (South Korea). Today, AIG’s deep-processed agricultural products ecosystem has a presence in over 50 countries and territories worldwide.

Amid the dynamic global market shifts, AIG demonstrates that Vietnamese businesses can take charge of the supply chain and build a national food brand from the country’s abundant agricultural resources, supported by the government and driven by entrepreneurial spirit. Investing in GC Food is a strategic move that reinforces AIG’s robust development and commitment to elevating Vietnam’s agricultural sector on the world stage.

The Great Migration and the Rise of Satellite Megacities

The urban landscape is undergoing a significant shift, with a wave of expansion that is fueling the rise of satellite megacities. These emerging urban centers offer a unique blend of ecological living spaces, world-class amenities, and strong potential for long-term growth, setting a new standard for modern urban development.

How Tycoon Pham Nhat Vuong Is Taking Over Hai Phong With His $2.2 Billion Real Estate, Industrial, and Logistics Projects

With an estimated investment of nearly $22 billion, Vingroup is the largest private investor in Hai Phong, spanning across real estate, industry, energy, and infrastructure sectors. The group has significantly contributed to the city’s goal of becoming the economic center of the northern sea, with its diverse range of projects and developments.

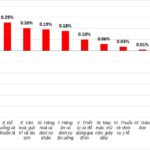

July CPI Rises 0.11% Month-Over-Month

According to the latest data released by the Statistics Bureau, the consumer price index (CPI) rose 0.11% in July from the previous month, primarily due to increases in housing maintenance material prices, food prices, and dining out. The CPI for July increased by 2.13% compared to December 2024, and by 3.19% year-on-year. On average, in the first seven months of 2025, the CPI rose by 3.26% year-on-year, with core inflation up by 3.18%.