The rights issue is offered at a ratio of 3:1 (for every 3 shares held, shareholders have the right to purchase 1 new share). These share purchase rights can only be transferred once during the specified period, and the recipient of the transferred rights may not further transfer them to a third party.

In the event that a shareholder does not register to purchase, does not pay for the shares, or there are any unallocated shares for any reason, the Board of Directors has the right to decide on a plan to distribute or offer these shares to other individuals or organizations at a price not lower than VND 10,000/share.

If the minimum successful offering rate of 70% is achieved, the Board of Directors will decide to cancel the remaining shares and end the offering. The company will increase its charter capital based on the actual number of successfully offered shares.

The additional shares purchased by existing shareholders or other investors through the exercise of their purchase rights will not be subject to transfer restrictions. However, shares allocated through the odd-lot policy and unallocated shares will be restricted from transfer for one year from the date of the completion of the offering.

With the expected proceeds of nearly VND 162 billion from this offering, NHA intends to use the entire amount to pay for costs and/or repay bank loans related to the investment project for the construction of a residential and commercial service complex in the 1/2000 master plan for the eastern area of Dong Van, Duy Tien district (DTĐT33.23) (now belonging to Ninh Binh province).

In the event that the proceeds from this offering are insufficient to cover 100% of the expected amount required for the above capital needs, the Company will flexibly utilize available capital sources or raise additional funds from external financial channels, including bank loans and credit from financial institutions, to make up for the shortfall and ensure the progress of the Project as planned.

On the other hand, if the entire proceeds from this offering cannot be disbursed immediately according to the project implementation schedule, the Board of Directors plans to open term deposit accounts with suitable maturities at the bank, based on the purpose of capital use approved by the General Meeting of Shareholders. The temporarily idle capital will be deposited in savings accounts to earn periodic interest, ensuring efficient capital utilization during the waiting period before formal disbursement.

The above share issuance plan for existing shareholders remains unchanged from the plan approved at the 2025 Annual General Meeting of Shareholders.

Prior to this offering, NHA had a dividend payout ratio of 10% in 2024, increasing the number of outstanding shares from nearly 44.2 million to nearly 48.6 million as of the present.

According to the contents approved at the 2025 Annual General Meeting of Shareholders, NHA will have one more issuance of 600,000 shares this year, dedicated to employees (ESOP). These shares will be restricted from transfer for one year after issuance.

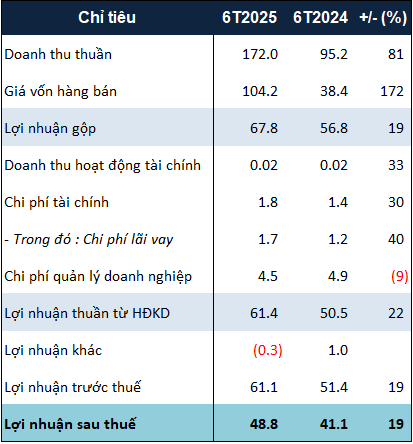

Recapping NHA’s business results for the first six months of 2025, the company recorded a gross revenue of VND 172 billion and a post-tax profit of nearly VND 49 billion, an increase of 81% and 19%, respectively, compared to the same period last year. According to the company’s explanation, this performance was largely driven by the construction segment, which saw a more than sevenfold increase in gross revenue to VND 105 billion. Meanwhile, the real estate segment decreased by nearly 18%, amounting to over VND 65 billion.

|

NHA’s Financial Results for the First Half of 2025 in VND billion

Source: 2025 Semi-annual Audited Financial Statements

|

Regarding the project in Duy Tien district, in the former province of Ha Nam, the project covers an area of 21,254 square meters and has a total investment of over VND 400 billion. NHA secured this project after winning the auction according to the decision dated November 19, 2024, of the People’s Committee of the former Ha Nam province. As of June 30, 2025, the basic construction cost of the project was nearly VND 59 billion, an increase of nearly 8% compared to the beginning of the year.

Ha Le

– 15:58 08/08/2025

Hòa Phát Approved for $146 Million Investment Boost for Hòa Phát Dung Quất 2, Increasing Annual Capacity by 500,000 Tons

The latest adjustments to the Dung Quat 2 project will boost annual capacity to 6.1 million tons of products, comprising 5.6 million tons of hot-rolled coil (HRC) steel and 500,000 tons of high-quality wire rod steel.

The Surprising Business Turnaround of the Bank that Just ‘Changed its Name, Changed Hands’

The acquisition of GPBank and OceanBank by VPBank and MB, respectively, marked a significant turnaround for the two struggling banks. Once plagued by financial woes, these banks have now risen like a phoenix from the ashes, shedding their loss-making past and embracing a new era of profitability. This remarkable transformation is a testament to the power of strategic mergers and the expertise that VPBank and MB bring to the table.

International Experts Predict HDBank’s Profit to Surpass 23,000 Billion VND by 2025

In Q2 of 2025, HDBank reported a remarkable pre-tax profit of VND 4,713 billion, bringing its total profit for the first half of the year to VND 10,068 billion. This impressive performance marks a 23% increase compared to the same period in 2024, solidifying the bank’s position among the top-performing financial institutions in the country.

Insider Trading: PET Leaders’ Strategic Exit as Share Prices Soar, Welcoming HDCapital as a Major Investor.

Recent developments at the Joint Stock Petroleum Services Corporation (Petrosetco, HOSE: PET) have caught the attention of investors. Five key leaders at the company have registered to sell their entire stock holdings, coinciding with the share price returning to a three-year high. On the flip side, HDCapital has emerged as a significant shareholder, acquiring 15.3 million PET shares on July 28.