**PV Power Plans Capital Increase to Fund Key Projects**

Workers at Ca Mau 1 Power Plant – Illustration

|

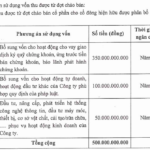

Vietnam Petroleum Power Joint Stock Company (PV Power, HOSE: POW) will finalize its shareholder list on August 25, 2025, to attend the upcoming extraordinary general meeting (EGM) scheduled for September 25 in Hanoi. The key agenda item is the approval of a capital increase plan, along with other matters within the competence of the shareholders.

Since its operation as a joint-stock company on July 1, 2018, PV Power’s charter capital has remained unchanged at nearly VND 23,419 billion. This is the first time the company has proposed a capital increase to meet the significant capital requirements for key projects. However, details regarding the method, form, and timeline have not yet been disclosed.

According to the 2025 plan, PV Power requires an investment of VND 6,632 billion, including VND 6,365 billion for construction, VND 140 billion for equipment procurement, and VND 127 billion for capital contribution to its subsidiaries. Approximately VND 1,885 billion will be funded by equity, and the remaining amount is expected to be borrowed. The total disbursement for the year is estimated at VND 9,052 billion.

This capital will be utilized for critical projects such as the Nhon Trach 3&4 Power Plant, the headquarters of the Corporation, LNG gas-fired power projects, renewable energy ventures, and the upgrade of production infrastructure.

Improved Performance and Stock Price Recovery

In Q2 2025, PV Power recorded revenue of nearly VND 9,415 billion, unchanged from the same period last year. Net profit reached VND 575 billion, a 47% increase. For the first six months of the year, revenue rose 12% to VND 17,565 billion, fulfilling 46% of the annual plan, while net profit amounted to VND 1,020 billion, a 52% increase, surpassing the full-year profit plan by 174% after just two quarters.

| PV Power returns to the milestone of semi-annual profit of thousand billion after 2 years |

|

|

Total assets as of the end of June exceeded VND 86,000 billion, including cash deposits of nearly VND 18,000 billion, a 15% increase from the beginning of the year. Interest income for the first half reached approximately VND 320 billion, nearly double that of the same period last year.

On the stock exchange, the POW share price increased in 4 out of the last 5 trading sessions, hovering around VND 15,100 per share, with a market capitalization of over $1.3 billion, one and a half times higher than the April low, and approaching the peak of the past three years. Monthly liquidity reached nearly 16.5 million shares per day, double the average of the year.

Addressing Bad Debt and Enhancing Cash Flow

As of the end of Q2, PV Power recorded bad debt of over VND 865 billion, an increase of 85% from the beginning of the year, mainly from the Power Trading Company (EPTC/EVN) and the Vietnam Oil and Gas Insurance Corporation.

Regarding EPTC, the two parties agreed on the recovery of O&M costs for the period from January 1 to June 30, 2021, amounting to VND 381 billion, expected to be completed in Q2 2025. PV Power also coordinated with EVN to reduce receivables from over VND 10,000 billion (in 2023) to VND 3,700 billion by the end of 2024, contributing to financial health.

– 13:05 08/08/2025

Breaking Ground: Three New Expressway Projects Spanning Over 300km to Commence on August 19th

The upcoming launch of three expressway projects, Dầu Giây–Tân Phú, Gia Nghĩa–Chơn Thành, and Hanoi’s Ring Road 4, on August 19, will add a significant 300km to Vietnam’s road network.

The Foreign Securities Firm on the Verge of a Thousand Billion Capital Increase

On December 6, the Ministry of Finance granted a certificate of registration for public offering of shares to Guotai Junan Securities Joint Stock Company (Vietnam) (HNX: IVS). The offering entails the issuance of 69.35 million new shares, maintaining a 1:1 ratio, thus increasing the company’s capital to VND 1,387 billion.

“ASEANSC Offers 50 Million Shares to Boost Capital to VND 1,500 Billion”

AseanSc is proud to announce that it is seeking shareholder approval for a proposed sale of 50 million shares. This move is part of our ambitious plans to raise our capital to 1,500 billion VND. We are confident that this decision will drive our company’s growth and open up new avenues for expansion.