Hoang Huy Financial Services Investment Joint Stock Company (HOSE: TCH) has just announced its plan to offer nearly 200.5 million shares to existing shareholders, raising over VND 2,000 billion.

The issuance of shares to the public was approved by TCH shareholders at an extraordinary general meeting held on September 5, 2025.

The entitlement ratio is 10:3, meaning that for every 10 shares held, shareholders are entitled to purchase 3 new shares. The record date is August 21, corresponding to the ex-rights date of August 20. The subscription and payment period will be from August 27 to September 15.

The offering price is VND 10,000 per share, nearly half of TCH’s market price of VND 24,150 per share at the close of the trading session on August 7.

The offered shares will not be restricted for transfer. However, in case of fractional shares and unsold shares offered to outside investors, there will be a one-year transfer restriction. The subscription rights are transferable once. The offering is expected to be completed within 2025, after obtaining the certificate of securities registration for public offering from the State Securities Commission.

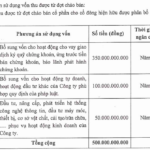

Hoang Huy plans to utilize the raised capital for investment in two real estate projects in Hai Phong: Hoang Huy Green River urban area project in Hoa Dong ward, Thuy Nguyen district, and H2 commercial and service apartment building project at Hoang Huy Commerce in Kenh Duong ward and Vinh Niem ward, Le Chan district.

The Hoang Huy Green River project spans over 32.5 hectares with a total investment of more than VND 4,050 billion. It comprises 780 landed houses, 447 social housing units, and a range of urban amenities. The project’s infrastructure is substantially complete; phase 1 is currently underway with 282 houses constructed up to the third floor. The company anticipates recognizing revenue from this project by the end of 2025.

The remaining project, H2 at Hoang Huy Commerce, covers nearly 1 hectare and features a 36-story apartment building. The total investment amounts to approximately VND 2,200 billion. The project has reached the first floor in terms of construction and is expected to be launched within 1-2 months. Hoang Huy anticipates completing the construction within 20 months and starting to recognize revenue from 2026 onwards.

Previously, the company spent VND 800 billion on acquiring 64 million shares of its subsidiary, Hoang Huy Services Investment Joint Stock Company (HOSE: HHS), in June 2025. Following this transaction, TCH’s ownership in HHS increased from 51.06% to 58.31%, equivalent to nearly 252 million shares.

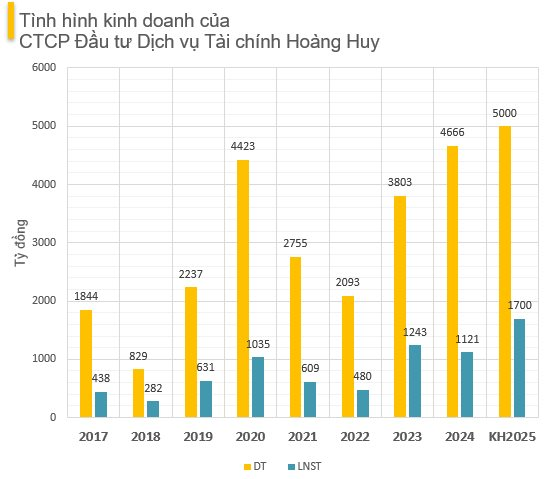

For the 2025 fiscal year (April 1, 2025 – March 31, 2026), Hoang Huy has set ambitious business plans with a targeted total revenue of VND 5,000 billion and after-tax profit of VND 1,700 billion, reflecting increases of 7.1% and 51.6%, respectively, compared to the previous fiscal year’s performance. Should these plans be realized, it would mark the highest revenue and profit in TCH’s operating history.

In the first quarter of the 2025 fiscal year, TCH reported consolidated revenue of VND 390.36 billion and after-tax profit of VND 56 billion, representing decreases of 52.9% and 75.5%, respectively, compared to the same period last year. These results are still far from the ambitious business plans presented at the annual general meeting of shareholders in 2025.

Unlocking Land Use Fees: Binh Duong’s Three Project Puzzle

Recently, three real estate projects in Binh Duong Province have received approval for land prices, enabling businesses to fulfill their financial obligations.

“ASEANSC Offers 50 Million Shares to Boost Capital to VND 1,500 Billion”

AseanSc is proud to announce that it is seeking shareholder approval for a proposed sale of 50 million shares. This move is part of our ambitious plans to raise our capital to 1,500 billion VND. We are confident that this decision will drive our company’s growth and open up new avenues for expansion.

The Steelmaker’s Stock Offering: A Bold Move to Forge a Brighter Future

“Nam Kim Steel Joint Stock Company (HOSE: NKG) has just announced the record date for its upcoming share offering, which is expected to raise nearly VND 1,600 billion.”

“Not as Vibrant as the 2018-2019 Phase, But the Real Estate Market is Now Experiencing a Strong Price Uptick.”

“It was an honor to have Dr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, grace us with his presence and insights at the event, ‘Discover the Most Livable Project in Viet Tri City,’ held on November 30, 2024. His expertise and knowledge contributed immensely to the success of the event and enlightened all attendees on the latest trends and developments in the real estate landscape of Viet Tri City and beyond.”