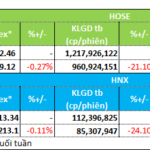

Today saw a large trading volume of over 1.7 billion shares, but no major sell-off occurred. The market remained resilient, and the index continued its strong growth trajectory, gaining momentum towards the end of the session. It closed 12.35 points higher at 1,223.35, a 1.02% increase.

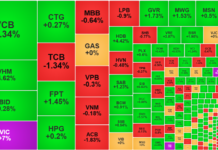

The breadth was positive, with 289 gainers leading over 208 decliners. Real estate stocks once again took the lead, with VIC hitting the daily limit-up and contributing 3.73 points to the market’s gain, while VHM rose 4.62%, adding 2.64 points. Other notable performers included HDB, FPT, VRE, BVH, and VCB. Today also marked the annual general meeting of VIC and HDB, where positive insights from the companies’ management spurred further interest in the real estate sector. This sentiment spilled over to other real estate stocks, with KBC, NVL, PDR, and DXG all posting solid gains, while industrial zone SIP soared.

Telecommunications stocks continued their rally with VGI and CTR, and information technology stocks FPT and CMG also shone in the green. The market’s overall positive sentiment was attributed to the absence of profit-taking sell-offs, although investors remained cautious, refraining from chasing prices higher. As a result, most other sectors witnessed more subdued gains.

The securities and banking sectors experienced contrasting fortunes, with the former seeing a deep divide. While VND, VIX, and HCM suffered significant losses, the majority of securities stocks posted average gains of over 1%. Similarly, in the banking sector, several stocks reversed course, with TCB, MBB, VPB, ACB, LPB, and SHB all witnessing corrections.

Market liquidity across the three exchanges dipped to over VND 19,000 billion. The market is expected to continue its upward trajectory in the short term, bolstered by the Ho Chi Minh City Stock Exchange’s upcoming launch of the KRX system on May 5.

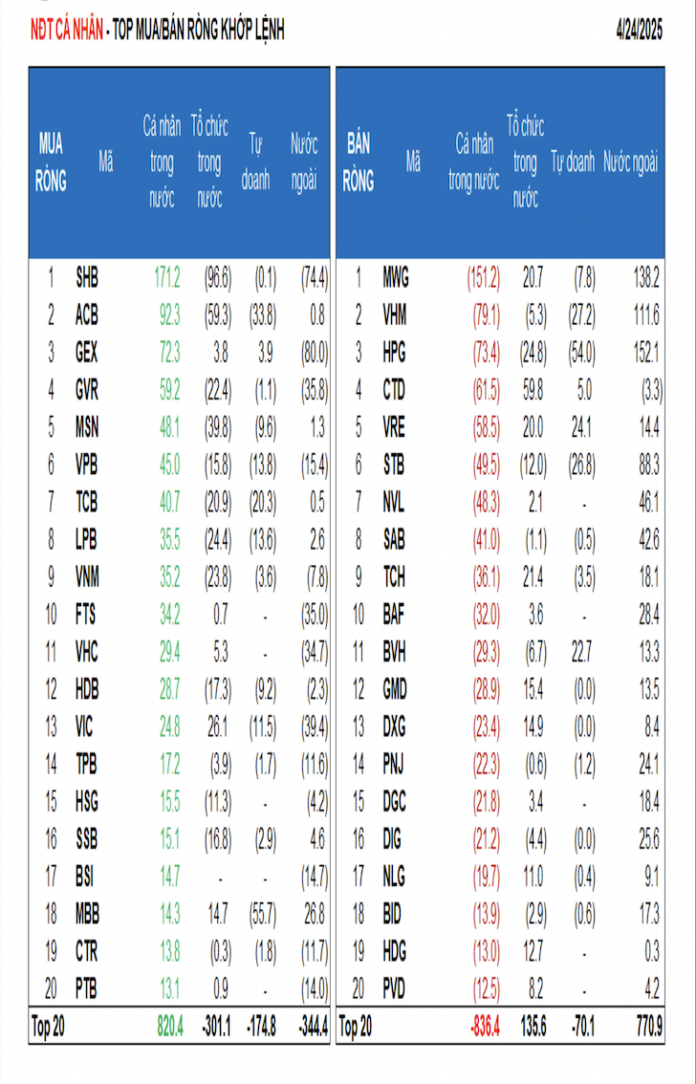

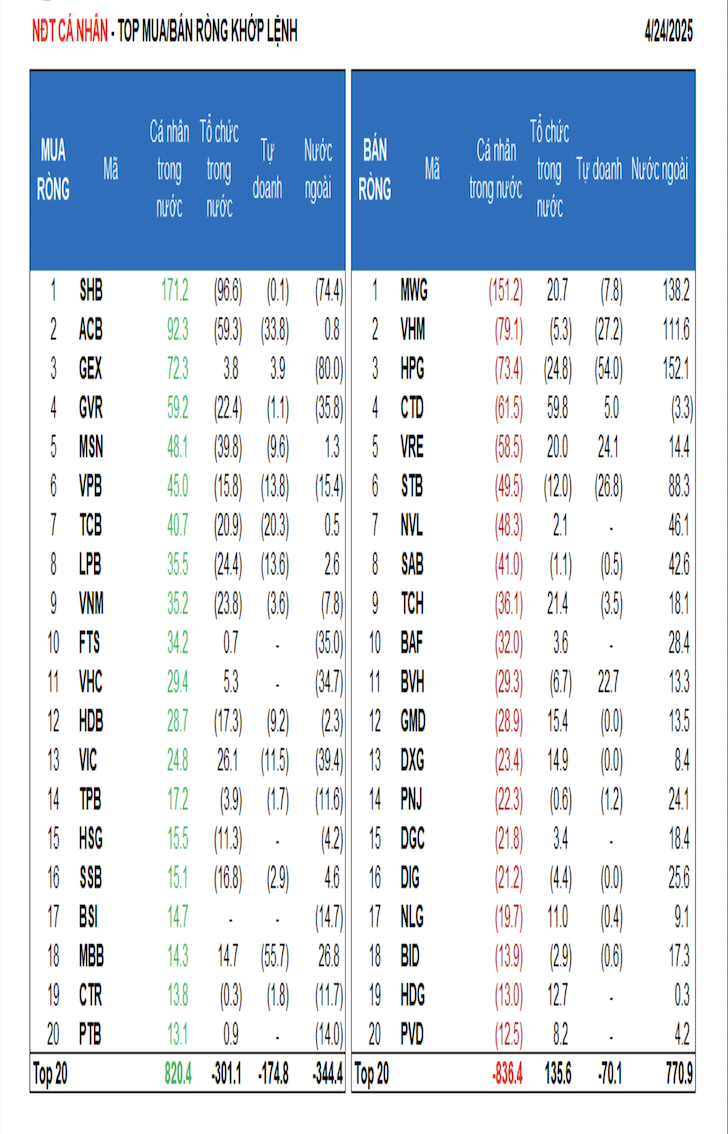

Foreign investors unexpectedly net bought VND 458.2 billion, with a net buy of VND 583.2 billion in matched orders. Their net buy in matched orders focused on the real estate and retail sectors, with top purchases including HPG, MWG, VHM, STB, NVL, SAB, BAF, MBB, DIG, and PNJ.

On the selling side, foreign investors offloaded industrial goods and services stocks, with top sells including GEX, SHB, VIC, GVR, FTS, VCI, VPB, BSI, and PTB in matched orders.

Individual investors net sold VND 73.5 billion, with a net sell of VND 100.0 billion in matched orders. In matched orders, they net bought 9 out of 18 sectors, mainly focusing on the banking sector. Their top purchases included SHB, ACB, GEX, GVR, MSN, VPB, TCB, LPB, VNM, and FTS.

On the selling side, they net sold 9 out of 18 sectors in matched orders, primarily offloading real estate and retail stocks. Top sells included MWG, VHM, HPG, CTD, VRE, STB, SAB, TCH, and BAF.

Proprietary trading arms of securities firms net sold VND 220.0 billion, with a net sell of VND 268.8 billion in matched orders. In matched orders, they net bought 3 out of 18 sectors, with the strongest purchases in insurance and financial services. Top buys included VRE, BVH, CTD, GEX, FUESSVFL, VCI, FUEVFVND, REE, HHS, and E1VFVN30. On the selling side, they offloaded banking stocks, with top sells including MBB, HPG, ACB, VHM, STB, TCB, VPB, LPB, VIC, and MSN.

Domestic institutional investors net sold VND 285.0 billion, with a net sell of VND 214.4 billion in matched orders. In matched orders, they net sold 10 out of 18 sectors, with the largest value in the banking sector. Top sells included SHB, ACB, MSN, CTG, HPG, LPB, VNM, GVR, TCB, and HDB. On the buying side, they focused on real estate stocks, with top purchases including CTD, VIC, TCH, MWG, VRE, KDH, VCI, GMD, DXG, and MBB.

Block deals today totaled VND 1,573.5 billion, down 26.6% from the previous session, contributing 8.1% to the total trading value. Notably, individual investors continued to be active in the banking sector (TCB, MSB, HDB, VPB), large-cap stocks (HPG, MSN, MWG), and VPI.

Money flow by sector showed an increase in allocation to securities, electrical equipment, oil and gas, software, warehousing and logistics, textiles, and courier services, while decreasing in real estate, banking, steel, chemicals, agricultural and marine products, food, retail, and building materials and interiors.

In terms of matched orders, money flow by market cap increased in mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) stocks.

The Cautious Sentiment Returns

The VN-Index witnessed a significant decline, with trading volume dipping below the 20-day average, reflecting investors’ extremely cautious sentiment. The index is currently retesting the old peak from November 2024 (1,195-1,215 points), which also coincides with the bottom established at the beginning of 2025. If the index sustains these levels, the outlook remains relatively optimistic. Additionally, the MACD indicator is poised to generate a buy signal as the gap with the signal line narrows. Confirmation of this buy signal would alleviate short-term downside risks.

The Top Stocks to Watch on April 18th’s Open

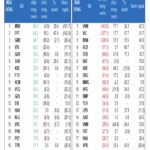

“A deep dive into the recent stock market trends: Unveiling the top gainers and losers as per Vietstock’s statistical insights.”

The VN-Index Surges Past 1,200 Points: Experts Predict a Market Rebound

The stock market is expected to continue its recovery trend next week, with key indices remaining above the 1,200-point mark. Bank stocks, consumer staples, and retail sectors are expected to be in focus, with potential for strong gains. As investors eye these sectors, the market sentiment is likely to remain positive, building on the recent momentum.