Vietnam’s Banking Sector: Robust Credit Growth and Economic Recovery

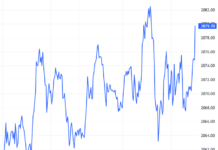

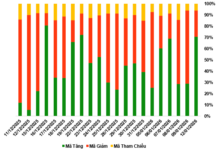

Vietnam’s banking sector demonstrates a notable improvement in the economy’s absorptive capacity for capital. The financial statements of 27 listed banks and the Agricultural Bank of Vietnam (Agribank) revealed a combined loan balance of approximately VND 14,940 trillion as of Q2 2025, reflecting a 10% increase compared to 2024. This indicates a robust credit growth, with the Big 4 banks, including BIDV, VietinBank, Vietcombank, and Agribank, dominating over 50% market share. Notably, several banks, such as NCB and VPBank, achieved a remarkable 20% growth in loan balance compared to the previous year.

Accelerating Credit Growth

As of Q2 2025, the total outstanding loans of 27 listed banks and Agribank reached approximately VND 14,940 trillion, a significant 10% increase compared to the end of 2024. The Big 4 banks, including BIDV, VietinBank, Vietcombank, and Agribank, dominated with over 50% market share, amounting to VND 7,500 trillion in outstanding loans. The credit growth rates of these leading banks were also impressive, with VietinBank, Agribank, Vietcombank, and BIDV achieving approximately 10%, 7.6%, 7%, and 6% increases, respectively, since the beginning of the year.

Additionally, some banks outperformed the industry average in terms of credit growth. Notably, NCB and VPBank achieved a remarkable 20% increase in loan balance compared to the end of 2024. This was followed by ABBank with a 16% increase, while HDBank and Nam A Bank both recorded a 15% growth in their loan portfolios.

According to NCB representatives, their 6-month loan balance reached 90.4% of the annual plan due to a focus on high-credit-score customers and the rapid deployment of digital technologies for convenient and fast disbursement.

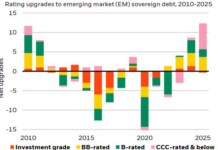

Assessing these results, Associate Professor Dr. Pham Thi Hoang Anh, Deputy Director of the Banking Academy, stated that such impressive credit growth reflects enhanced investment opportunities in production and business. She attributed this development to the Vietnamese government’s aggressive reforms in mechanisms, policies, and institutions, which have bolstered the confidence of domestic and foreign investors. However, she emphasized the importance of maintaining credit quality while expanding the credit scale and directing capital towards priority sectors in line with the country’s socio-economic development goals.

Echoing this sentiment, Associate Professor Dr. Nguyen Thuong Lang, a senior lecturer at the National Economics University, stressed that to achieve the government’s economic growth target for the year, credit growth in the remaining five months must increase by 1.8 to 2.3 times compared to the first seven months. He underscored the necessity of improving capital usage efficiency and prioritizing credit for green exports, renewable energy, high-tech industries, and efficient projects. Lower interest rates, he added, would stimulate both aggregate demand and supply, fostering sustainable growth.

A significant portion of the credit growth is directed towards the real estate and securities sectors, posing potential risks.

Managing Risks in a High-Growth Environment

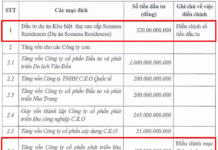

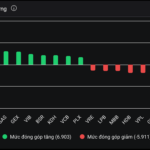

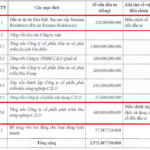

As of June 30, the credit balance for the real estate sector reached approximately VND 3,180 trillion, a substantial increase of 2.4 times compared to the end of 2024, accounting for 18.5% of the total outstanding loans in the system. This significant influx of capital into the real estate sector is also reflected in the loan portfolios of several banks.

Techcombank’s lending to real estate businesses (including credit and bonds) accounted for 59% of its total outstanding loans, and when including individual customers, this figure rose to over 64%. Their consolidated real estate business lending grew by 21.5%, nearly doubling the bank’s overall credit growth rate of 11.6%.

Other banks also reported significant increases in real estate business lending, including MB with VND 85,834 billion, a 34% increase; SHB with VND 163,754 billion, a 28.4% increase; and HDBank with VND 83,125 billion, a 22% increase compared to the beginning of the year.

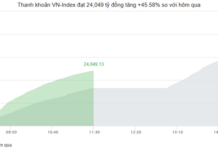

In addition to the real estate sector, margin lending for securities purchases has also reached record highs. The margin debt of Vietnamese securities companies currently stands at VND 303,000 billion, the highest level ever.

Experts caution that the concentration of capital in high-risk sectors like real estate and securities could lead to imbalances and an increase in non-performing loans. Associate Professor Dr. Pham Thi Hoang Anh advised commercial banks to strike a balance between growing their loan portfolios and maintaining credit quality. She recommended directing more medium and long-term capital through the stock market and bond market to reduce pressure on the banking system and enhance the sustainability of credit.

At the July Government meeting with provinces and centrally-run cities, Governor of the State Bank of Vietnam, Nguyen Thi Hong, affirmed that the higher credit growth in the real estate sector compared to the overall average is in line with the government’s support for this sector. As projects are unblocked, capital demand is inevitable. Regarding the securities sector, she noted that credit balance accounts for only 1.5% of total outstanding loans, posing no systemic risk.

Governor Hong assured that the State Bank of Vietnam closely monitors safety indicators, with the short-term capital ratio for medium and long-term loans remaining below 30%. She emphasized that credit institutions must balance their capital according to maturity to ensure the safety of the system.

Dr. Nguyen Tri Hieu: “Lowering Interest Rates to Support Growth is Logical, but it Also Harbors the Risk of Asset Bubbles”

The banking sector is the “backbone” of the economy, providing capital and making an ever-increasing contribution to the state budget. However, behind these impressive figures lies the pressure of a high credit-to-GDP ratio, maturity and interest rate risks, and the urgent need for digital transformation to stay in the global race.

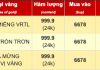

Does Loosening Credit Room Affect Savings Deposits?

The credit growth landscape is set for a potential surge, however, we shouldn’t expect a rush to increase lending rates. This surge won’t spark a rate race, and it’s important to note that deposit savings of the public remain secure and unaffected.

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a special credit package for reasonably priced housing to further stimulate credit growth.