Illustrative Image

Deposit interest rates at SHB in March 2024

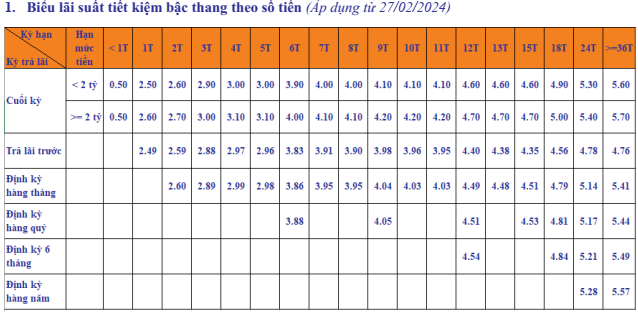

In March, customers depositing at SHB transaction counters are implemented in the form of graduated savings with end-of-term interest payment with 2 deposit levels: Below 2 billion dong and from 2 billion dong or more.

With the deposit limit below 2 billion dong, interest rates range from 0.5 – 5.6% per year for end-of-term interest payment.

Specifically, the corresponding interest rates for each term are as follows: less than 1-month term is 0.5% per year; 1-month term is 2.5% per year; 2-month term is 2.6% per year; 3-month term is 2.9% per year; 4 and 5-month terms are 3% per year; 6-month term is 3.9% per year; 7-8 month term is 4% per year; 9-11 month term is 4.1% per year; 12-15 month term is 4.6% per year; 18-month term is 4.9% per year; 24-month term is 5.3% per year;

For deposits below 2 billion dong, the best interest rate for a 36-month term is 5.6% per year.

With the deposit limit of 2 billion dong or more, SHB offers higher interest rates 0.1% per year compared to the deposit limit below 2 billion dong, with interest rates ranging from 0.5-5.7% per year for end-of-term interest payment.

Specifically, the quoted interest rates for each term are: less than 1-month term is 0.5% per year; 1-month term is 2.6% per year; 2-month term is 2.7% per year; 3-month term is 3% per year; 4 and 5-month terms are 3.1% per year; 6-month term is 4% per year; 7-8 month term is 4.1% per year; 9-11 month term is 4.2% per year; 12-15 month term is 4.7% per year; 18-month term is 5% per year; 24-month term is 5.4% per year;

The highest interest rate is applied to the 36-month term, which is 5.7% per year.

In addition to end-of-term interest payment, customers can choose other interest payment methods such as: Prepayment of interest ( 2.49 – 4.78% per year); Monthly fixed interest payment ( 2.6 – 5.41% per year); Quarterly fixed interest payment (3.88 – 5.53% per year); 6-monthly fixed interest payment (4.54 – 5.49% per year); Yearly fixed interest payment (5.28 – 5.57% per year).

Furthermore, customers with a deposit amount of 500 billion dong or more can directly contact SHB transaction counters for special offers.

Source: SHB

SHB’s online deposit interest rates in March 2024

For online deposit, the interest rates range from 2.6 – 5.8% per year.

Specifically, online savings with a 1-month term have an interest rate of 2.6% per year, 2-month term is 2.7% per year, 3-month term is 3% per year, 4 – 5 month term is 3.1% per year, 6-month term is 4.2% per year;

Customers depositing via the app with a 7 – 8 month term will receive an interest rate of 4.3% per year; 9 – 11 month term is 4.4% per year; 12 – 15 month term is 4.8% per year; 18 month term is 5.1% per year, 24 – month term is 5.5% per year.

5.8% per year is the highest interest rate for online deposits, applied to terms of 36 months or more.

Source: SHB

In addition, SHB continues to offer a savings package with deposit interest rates ranging from 0.1 – 5.6% per year, depending on the term.

Current accounts are still maintained with an interest rate of 0.1% per year on the account balance.

Source: SHB