According to the emphasized opinion in LGL’s reviewed semi-annual financial statements for 2025, UHY stated that the Hanoi Tax Department had previously issued a tax enforcement decision and notified LGL that their invoices were no longer valid. The effectiveness of this decision would end when the company pays its tax and late payment fines in full. However, as of now, the debt remains unresolved.

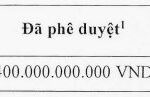

In a explanatory document sent to the State Securities Commission, LGL attributed the tax debt to a project constructing a resettlement housing fund for the People’s Committee of District 10 (former), Ho Chi Minh City, at Lot C, 7/28 Thanh Thai land area. The project was completed and handed over in late 2018, with a total cost of approximately VND 300 billion. However, the company has not yet received payment from the budget. The delayed finalization has resulted in significant financial costs, affecting both profits and cash flow.

The company stated that the Ho Chi Minh City Department of Finance has submitted to the City People’s Committee for approval of the phase 1 finalization, with a value of about VND 290 billion, as a basis for payment. LGL is in the process of completing procedures to soon receive this amount and, at the same time, mobilizing additional resources to prioritize fulfilling its obligations to the state budget.

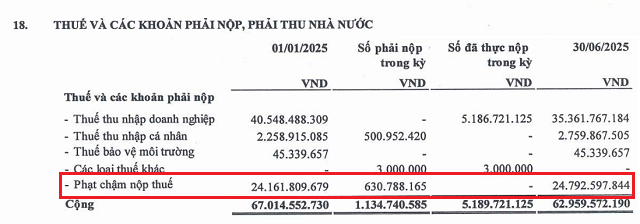

In the meantime, the company uses invoices for each occurrence and pays 18% of the invoice revenue into the state budget. The report noted that by the end of June, the late tax payment penalty amounted to nearly VND 25 billion, an increase of VND 630 million in the first six months and nine times higher than in 2020.

LGL faces a late tax payment penalty of nearly VND 25 billion. Source: LGL’s reviewed semi-annual financial statements for 2025

|

The Thanh Thai project (commercial name: Rivera Park Saigon) is located at the intersection of Thanh Thai and Nguyen Tri Phuong streets. This is the first project in LGL’s Rivera Park chain, which started in 2014 and was handed over in 2017 with an investment of over VND 1,400 billion.

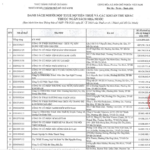

Specifically for Lot C, comprising 288 apartments, LGL signed a sales contract with the District 10 Public Service One-Member Co., Ltd. at the end of 2018, with a provisional price of VND 252 billion. However, inventory as of now still records VND 277 billion.

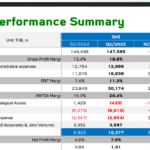

In terms of business results, in the first six months of 2025, LGL recorded revenue from sales and provision of services of nearly VND 40 billion, but gross profit was only VND 455 million. Thanks to a dividend of over VND 17 billion, the company’s after-tax profit was VND 6.2 billion, reversing the loss of more than VND 23 billion in the same period last year. However, this result is still lower than the profit target of VND 18 billion for the whole year.

In addition, the reviewed semi-annual financial statements for 2025 show that the amount payable of nearly VND 54 billion to the partner for the Rivera Park Saigon project, Vietnam Commercial Development Joint Stock Company (Vietradico), has been transferred to long-term after the two parties agreed to extend the payment deadline by 24 months.

Rivera Park Saigon Project – Photo: LGL

|

Has Long Giang Land’s stock found an “escape” from the controlled state?

– 13:40 19/08/2025

“Agri-Giant C.P. Vietnam Takes a Hit: Revenue Down 21% Post Sick Pig Scandal”

Charoen Pokphand Foods (C.P. Foods), a leading Thai conglomerate, witnessed a slight dip in its global revenue for Q2 2025, with Vietnam being the primary contributor to this decline.

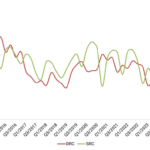

Profits Plummet for Tire Manufacturing Group

The second quarter of 2025 witnessed a distinct dichotomy within the rubber industry, with a clear divide between product manufacturers and latex harvesters. While rubber tappers thrived amidst sustained high latex prices, tire manufacturers faced significant challenges due to soaring raw material costs, resulting in their lowest gross profit margins in a decade.