According to the audited financial statements for the year 2023, SZB recorded a net revenue of nearly VND 383 billion, an increase of 6% compared to the previous year. The leasing of land and infrastructure business segment remained the main source of revenue with nearly VND 257 billion (accounting for 67% of total revenue), up 8%. Net profit reached over VND 116 billion, an increase of 9%.

Compared to the plan, Sonadezi Long Binh exceeded the total revenue target by 3% and the after-tax profit target by 4% in 2023. This is also the year the Company achieved the highest business results (including revenue and profit) since its listing on HNX at the end of 2019.

| Financial Performance of SZB from 2019-2023 |

Sonadezi Long Binh stated that leasing land and infrastructure business remain their core focus. In 2023, the Company successfully signed new leasing contracts for 2 FDI projects with investors from Germany and China, with a total value of about VND 144 billion.

Regarding the plan for 2024, SZB announced that the Company has completed the signing of contracts and transferred the rights to a 5.7ha land plot in Chau Duc Industrial Park, bringing in a revenue of over VND 108 billion. This project marks a significant increase in revenue in early 2024.

The Company also set a target to fully exploit the remaining 60,000m2 of land in Xuan Loc Industrial Park to achieve 100% occupancy rate; fully utilize the ready-to-rent workshops, with a scale of 11,500m2 in Thanh Phu and Chau Duc Industrial Parks; invest in constructing a group of workshops on a 42,500m2 land plot to ensure the supply for the coming years.

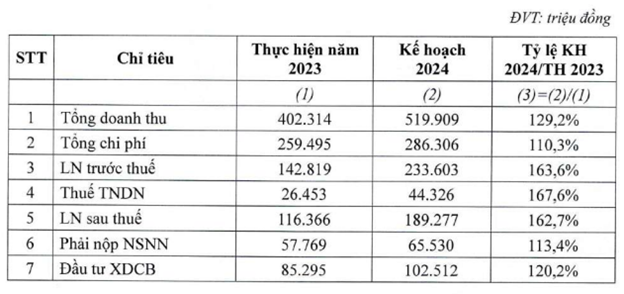

With that spirit, SZB has set an optimistic business plan for 2024 with a target of nearly VND 520 billion in total revenue and over VND 189 billion in after-tax profit, an increase of 29% and 63% respectively compared to 2023. SZB also plans to pay a dividend at a rate of 35%.

|

Business Plan for 2024 of SZB

Source: SZB

|

The Annual General Meeting of Shareholders 2024 of SZB is expected to be held on March 28, 2024, at 1, 3A Street, Bien Hoa 2 Industrial Park, Long Binh Tan Ward, Bien Hoa City, Dong Nai Province.

In the stock market, VN-Index experienced a significant decrease on March 8, dropping 1.66% to 1,247.35 points. However, the stock price of SZB went against the market trend, closing at VND 37,600 per share, an increase of 4.16% in the session and a 20% increase since the beginning of 2024.

| Price movement of SZB stock since the beginning of 2024 |