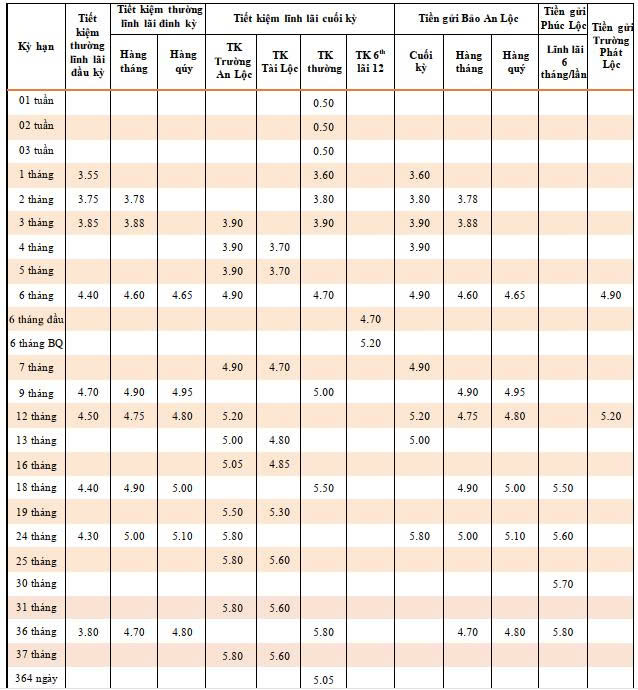

TPBank’s August Counter Savings Interest Rates

According to a survey conducted in early August, the interest rates offered by Tien Phong Commercial Joint Stock Bank (TPBank) for individual customers depositing at the counter with interest paid at maturity range from 0.5% to 5.8% per annum.

Specifically, interest rates for short-term deposits ranging from 1 week to 3 weeks remain unchanged from the previous month at 0.5%/year.

Meanwhile, the interest rates for 1-month, 2-month, and 3-month terms for regular savings accounts are set at 3.6%/year, 3.8%/year, and 3.9%/year, respectively.

For the 6-month term, TPBank offers an interest rate of 4.7%/year. Subsequently, the interest rates for 9-month and 18-month terms are 5.0%/year and 5.5%/year, respectively.

The highest interest rate of 5.8%/year continues to be applied to deposits with a 36-month term.

Source: TPBank

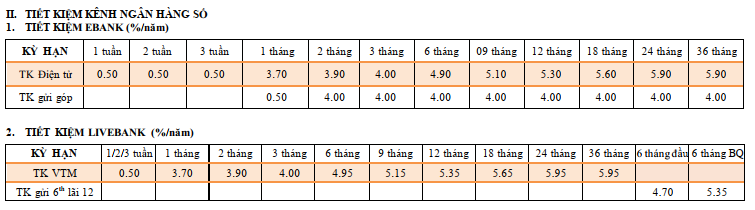

TPBank’s August Online Savings Interest Rates

During August, TPBank introduced interest rates for online savings accounts on EBank ranging from 0.5%/year to 5.9%/year.

For terms less than 1 month, the interest rate is 0.5%/year. The interest rates for 1-month, 2-month, and 3-month terms are 3.7%/year, 3.9%/year, and 4.0%/year, respectively. The 6-month and 9-month terms offer interest rates of 4.9%/year and 5.1%/year, respectively. For the 12-24 month term, the savings interest rates are 5.3% – 5.6%/year.

The highest interest rate of 5.9%/year is offered by TPBank for the 24-36 month term.

However, customers should note that TPBank may offer different deposit interest rates to certain customers, not exceeding the interest rate cap set by the State Bank for each term.

If customers with fixed-term savings products as specified above wish to withdraw their deposits before maturity, the interest rate applied will be the lowest non-term interest rate in effect on the date of early withdrawal.

The Power of Compounding: Maximizing Your Returns with a 6.2% Interest Rate on a 1-Year Fixed Deposit

The 1-year term deposit interest rates offered by banks vary, with rates ranging from 3.9% to 6.2% annually. These rates are subject to the banks’ individual policies, and some institutions offer higher rates for online deposits compared to over-the-counter transactions.

The Great Savings Interest Rate Surge

We are thrilled to announce that our bank is raising its savings interest rates starting today, September 17th. This decision reflects our commitment to delivering exceptional value to our esteemed customers. With this rate increase, we aim to empower our customers to grow their hard-earned savings and achieve their financial goals. Stay tuned for more updates, and thank you for choosing [Bank Name].