Corporate Dividend Payouts: A Snapshot of Vietnam’s Thriving Economy

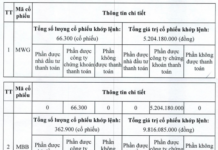

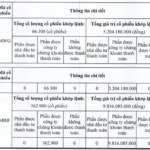

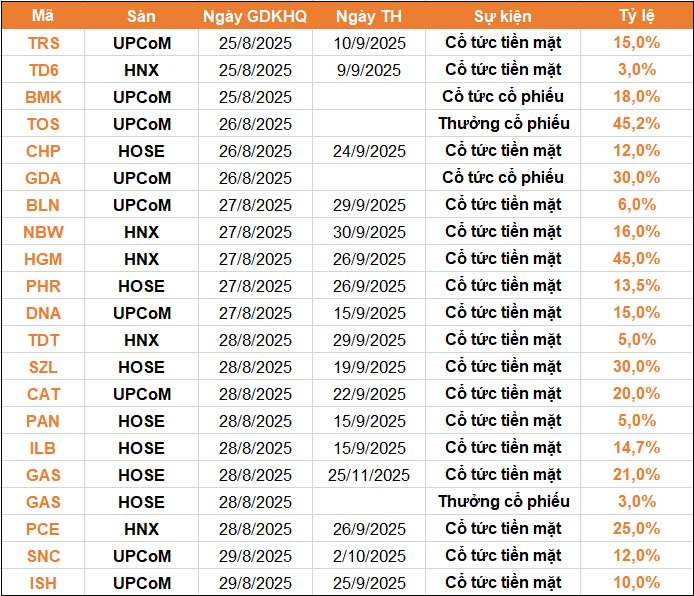

This week, 20 companies announced dividend payouts for the week of August 25-29, with 16 opting for cash dividends. The highest rate stands at an impressive 45%, while the lowest is a modest 3%.

Additionally, two companies chose to distribute stock dividends, one offered bonus shares, and one provided a hybrid dividend.

A visual representation of the diverse dividend payout methods employed by Vietnamese companies.

Dong A Steel Joint Stock Company (Code: GDA)

announced that August 26 is the ex-dividend date for its 2024 stock dividend, with a ratio of 30%. This means that for every 100 shares owned, shareholders will receive 30 new shares.

With over 114.69 million shares currently in circulation, Dong A Steel is expected to issue more than 34.4 million new shares. If this issuance is successful, the company’s charter capital is projected to increase to VND 1,491 billion.

On August 26,

Central Hydropower Joint Stock Company (Code: CHP)

will finalize its 2024 year-end dividend payout list.

Central Hydropower has opted for a cash dividend, offering a 12% ratio (equivalent to VND 1,200 per share). The expected payment date is September 24.

With approximately 147 million shares in circulation, CHP is expected to disburse over VND 176 billion for this dividend round. Earlier, in March 2025, the company distributed nearly VND 147 billion as the first dividend installment for 2024, with a 10% ratio. Thus, the company will have completed dividend payments for the year, adhering to the 22% ratio approved at the 2025 Annual General Meeting of Shareholders.

On August 27,

Tan Cang Sea Services Joint Stock Company (Code: TOS)

will finalize its shareholder list to issue bonus shares and increase its charter capital. Previously, the company had announced an ex-dividend date of August 11 but has since changed it to August 27.

TOS plans to issue over 14 million shares, with a ratio of 14,000,114/ 30,999,886, equivalent to 45.16%. This means that for every 100 shares owned, shareholders will receive 45.16 new shares. Any fractional shares will be rounded down and canceled, not issued.

The total capital issuance, at par value, is over VND 140 billion. Upon successful issuance, TOS’s charter capital will increase from VND 140 billion to VND 450 billion.

According to the latest announcement, August 28 will be the record date for

Ha Giang Mechanics and Mineral Joint Stock Company (Code: HGM)

to finalize its shareholder list for the 2025 interim cash dividend payment. The payout ratio is set at 45%, meaning that for each share held, shareholders will receive VND 4,500.

With 12.6 million shares in circulation, the company estimates a dividend payout of approximately VND 57 billion. The expected payment date is September 26, 2025.

Vietnam National Gas Corporation (PV GAS, Code: GAS)

announced that August 29 is the record date for its 2024 dividend payout and issuance of shares from the capital increase using retained earnings.

PV GAS will distribute a cash dividend with a ratio of 21%, equivalent to VND 2,100 per share. With nearly 2,342.7 million listed and circulating shares, the company will disburse nearly VND 4,920 billion in dividends. The expected payment date is November 25.

Concurrently, the company will issue bonus shares with a ratio of 100:3, meaning that for every 100 shares held, shareholders will receive 3 new shares. Any fractional shares will be canceled and not issued.

The Rising Star of Vietnam’s Economy: Outpacing Thailand?

“The Nation” highlights Vietnam’s emergence as Asia’s new manufacturing powerhouse, attributing it to the country’s impressive pace of reform and growth. While Thailand, slow to innovate, risks falling behind its dynamic neighbor. The article emphasizes Vietnam’s rapid ascent and the potential consequences for the region’s economic landscape.

“Stock Price Doubles Since the Start of the Year: MCST Group (ALV) Prepares a 70% Dividend Payout”

On August 11, the State Securities Commission announced that it had received complete documentation regarding the bonus share issuance of MCST Group Joint Stock Company (stock code: ALV).

“Lizen Seeks to Raise $100 Million via Equity Offering at a 15% Discount to Expand Global Footprint.”

Lizen is set to offer a strategic investment opportunity with a private placement of 100 million shares, priced at a 15% discount to the market rate. With this move, the company aims to raise 1,000 billion VND to fuel its ambitious growth strategy. The funds will be utilized to retire debt, invest in state-of-the-art equipment, expand its global footprint, and venture into large-scale PPP projects. This proactive approach positions Lizen for significant advancement, as it fortifies its financial standing and seizes opportunities for expansion and innovation.