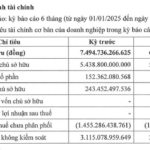

Taseco Group’s consolidated financial report for the first half of 2025 revealed a remarkable performance, with a post-tax profit of VND 402.7 billion, marking a 68% surge compared to the same period last year. This growth coincides with the expansion of its operational scale. As of June 30, 2025, the Group’s total assets amounted to VND 14,537.5 billion, reflecting a 35.4% increase from the beginning of the year.

Source: Taseco Group’s Financial Report

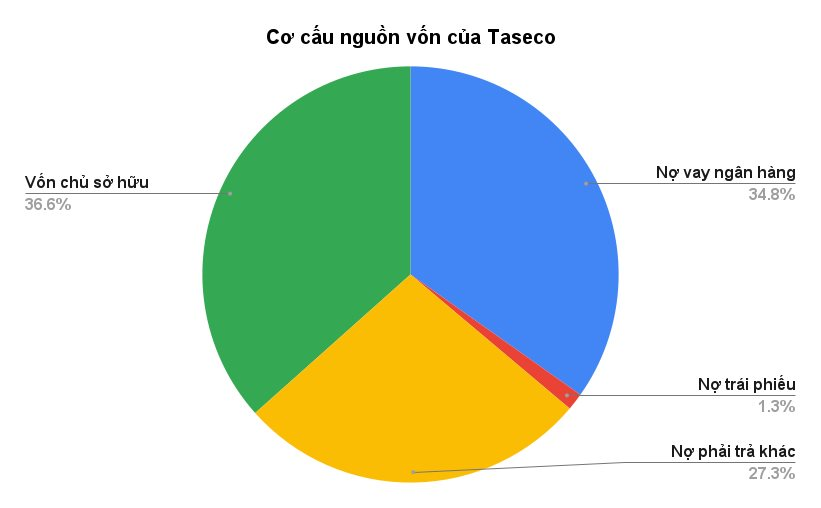

On the capital front, total liabilities rose by nearly 54% to VND 9,218 billion, while equity stood at VND 5,319.5 billion. Consequently, the Group’s financial leverage ratios are relatively high, with a Debt-to-Equity ratio (D/E) of 1.73 and a Debt-to-Total Assets ratio of 0.63.

The Group’s capital raising strategy underwent a noticeable shift. While bank loan balances soared by 83% to VND 5,060 billion, bond debt witnessed a significant decline to VND 194 billion following the maturity and settlement of a bond lot. This move aligns with a preference for bank and equity capital.

Taseco Group, steered by Chairman Pham Ngoc Thanh, has evolved into a diversified conglomerate since its inception as a non-aviation service provider at Noi Bai Airport in 2005. The Group’s ecosystem comprises two core members listed on the HOSE: Taseco Land (TAL), in which Taseco Group holds 72.5% stake, spearheading the real estate segment, and Taseco Airs (AST), with a 51% stake, focusing on aviation services.

Design of Landmark 55 Project, Tay Ho Tay Urban Center, Bac Tu Liem District, Hanoi

Taseco Land (HOSE: TAL) witnessed significant improvements in operational efficiency. For the first six months of 2025, Taseco Land posted gross revenue of VND 933 billion, on par with the same period last year.

However, bolstered by a gross profit margin increase from 24.3% to 33.7%, the company realized a post-tax profit of VND 60 billion, a 3.5-fold increase compared to the first half of 2024. Taseco Land is channeling its resources into large-scale projects such as Landmark 55 in Hanoi, À La Carte Ha Long Resort, and a newly won urban area project in Bac Ninh spanning approximately 62.27 hectares.

To finance these ambitious endeavors, Taseco Land approved a plan to privately offer 48.15 million shares, aiming to raise VND 1,493 billion.

Lucky Cafe & Fastfood at Tan Son Nhat Airport’s Terminal 3

In contrast, Taseco Airs (HOSE: AST) remains a stalwart contributor to the Group’s success. Benefiting from the robust recovery in the tourism industry, Taseco Airs recorded a 18% year-on-year increase in post-tax profit for the first half, amounting to VND 122 billion, thus accomplishing 58.6% of its full-year profit plan.

This growth is attributed to its extensive network of over 144 business locations across major airports, and the company foresees significant expansion opportunities with the upcoming operation of services at Tan Son Nhat Airport’s Terminal 3.

The Second Largest Insurer in Vietnam Invests over $820 Million in Stocks, Recording a Profit of $35 Million in the First Half of the Year

As of June 30th, Prudential Vietnam Insurance’s short-term investment portfolio was predominantly comprised of listed stocks and UPCoM-traded equities, accounting for over half of its total value at VND 19,438 billion.

“Debt Surpasses VND 10.1 Trillion: Tien Phuoc Group Reports Profit of Nearly VND 452 Billion in First Half of Year.”

This is Tien Phuoc Group’s record profit since 2021. A remarkable achievement, this financial success story is a testament to the group’s unwavering dedication, innovative strategies, and exceptional performance. With a sharp eye for market trends and a commitment to excellence, Tien Phuoc Group has navigated the economic landscape with prowess, solidifying its position as an industry leader. This milestone underscores the group’s resilience and fortitude, setting a new benchmark for prosperity and growth.

“IPA Hydropower Company Reports 14% Dip in Half-Yearly Profits”

“In the first half of 2025, Bac Ha Energy reported a remarkable after-tax profit of over 30 billion VND, reflecting a 14% decrease compared to the same period last year. The company also witnessed a significant reduction in its total liabilities, which fell by 25.6% to 551 billion VND, showcasing a strong financial performance and a positive trajectory for the remainder of the year.”