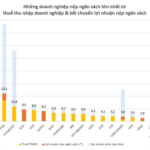

According to data from CafeF Lists 2025, the top 200 enterprises in the VNTAX 200 list contributed nearly VND 800,000 billion to the state budget in 2024, accounting for 40% of the country’s total budget revenue. For the private banking sector, 2024 was a breakthrough year as the total budget contribution of the top 20 banks exceeded VND 95,400 billion, a 19% increase from the previous year and 68% higher than in 2022. This record-breaking figure showcases the robust performance of the banking sector amid Vietnam’s accelerating economy and growing budgetary needs.

Among private banks, leading names such as Techcombank, HDBank, and VPBank have been recognized for their exceptional contributions. Notably, HDBank not only excelled in profit records but also contributed over VND 6,000 billion to the state budget in 2024 – double the amount from the previous year. This achievement propelled the bank into the Top 10 banks with the highest contributions nationwide and the Top 2 among private banks. It demonstrates HDBank’s remarkable growth and underscores its commitment to supporting the nation through tangible and sustainable actions.

Mr. Nguyen Van Hao, HDBank’s Deputy General Director, receives recognition from Mr. Phan Duc Hieu, a member of the National Assembly’s Economic Committee, and Mr. Nguyen Hong Sam, Director-General of the Government Web Portal.

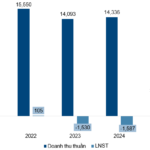

In addition to its budgetary contributions, HDBank consistently showcases its strong financial capabilities. As of Q2/2025, the bank maintained its impressive growth trajectory, ranking among the Top 5 banks with profits exceeding VND 10,000 billion. Consolidated pre-tax profit in Q2 reached VND 4,713 billion, a 13.9% increase year-on-year, reflecting the effectiveness of its risk management and capital cost optimization strategies. Consolidated total assets stood at VND 784,096 billion, a 25.6% surge compared to the same period last year. Credit growth was managed prudently alongside stringent asset quality control, with the bad debt ratio at just 1.78%, significantly lower than the industry average. Financial safety indicators showed continuous improvement, highlighting the resilience and sustainability of HDBank’s business operations.

The recognition of HDBank and other private banks in the PRIVATE 100 and VNTAX 200 lists this year is not just a well-deserved acknowledgment of their relentless business efforts but also a testament to the growing significance of the private sector in fortifying the nation’s finances. Guided by the principle of balancing corporate interests with community responsibilities, HDBank, alongside commercial banks, pledges to continue partnering with the government in building a prosperous Vietnam.

“TPBank Recognized as a Top Private Bank in Vietnam for Its Significant Tax Contributions.”

“At the 2025 Enterprise Budget Contribution Awards, TPBank made a remarkable impression by ranking among the top 20 banks in Vietnam for budget contribution, and an impressive 9th position among private banks. “

Viettel: Forging Ahead with Record-Breaking Contributions to the National Coffers

Let me know if you would like me to tweak this title or provide additional suggestions.

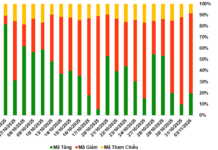

“CafeF has recently unveiled the VNTAX 200 list, comprising the top businesses contributing an impressive 200 billion VND and above to the state budget in the latest fiscal year. Notably, a significant number of these enterprises boast substantial budget contributions derived from their profit margins.”

MSN – Strengthening its Position for Sustainable Growth (Part 2)

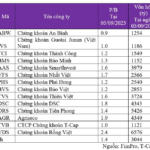

The Masan Group (HOSE: MSN) is witnessing positive signals across its various business segments, including WinCommerce, Masan MEATLife, and Masan High-Tech Materials. These divisions are anticipated to significantly contribute to the company’s long-term growth and solidify its foundation for stable operations. With its current valuation, MSN stock presents an attractive investment opportunity for long-term investors seeking exposure to a well-diversified and robustly performing company.