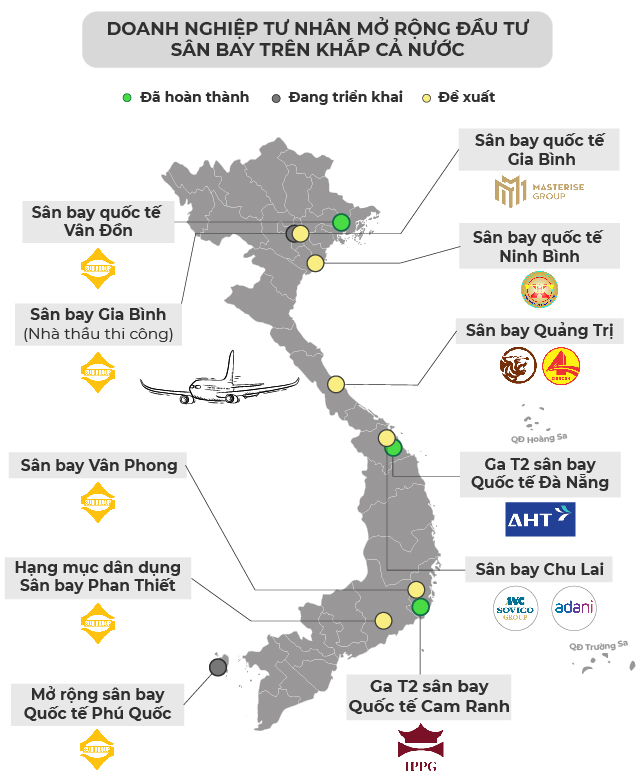

In the race to develop Vietnam’s aviation infrastructure, Sun Group stands out with its ambitious airport projects nationwide. At Gia Binh Airport, the conglomerate is the main contractor, pledging completion within 12 months from December 2024. Additionally, Sun Group is expanding Phu Quoc Airport and proposing new projects at Van Phong and Phan Thiet Airports.

Previously, Sun Group successfully constructed Van Don International Airport under a public-private partnership (PPP) model, completing it in just two years (2016-2018). The group currently operates and manages this airport.

Other major players are also joining the race. T&T Group has proposed building Quang Tri Airport, while Masterise Group is behind the Gia Binh International Airport project. Xuan Truong Group is pushing for Ninh Binh International Airport. Meanwhile, SOVICO-ADANI Group and Vietjet have partnered with Quang Nam province to propose investments in Chu Lai International Airport.

Earlier, IPPG, led by Chairman Johnathan Hanh Nguyen, collaborated with ACV and four other partners to construct Terminal 2 at Cam Ranh International Airport. Terminal 2 at Da Nang International Airport is being developed by Da Nang International Terminal Investment and Exploitation JSC (AHT).

According to the 2030 master plan, most airports proposed by private enterprises have capacities below 30 million passengers per year, a scale that PwC considers economically efficient.

PwC’s report, “Airports and Economies of Scale,” analyzed nearly 50 global airports, revealing a saturation point in scale. Airports achieve optimal efficiency at 40 million WLU (Workload Units) per year, where 1 WLU equals one passenger or 100 kg of cargo. Beyond this threshold, operational and capital costs rise faster than revenue, leading to declining profitability metrics like ROA, ROCE, and ROIC.

Overburdened infrastructure leads to frequent congestion at terminals and runways, reducing operational turnover. Managing large-scale complexes requires extensive staffing, cumbersome maintenance, and high energy consumption. PwC notes that these costs increase exponentially with scale expansion.

Moreover, large airport expansion projects often span multiple years, demand substantial capital, and carry risks amid market fluctuations.

PwC’s research highlights that airports handling 15-40 million WLU annually outperform larger ones, with an average ROA of 5.2%, significantly higher than the 3.7% for airports above 40 million WLU.

Lean operations, flexible upgrades, and low marginal costs enable this group to adapt to market volatility, avoiding the pitfalls of rigid operational models. This adaptability is crucial in an industry influenced by economic shifts, pandemics, and climate change.

Passenger experience is also critical, with factors like distance to city centers, terminal navigation time, and runway-to-gate distances directly impacting perceived value and operational efficiency.

– 11:10 26/09/2025