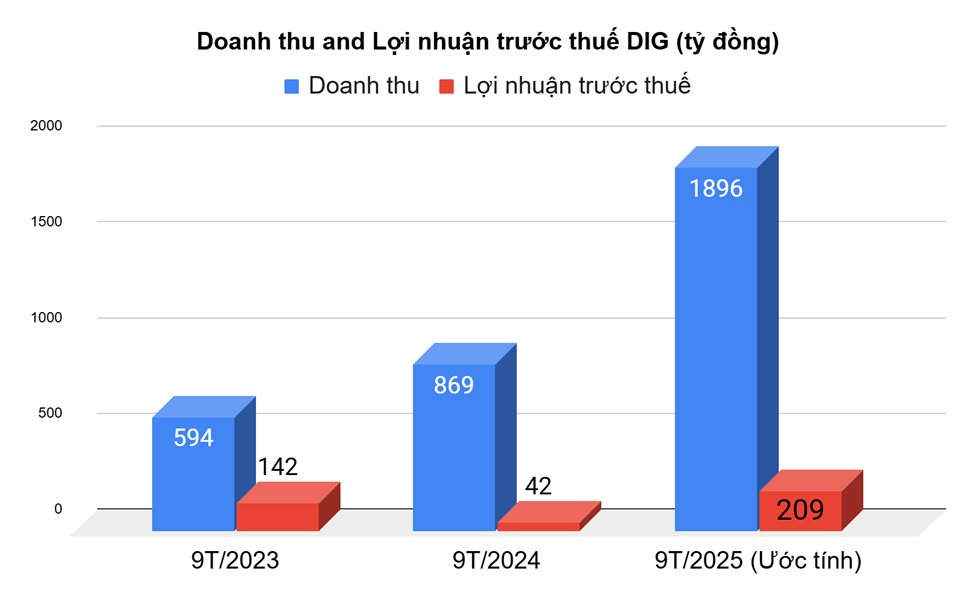

According to published data, in the first nine months of 2025, DIC Corp is estimated to have achieved a total revenue and other income of 1.896 trillion VND, with pre-tax profit reaching 209 billion VND. Compared to the same period last year, revenue is double, and profit is nearly five times higher than the first nine months of 2024.

This growth is significantly attributed to the successful transfer of the Lam Hạ Center Point project. However, compared to the annual plan with a target of 3.5 trillion VND in revenue and 718 billion VND in pre-tax profit, the company has only achieved 54% of the revenue target and notably, just 29% of the profit goal.

Perspective of the Lam Hạ Center Point Residential Area. Photo: DIG

However, the company’s leadership is confident in the imminent completion of a key transaction. Specifically, CEO Nguyễn Quang Tín stated that the sale of the Đại Phước project is in its final legal stages and is expected to be finalized in October.

“This deal is projected to contribute over 2.4 trillion VND in revenue and 748 billion VND in gross profit, accounting for a significant portion of this year’s business targets,” Mr. Tín emphasized. This is considered the “ace in the hole” that will largely determine the success of the 2025 business plan.

The leadership’s optimism is further bolstered by a favorable macroeconomic context. According to Mr. Tín, the government’s policies to resolve bottlenecks are becoming more practical and effective. Additionally, low-interest rates and ample liquidity are seen as key factors driving market recovery.

Mr. Tín noted, “More money than goods is seen as an opportunity for real estate to gain momentum for recovery and development.” Nonetheless, the leadership emphasizes caution in management to safeguard shareholder interests amid unpredictable fluctuations.

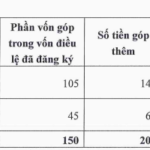

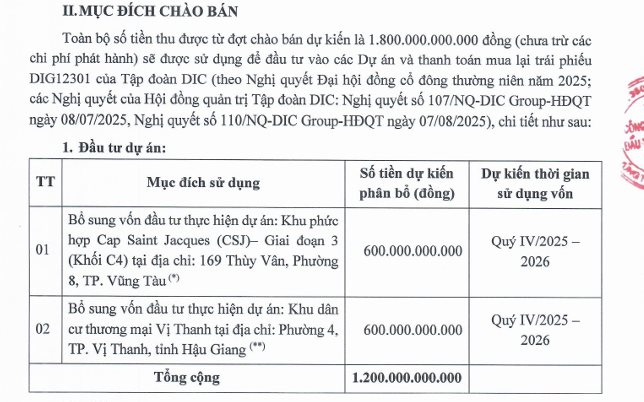

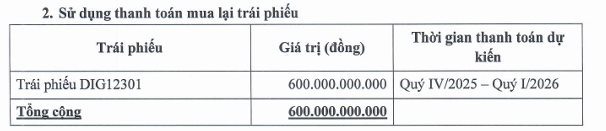

Alongside finalizing M&A deals, DIC Corp has received a certificate to offer 150 million shares to existing shareholders at 12,000 VND per share, expecting to raise 1.8 trillion VND. This capital will be prioritized for major projects such as the Cap Saint Jacques Complex, the Vị Thanh Commercial Residential Area, and repaying bond purchases.

Thus, through the sale of the Lam Hạ and Đại Phước projects and the share offering to raise capital, the leadership anticipates having approximately 5 trillion VND to prepare for potential M&A opportunities in 2026.

However, a remaining challenge is the slow disbursement of development investment capital. In the first nine months, the company has only achieved about 25% of the annual plan of over 6.6 trillion VND, requiring a significant acceleration in the final quarter of 2025.

Young Buyers Fuel Housing Demand, Real Estate Developers Rush to Launch New Projects

Anticipation of rising prices, the pursuit of secure investment havens, and the untapped potential of Ho Chi Minh City’s satellite regions are collectively driving a resurgence in real estate demand.

What Waves Will Shape the Stock Market Next Week?

Domestic stocks experienced a lackluster trading week, with capital flowing out of banking and securities sectors and shifting towards mid-cap and small-cap stocks. Analysts predict that the market is likely to continue its sideways movement next week unless liquidity improves.