Full Experience Journey: Earn Points, Win Big with Metro Thịnh Vượng

From October 1 to December 31, 2025, Rong Viet Securities (VDSC) launches the “Metro Thịnh Vượng” lottery program exclusively for new online securities account holders. Alongside attractive perks like 6 months of free stock trading, free online money transfers, premium account numbers, and a competitive Margin interest rate of 6.88% per annum, investors also enjoy complimentary access to a comprehensive suite of investment tools: iDragon, smartDragon, eduDragon, and hiDragon.

Additionally, investors can access the sustainable investment product, the Rong Viet Prosperity Investment Fund Certificate (RVPIF), directly on the iDragon app. RVPIF is an open-ended equity fund focused on listed companies with strong growth potential, attractive valuations, and a commitment to long-term sustainable value creation.

Moreover, each interaction at designated “stations” allows investors to accumulate Lottery Codes (MSDT) for monthly draws in October, November, and December. The prize structure is enticing: 1 First Prize of 10,000,000 VND in RVPIF certificates and 10 Consolation Prizes of 1,000,000 VND credited to securities accounts. For detailed criteria on earning lottery entries, click here.

The Perfect Time to Begin Your Investment Journey with “Metro Thịnh Vượng”

The latter half of 2025 is poised to be a promising period for Vietnam’s stock market, supported by stabilizing global macro factors and domestic economic policies fostering growth. The government’s fiscal and monetary measures are expected to further bolster this momentum.

Furthermore, the market is energized by regulatory reforms aimed at upgrading and enhancing transparency and sustainability. Initiatives like the Market Upgrade Plan, Decree 245/2025/NĐ-CP, and direct engagements between the Minister of Finance and FTSE Russell underscore this commitment.

These developments signal increased international investor confidence, paving the way for sustainable mid- to long-term growth in Vietnam’s stock market.

In this vibrant landscape, Rong Viet’s “Metro Thịnh Vượng” offers investors a seamless starting point. Each “station” provides an opportunity to explore a comprehensive ecosystem of investment tools and solutions, ensuring effective investment support.

Over 19 years, Rong Viet has solidified its reputation in Vietnam’s securities market. Guided by the mission “Creating a Prosperous Future” and a customer-centric approach, Rong Viet continuously expands its ecosystem, enhances service quality, and embraces digital transformation to deliver optimal investment outcomes.

Rong Viet awarded “Outstanding Financial Brokerage Service” at VWAS 2025

Rong Viet’s dedication is recognized through numerous prestigious domestic and international awards. At the 2025 Vietnam Wealth Advisor Summit (VWAS), Rong Viet was honored in multiple categories, including Outstanding Financial Brokerage Service, Outstanding Technology and Digital Transformation Product, Innovative Personal Financial Solutions, and Outstanding Asset Management Service. For four consecutive years since 2022, Rong Viet has been awarded by Global Banking & Finance (UK), with the latest title being “Best Investment Analysis and Advisory Service in Vietnam 2025.”

For detailed terms and conditions of the “Metro Thịnh Vượng” program, click here.

Foreign Investors Continue Selling Spree, Offloading Nearly VND 400 Billion in Real Estate Stocks on September 30th

In the afternoon session, CII and SHB emerged as the top net buyers in the market, with impressive purchase values of 90 billion VND and 82 billion VND, respectively.

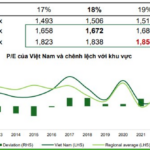

Premium Stocks Scarce in Vietnam’s Market

The VN-Index has surpassed the 1,600-point milestone for the first time, potentially paving the way for an upgrade. However, experts caution that the market still lacks diversity, heavily dominated by financial and real estate stocks.