“Em Xinh Say Hi,” a fresh reality music program featuring a lineup of popular young artists, has quickly made waves, particularly among Gen Z—the show’s core audience.

With its youthful and modern spirit, “Em Xinh Say Hi” naturally aligns with TPBank, its main sponsor. TPBank positions itself as a bank for the young and leads in digital experiences. Developed by a team with young hearts, the TPBank App embodies this spirit, ensuring every feature is not only functional but also resonates with the new-gen customers.

“Em Xinh Say Hi” shares a natural synergy with its main sponsor, TPBank (Image: Vieon)

This alignment has created a powerful synergy for TPBank alongside “Em Xinh Say Hi.” During the show’s airing, TPBank App downloads surged by 200%, with some days exceeding 120,000 downloads. According to Social Listening reports, TPBank led the industry in positive sentiment on social media for two consecutive months (July and August), with explosive discussions and a flood of praise from the show’s fans. Conversations about the TPBank App consistently trended, making it a frequent topic alongside the program.

Riding the show’s momentum, TPBank introduced a series of cool, trendy features, integrating the TPBank App into Gen Z’s fandom culture and strengthening customer connections through emotion.

Em Xinh Interface on TPBank App: Perfectly Gen Z

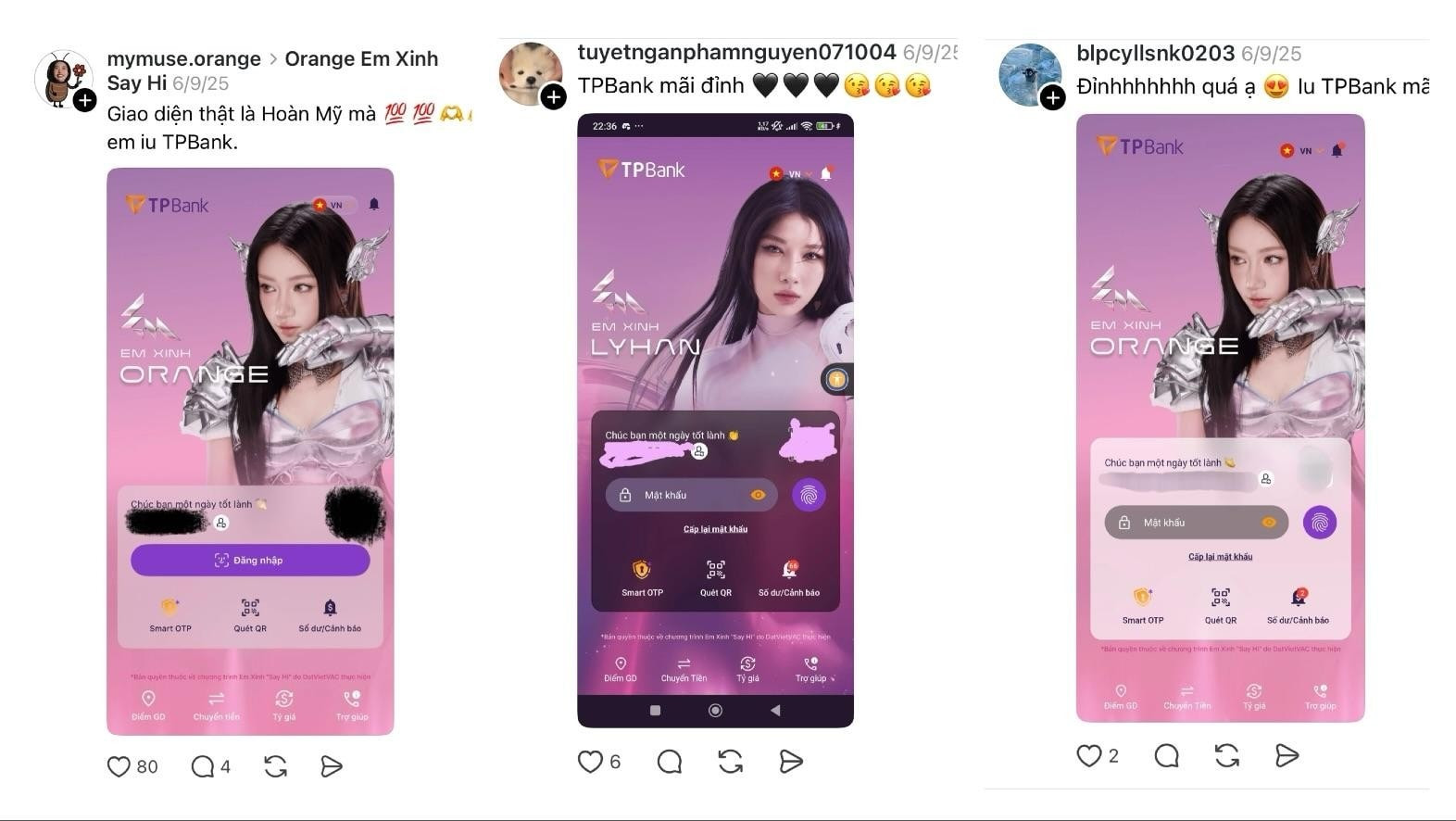

TPBank created a social media frenzy with its Em Xinh interface collection featuring four Em Xinh stars: Phương Ly, Orange, 52Hz, and Lyhan. Within minutes, discussions about the TPBank App skyrocketed on Threads, Facebook, Instagram, and more, instantly sparking a trend of changing TPBank App interfaces.

With just a few taps, the TPBank App transforms into the style of your favorite Em Xinh. Start your morning with Phương Ly’s energy, then switch to Orange’s boldness in the evening. If you love all four, feel free to change the interface daily. The TPBank App transcends traditional banking apps, turning a dry financial tool into a platform for fans to express their personality and idol love.

TPBank caused a social media storm with its Em Xinh interface collection on the TPBank App

On social media, Xinhiu (Em Xinh’s fandom) eagerly shared screenshots of their idol interfaces. To add excitement, TPBank launched the “Change Interface – Win Xinh Gifts” mini-game, offering limited-edition Em Xinh bandanas as prizes, intensifying the TPBank App interface change race.

Send Money with Style Using Em Xinh ChatPay Cards

If the idol interfaces weren’t enough, the Em Xinh version of ChatPay cards sent the community into a frenzy. ChatPay, TPBank’s signature conversational money transfer feature, now includes cards featuring Phương Ly, Orange, and 52Hz.

Transactions are no longer mundane. You can send a cute card with a sweet message like, “Here’s a bubble tea from Orange!” Recipients using ChatPay will instantly see the card, turning transfers into emotional, connective moments.

Xinhiu and their exclusive gifts from TPBank

A TPBank representative shared, “We aim to transform dry transactions into emotionally rich actions.” ChatPay is renowned for its “Paste to Pay” feature, where AI automatically fills in details from copied messages. With idol cards, ChatPay further cements its status as “perfectly Xinhiu”: both functional and emotional, embodying the “Top Utility, Top Living” spirit.

Exclusive Flash 2in1 Cards for Xinhiu

Directly on the TPBank App, customers can open the limited-edition Em Xinh Say Hi Visa Flash 2in1 card. This unique card combines credit and debit functions in one chip, catering to modern spending needs.

The limited-edition card features exclusive designs inspired by the show, making it both stylish and personal. Early applicants can get it for just 1 đồng and receive an exclusive combo: a bandana and adorable idol stickers. For fans, this card is more than a financial tool—it’s a digital fan club membership, perfect for spending and showcasing idol love and style.

A Trendy Digital Bank Living It Up with Gen Z

From customizing the app with idol interfaces to sending emotions via ChatPay cards and launching limited-edition cards, TPBank has proven that digital banking can be trendy, personal, and close to Gen Z.

With the tagline “Top Utility, Top Living,” TPBank asserts that fintech goes beyond convenience and security—it embraces youth culture and preferences.

To Gen Z, the TPBank App is now akin to a digital fan club for Em Xinh Say Hi—a bank in sync with their lifestyle, emotions, and trends. TPBank’s achievements have earned it the “top of the top” praise from the Xinhiu community.

This youthful, creative approach has garnered prestigious awards: TPBank won the Z First-Rate award at WeChoice Awards 2024 for the most beloved financial-consumer app among youth. ChatPay also made international waves, winning The Asian Banker’s Best Social Banking Initiative in Asia Pacific 2025. These awards are not just community and expert recognition but also a clear testament to the “Top Utility, Top Living” spirit in Gen Z’s eyes, solidifying TPBank’s position in regional digital banking.

SHB Joins Vietnam Card Day 2025, Accelerating Cashless Payments

As the official sponsor of Vietnam Card Day 2025, Saigon-Hanoi Commercial Joint Stock Bank (SHB) is set to deliver cutting-edge, secure payment experiences and exclusive rewards to its customers, particularly the Gen Z demographic. This initiative aims to promote a cashless lifestyle within the community, fostering a seamless and modern financial ecosystem.

Digital Trust: The New Launchpad for the Banking Sector

The surge in digital financial transactions in Vietnam in recent years underscores the growing trust users place in the stability, security, and personalization of online platforms.

Enhancing Early Warning Systems for Suspicious Transactions to Mitigate Fraud Risks in Financial Institutions

Early warning systems that provide proactive alerts and reminders to customers, helping them identify suspicious transactions and potential fraud, have proven highly effective. Their success underscores the need to prioritize, enhance, and expand these initiatives for broader impact and continuous development.