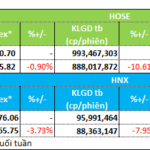

At the macroeconomic and financial update session hosted by the IMF and HSC Securities on October 7th, experts engaged in a comprehensive discussion, painting a multifaceted picture of Vietnam’s economy and stock market.

Stock Market Remains Promising

Mr. Michael Kokalari – Chief Economist at VinaCapital

|

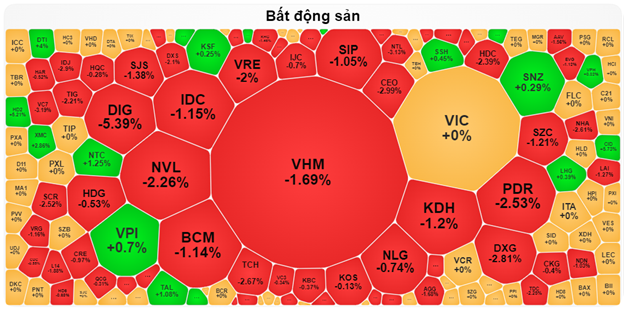

During the discussion, Mr. Michael Kokalari, Chief Economist at VinaCapital, expressed significant optimism about the stock market and consumer spending in the upcoming period. He believes the stock market will continue to grow robustly, even if the local currency depreciates. Mr. Kokalari is confident that the Vietnamese government’s continued push for growth is a positive signal for the economy, and the stock market will surge on the back of this growth momentum. The wealth effect generated by the stock market’s rise, coupled with optimism in the real estate sector, will contribute to improving consumer sentiment.

He forecasts that real retail consumption growth will return to its normal level of around 8% next year, without the need for additional stimulus policies.

Despite predicting a 4-5% depreciation of the Vietnamese Dong this year and potentially next year, Mr. Kokalari believes that if the economy and stock market perform well, investors will not be overly concerned about this slight depreciation. However, it remains a point of attention.

In the exchange, experts agreed that upgrading the national credit rating is more crucial than upgrading the stock market index.

Mr. Michael Kokalari considers the focus on upgrading the FTSE index for the stock market as “somewhat vague” and a topic discussed for many years. He emphasizes that upgrading the MSCI index is what truly matters. The VinaCapital expert believes the major theme to be discussed next year will be elevating the national credit rating to Investment Grade, as Vietnam will need to borrow from foreign investors to fund large-scale projects.

Mr. Phạm Vũ Thăng Long – Director of Macroeconomic Research, HSC Securities

|

Regarding the macroeconomic outlook, Mr. Phạm Vũ Thăng Long, Director of Macroeconomic Research at HSC Securities, forecasts that due to the impact of countervailing tariffs, exports and imports will slow down next year, growing at 5% and 5.5% respectively (down from this year’s estimated 11% and 13%), before regaining momentum in 2027.

The reason HSC believes Vietnam will maintain its competitiveness is that Vietnam’s average tariff rate after applying countervailing tariffs is nearly 18%—still highly competitive compared to most ASEAN economies and significantly lower than China (38%) and India (37%).

However, some sectors such as textiles (37.5%), footwear (30%), and metals (36%) face higher tariff burdens. Nevertheless, compared to key competitors, Vietnam still holds potential advantages in many key product groups such as machinery, electrical equipment, and furniture.

According to the IMF report, if the risk of tariffs on transshipment goods is considered, Vietnam’s average tariff rate could rise from 18% to over 25%. This risk is particularly high for goods with low domestic content and heavy reliance on raw materials from China, such as electronics, textiles, footwear, and machinery.

Similar to the trade outlook, HSC predicts that committed and realized FDI will slow down in 2026 before accelerating again in 2027. However, in the first nine months of this year, realized FDI still grew by 8.5%, and commitments increased by 15.2%, reflecting investor optimism as the tariff outlook becomes clearer.

Vietnam still possesses many long-term competitive advantages to attract FDI. The three most important factors to enhance FDI attractiveness are: improving infrastructure, enhancing the legal framework, and simplifying administrative procedures.

Need to Balance the Financial System and Improve Labor Productivity

Experts assess that Vietnam could boost growth by an additional two percentage points above the baseline over the next five years if it successfully implements an ambitious structural reform program. However, Vietnam’s economy still faces several challenges, with key risks centered around imbalances in the financial system and productivity.

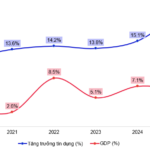

Vietnam is a credit-driven economy, with the credit-to-GDP ratio approaching 140%, significantly higher than the average for emerging markets (around 40%). Mr. Jochen Schmitmann, Resident Representative of the International Monetary Fund (IMF) in Vietnam, Cambodia, and Laos, warns that rapid credit growth (around 20% this year) could lead to asset quality issues.

Mr. Jochen Schmitmann – Resident Representative of the IMF in Vietnam, Cambodia, and Laos

|

Additionally, Vietnam’s economic growth heavily relies on input factors (capital and labor). Over the past 20 years, total factor productivity growth has been nearly zero. This 0% growth is significantly lower than the average contribution of 2 percentage points for emerging markets and 1.6 percentage points for developed economies. Mr. Schmitmann views the weak productivity issue as an opportunity for Vietnam to achieve higher growth. Even a slight improvement toward the average of other countries could yield significant growth benefits.

On the other hand, VinaCapital‘s Chief Economist, Michael Kokalari, is concerned that high levels of economic stimulus could make the currency a pressure release valve, leading to depreciation this year and potentially next year.

– 13:42 08/10/2025

Elevating Market Status: A Catalyst for Vietnam’s Stock Market Ascendancy

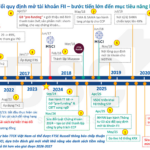

According to Tran Hoang Son, Director of Stock Market Strategy at VPBank (VPBankS), FTSE Russell’s confirmation of Vietnam’s stock market upgrade to Secondary Emerging status brings significant benefits. These include increased foreign investment inflows, enhanced market liquidity and efficiency, elevated economic reputation and standing in the region, and accelerated economic and corporate growth.

Critical Decision on Vietnam’s Stock Market to Be Announced in Less Than 48 Hours

This is a pivotal decision, the most anticipated by Vietnamese stock market investors at this moment.