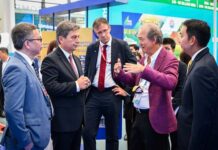

On the afternoon of October 8, 2025, SSI Securities Corporation (SSI) signed a Memorandum of Understanding (MoU) with Nasdaq, marking a significant collaboration across three key areas: sharing expertise on international listing standards, organizing training programs for Vietnamese enterprises, and exploring technology applications to enhance the capital market.

This agreement builds upon SSI’s recent international partnerships, solidifying its commitment to global engagement.

Notably, SSI partnered with VanEck, a leading asset manager in New York, to facilitate global capital connections and pave the way for asset tokenization in Vietnam. Additionally, SSI collaborated with FTSE Russell to develop digital asset indices, bringing international transparency standards to the domestic market. In fintech, SSI Digital (SSID) forged strategic alliances with global organizations such as Tether, AWS, and U2U Network to advance blockchain infrastructure, cloud computing, and digital asset solutions in Vietnam.

The MoU between SSI and Nasdaq was signed amidst the uplifting news of Vietnam’s market upgrade by FTSE Russell from Frontier to Secondary Emerging status.

Through these extensive and continuous partnerships, SSI solidifies its position as a “trusted local partner”—deeply rooted in the domestic market while leveraging a global network to drive Vietnam’s capital market toward international standards.

Regarding business performance, SSI reported a pre-tax profit of approximately VND 4,000 billion for the first nine months of 2025, a 33.8% increase year-over-year. This achievement fulfills 94% of the annual plan. If market conditions remain favorable, SSI’s 2025 full-year results are projected to exceed the plan by 15–20%.

Vietnamese Securities Firm Partners with Nasdaq

On the afternoon of October 8, 2025, in Hanoi, SSI Securities Corporation (HOSE: SSI) signed a Memorandum of Understanding (MoU) with Nasdaq, marking the beginning of a collaboration across three key areas: sharing expertise on international listing standards, organizing training programs for Vietnamese enterprises, and exploring the application of technology to serve the capital market.

Vietnam Set to Welcome Securities Firm with $1.1 Billion in Chartered Capital

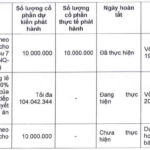

SSI shareholders have approved a plan to issue 415.6 million shares to existing shareholders at a 5:1 ratio, aiming to raise over VND 6.2 trillion.

“SSI Plans to Offer 415 Million Shares to Shareholders”

At the upcoming extraordinary general meeting, SSI Securities Corporation will propose a plan to offer a maximum of 415.58 million shares to existing shareholders through a rights issue.