This morning, FTSE Russell officially announced the results of its periodic market classification, upgrading Vietnam’s stock market from Frontier to Secondary Emerging status.

This historic milestone, achieved after over a decade of reform efforts, marks international recognition of Vietnam’s remarkable progress. The upgrade is expected to attract significant capital inflows from both domestic and foreign investors, fostering sustainable growth in the financial market and the broader economy.

Seeds Planted a Decade Ago

Vietnam’s journey toward this upgrade began in 2013-2014 when the government and regulatory bodies recognized that achieving emerging market status would be key to attracting international investment and driving economic growth. Former Chairman of the State Securities Commission (SSC), Vu Bang, emphasized that Vietnam could not remain isolated from the global stock market system. To mobilize global capital, the country had to reform and upgrade its market.

At that time, Vietnam’s stock market was still in its infancy, with low listing volumes, poor liquidity, and complex procedures for foreign investors to open trading accounts. These barriers deterred global investors. Following a outlined roadmap, Vietnam demonstrated its commitment and implemented specific action plans, identifying key policy improvements needed to achieve emerging market status. These included market size, liquidity, legal frameworks, and technological infrastructure. Efforts were made to restructure the product base, clarify listing conditions, and enhance post-listing compliance to expand market scale and liquidity.

By 2018, these efforts began to bear fruit when FTSE Russell placed Vietnam on its “Watch List” for potential upgrade from Frontier to Emerging status. In 2019, MSCI, the most influential global index provider, also mentioned Vietnam in its market assessment report. This marked a significant turning point, highlighting Vietnam as one of the few Asian countries gaining attention.

Being placed on the Watch List was a result of Vietnam’s continuous economic and capital market development, aligning with international best practices. It reflected the dedicated efforts of the Ministry of Finance, the State Securities Commission, the two stock exchanges, and the Vietnam Securities Depository to enhance the stock market and contribute to overall economic growth.

A Long Journey to Reap the Rewards of Market Upgrade

However, being on the Watch List was just the beginning. The real challenge was the seven-year journey of market improvement, filled with obstacles requiring persistence and coordinated reforms. Regulatory bodies worked tirelessly with relevant ministries, agencies, and organizations to address issues according to the criteria set by MSCI and FTSE Russell, ensuring Vietnam’s stock market met the requirements for an upgrade.

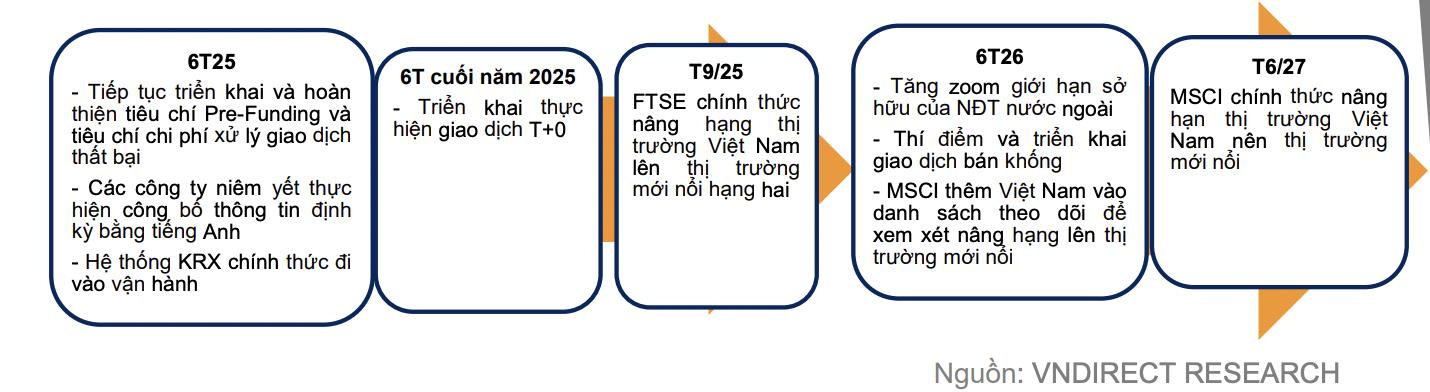

In the past two years, the message of market upgrade has been communicated with unprecedented clarity. The government and the Prime Minister have closely monitored and decisively steered the process to meet international standards. Notable achievements include Decree 245/2025/ND-CP (issued on September 11, 2025) and Decision 2014/QD-TTg (September 12, 2025), which approved the Market Upgrade Plan. These demonstrate the government’s commitment to achieving FTSE Secondary Emerging status by 2025 and MSCI Emerging status by 2030.

The introduction of the new KRX system enabled T+0 trading, processing orders 20 times faster than the old system, and laid the foundation for new products like short selling, odd-lot trading, and new versions of covered warrants. Additionally, Circular 68/2024 allowed foreign institutional investors to trade without pre-funding (Non Pre-funding solution – NPS), removing a significant barrier that had slowed the upgrade process.

In August 2025, the State Bank of Vietnam issued Circular 25/2025/TT-NHNN, amending provisions in Circular 17 to facilitate the opening and use of payment accounts for non-resident foreign investors, optimizing conditions for foreign investment.

Also in 2025, the Ministry of Finance and the State Securities Commission actively engaged with major investors, funds, and international organizations to ensure Vietnam’s stock market was evaluated fairly and transparently. The upgrade to Emerging status announced by FTSE Russell this morning is a well-deserved reward for these relentless efforts.

According to Ms. Nguyen Hoang Yen, Chairwoman of Mirae Asset Securities Vietnam (MAS), this is a highly significant milestone, affirming that Vietnam’s reforms over the past 25 years have yielded clear and positive results. The upgrade is not just a change in classification but international recognition of Vietnam’s market transparency, operational capabilities, and attractiveness. It elevates Vietnam’s financial market brand, aligning with its recent economic advancements, and strengthens its connection to global capital.

Market Upgrade: Not the Final Destination

For a decade, investors have dreamed of Vietnam’s stock market upgrade. Now, this dream has become a reality, with Vietnam joining the ranks of Secondary Emerging markets alongside rapidly growing economies like India and resource-rich nations undergoing impressive transformations, such as Saudi Arabia.

This achievement will not only attract billions in passive and active investment funds but also improve corporate governance, enhance information transparency, and diversify financial products. Moreover, the upgrade will encourage Vietnamese businesses to adopt global standards, supporting sustainable economic growth and the goal of becoming a high-income, green, and inclusive economy by 2045.

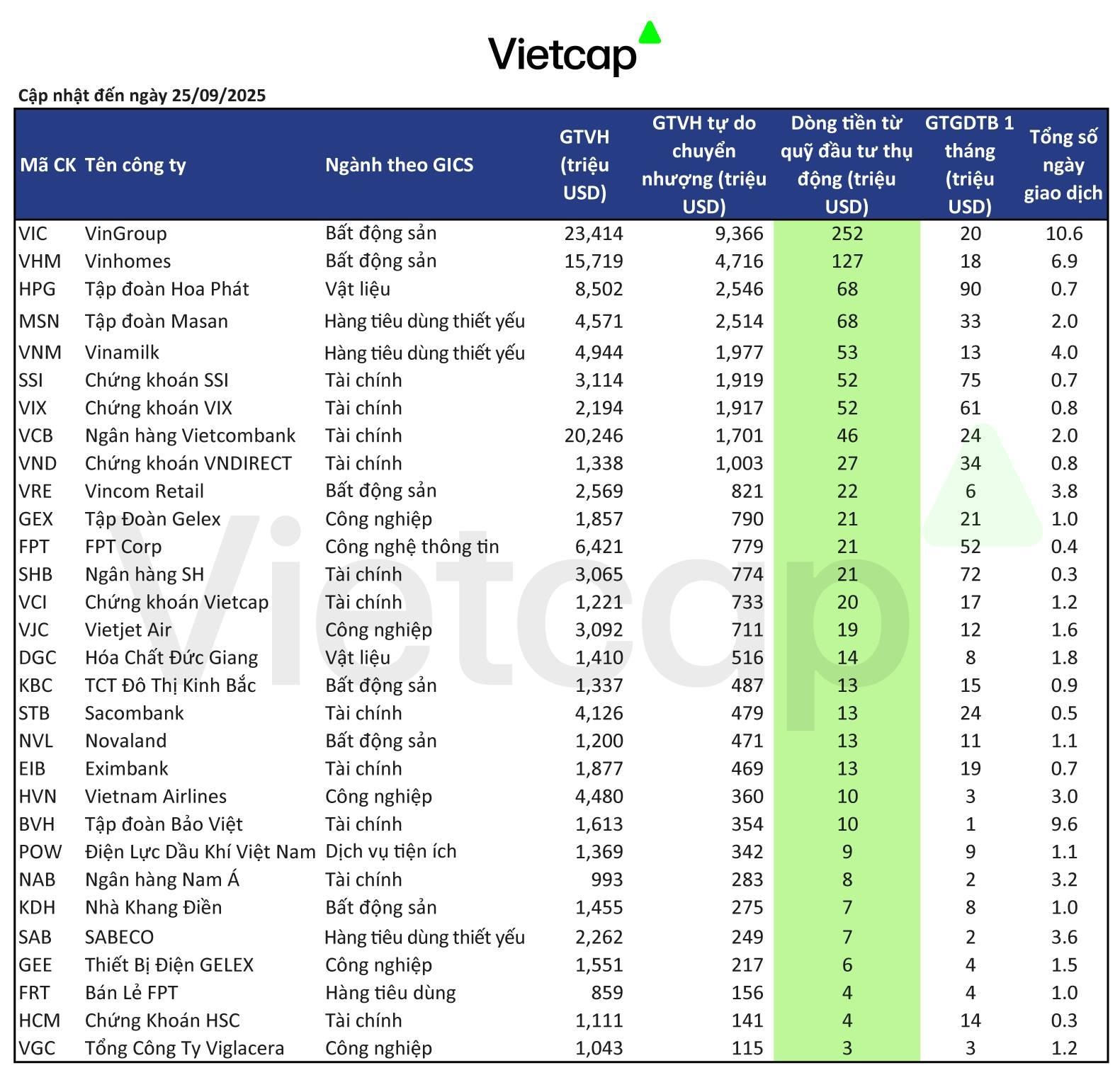

NHSV Securities estimates that Vietnam’s stock market will attract approximately $1.5 billion in passive funds and $1.9-7.4 billion in active funds (depending on Vietnam’s actual weight in the index). Benefiting stocks include securities companies, as increased trading by investment funds will boost their revenue and profits. Additionally, stocks already in the FTSE Vietnam Index, such as HPG, VHM, MSN, VNM, VIC, VCB, SSI, VRE, VIX, VCI, VND, DGC, SHB, GEX, KDH, VJC, and EIB, are expected to attract significant inflows.

According to Mr. Bui Van Huy, Vice Chairman of FIDT, the FTSE Russell upgrade could mark the beginning of a new growth cycle for Vietnam’s economy.

“The upgrade is not just about attracting billions in foreign investment but also affirming Vietnam’s financial institutional quality and marking a crucial step toward becoming a modern market economy with a central role for the private sector,” said Mr. Bui Van Huy.

Projection of 30 Vietnamese stocks to be added to emerging market index funds

However, this is not the final destination for Vietnam’s stock market. Moving forward, Vietnam must create an attractive investment portfolio for foreign investors by enhancing information transparency, developing green and ESG-compliant products, and streamlining administrative procedures for foreign investors. The ultimate goal is to build a stable, transparent market that effectively supports the economy, businesses, and long-term capital markets.

According to the Market Upgrade Plan approved by the Prime Minister on September 12, 2025, Vietnam has set specific goals. In the short term, it aims to fully meet FTSE Russell’s criteria for Secondary Emerging status by 2025 and maintain this classification. Long-term goals include meeting MSCI’s criteria for Emerging status and FTSE Russell’s criteria for Advanced Emerging status by 2030.

At a recent press conference, Deputy Minister of Finance Nguyen Duc Chi emphasized that the upgrade is just the beginning; the market must maintain its position and strive for higher levels in the future.

“This is a crucial milestone for the stock market’s development, promoting greater transparency to support businesses in capital mobilization and drive the growth of the capital market and the economy,” stated the Deputy Minister.

Overall, Vietnam is entering an era of ascent, and its stock market is poised for a new, more sustainable phase of development. Maintaining its position in the Secondary Emerging group is essential, followed by advancing to higher levels. Vietnam must also maximize the benefits of the upgrade to foster sustainable market growth.

HSBC Forecasts Foreign Capital Inflow to Vietnam at $3.4–10.4 Billion Post-Upgrade

At dawn on October 8th, FTSE Russell announced the upgrade of Vietnam’s stock market to Secondary Emerging Market status. This reclassification will officially take effect on September 21, 2026, following the mid-year review in March 2026.

Investors Remain Unfazed by Local Currency Depreciation Amid Strong Stock Market Performance

VinaCapital’s experts forecast a 4-5% depreciation of the Vietnamese Dong this year, with a similar outlook for next year. According to Mr. Kokalari, if the economy and stock market perform well, investors are unlikely to be overly concerned about this modest devaluation. Nonetheless, it remains a point worth monitoring.

Sun Group and Hilton Forge Strategic Partnership to Develop Accommodation Infrastructure for APEC 2027

On the morning of October 7, 2025, Hilton’s senior leadership arrived in Phu Quoc to sign a strategic partnership with Sun Group, aiming to develop five luxury hotels with over 2,000 rooms across Quang Ninh, Da Nang, and Phu Quoc. This milestone marks the debut of Conrad Hotels & Resorts and LXR Hotels & Resorts in Vietnam, while also preparing premium accommodations to support the upcoming APEC 2027.

The Shadow of Japan’s Giant: Unveiling the Billion-Dollar Projects of Vinhomes and Phu My Hung

With a multi-billion-dollar investment in Vietnam’s real estate, Nomura Group strategically partners with leading market giants rather than pursuing independent project development.