Following the announcement of the upgrade, the stock market opened the October 8th trading session with a buoyant sentiment. Despite facing resistance and volatility at key levels, the VN-Index gradually recovered, showing a more positive trend in the afternoon session with improved liquidity. By the close, the VN-Index gained 12.53 points (+0.74%) to reach 1,697.83 points, nearing the previous peak of 1,710 points. Amid the euphoria of Vietnamese investors, foreign investors unexpectedly returned to net buying, with a total of approximately VND 156 billion across the market.

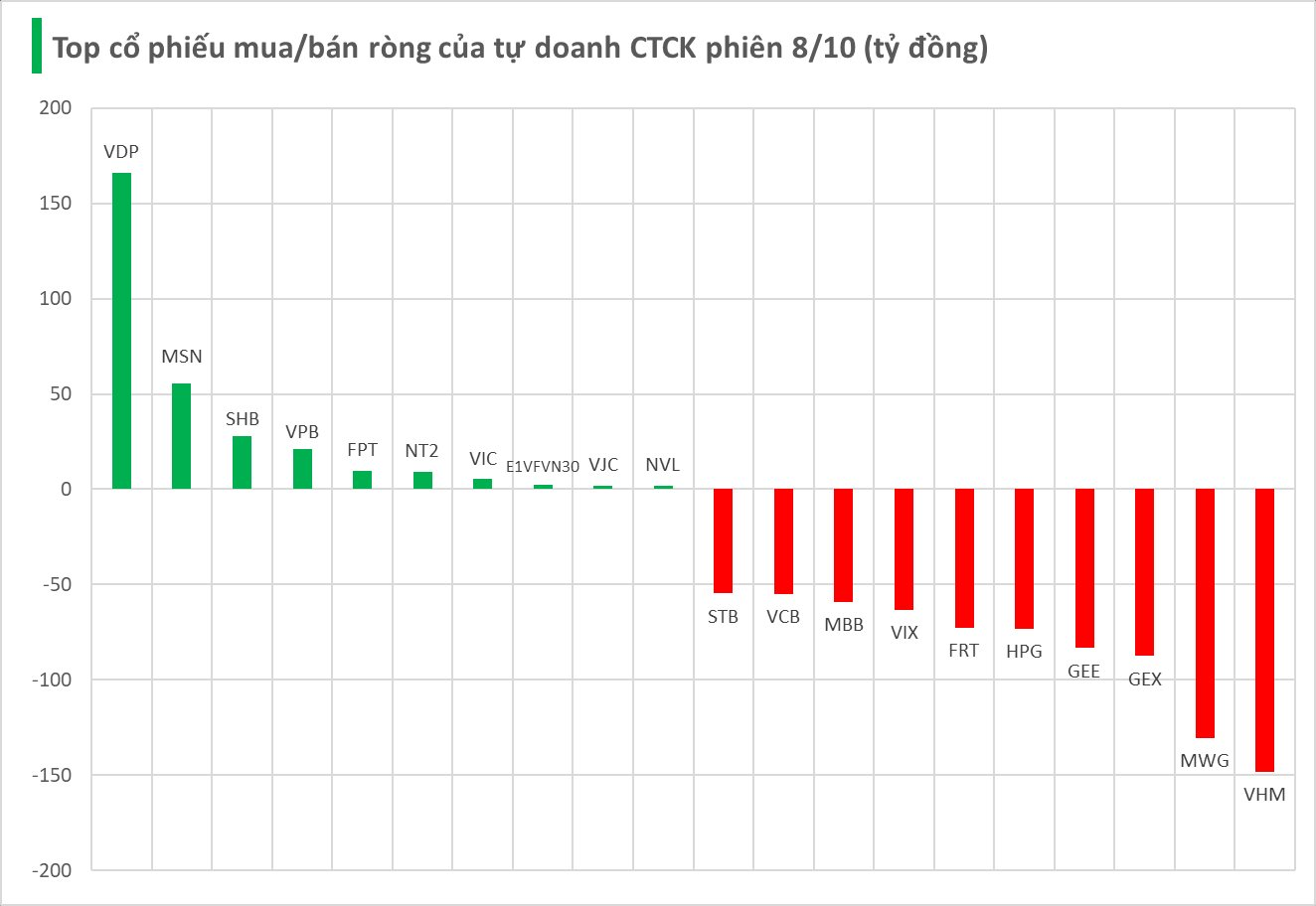

In contrast, securities firms’ proprietary trading desks turned net sellers, offloading VND 1,070 billion.

Analyzing individual stocks, VHM led the net selling list with a value of -VND 148 billion, followed by MWG (-VND 130 billion), GEX (-VND 87 billion), GEE (-VND 83 billion), HPG (-VND 73 billion), FRT (-VND 73 billion), VIX (-VND 63 billion), MBB (-VND 59 billion), VCB (-VND 55 billion), and STB (-VND 55 billion).

Conversely, VDP emerged as the top net buy with a value of VND 166 billion, significantly outpacing other stocks. Trailing behind were MSN (VND 55 billion), SHB (VND 28 billion), VPB (VND 21 billion), FPT (VND 10 billion), NT2 (VND 9 billion), VIC (VND 5 billion), and E1VFVN30, VJC, and NVL (each at VND 2 billion).

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.

Investors Remain Unfazed by Local Currency Depreciation Amid Strong Stock Market Performance

VinaCapital’s experts forecast a 4-5% depreciation of the Vietnamese Dong this year, with a similar outlook for next year. According to Mr. Kokalari, if the economy and stock market perform well, investors are unlikely to be overly concerned about this modest devaluation. Nonetheless, it remains a point worth monitoring.

Market Pulse 08/10: Foreign Investors Halt Net Selling Streak

At the close of trading, the VN-Index surged by 12.53 points (+0.74%), reaching 1,697.83 points, while the HNX-Index climbed 0.47 points (+0.17%) to 273.34 points. Market breadth favored the bulls, with 389 advancing stocks outpacing 285 decliners. Similarly, the VN30 basket saw green dominate, as 19 constituents rose, 7 fell, and 4 remained unchanged.

Vietstock Daily 09/10/2025: Ready to Break New Highs?

The VN-Index rallied following a session of tug-of-war trading, forming a Long Lower Shadow candlestick pattern. The MACD indicator has issued a fresh buy signal as it crossed above the Signal line, while the Stochastic Oscillator continues its upward trajectory, reinforcing the recovery momentum. Should these signals persist, the likelihood of surpassing the September 2025 peak (around 1,700-1,711 points) will strengthen in upcoming sessions.

Elevating Market Status: A Catalyst for Vietnam’s Stock Market Ascendancy

According to Tran Hoang Son, Director of Stock Market Strategy at VPBank (VPBankS), FTSE Russell’s confirmation of Vietnam’s stock market upgrade to Secondary Emerging status brings significant benefits. These include increased foreign investment inflows, enhanced market liquidity and efficiency, elevated economic reputation and standing in the region, and accelerated economic and corporate growth.