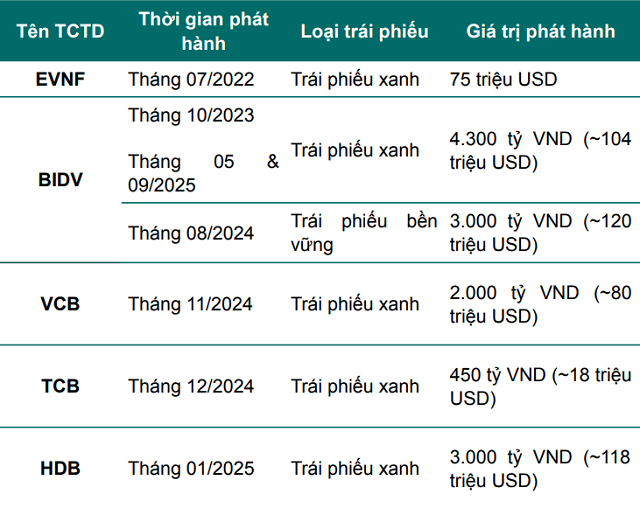

According to a report presented at a specialized seminar organized by the BIDV research group on October 7, by the end of 2024, the total value of green, social, and sustainability (GSS) bonds issued domestically reached approximately 19.9 trillion VND, with 73% issued by credit institutions.

The total outstanding corporate bond debt for the same period was 1,270 trillion VND, meaning GSS bonds accounted for only 1.56%. Globally, this ratio stands at 4%, and in Asia, it reaches 8%, indicating significant growth potential for Vietnam. As of May 31, 2025, the green credit debt of the banking system was around 705 trillion VND, equivalent to 4.3% of the total economic debt—nearly matching the emerging market average but still below the State Bank’s 10% target.

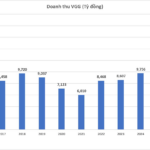

Vietnam’s green bond market remains heavily reliant on a few major commercial banks. Source: BIDV Research Group

|

The BIDV research group notes that credit institutions primarily use their own capital to develop sustainable bonds, lacking specific state financial support mechanisms. This results in modest issuance volumes and high costs.

In practice, green bond issuance costs are nearly on par with conventional bonds, while issuers incur additional expenses for framework development, hiring independent advisors and evaluators (SPOs), audits, and periodic environmental-social impact reporting. A representative from a commercial bank stated that pre- and post-issuance reporting processes are “significantly more burdensome than international standards,” with high post-issuance costs due to annual independent audits. “The market is still immature, and most organizations are navigating it independently,” they shared.

Beyond costs, the domestic market lacks a comprehensive support ecosystem. Vietnam has few SPO consulting and evaluation firms meeting international standards, forcing most enterprises to rely on foreign services. A shortage of ESG expertise, emissions data, and information management tools further increases costs and delays progress.

In this context, Decision 21/2025/QĐ-TTg on Environmental Criteria and Green Project Classification (Vietnam Green Taxonomy) is considered a pivotal milestone. This framework is the first legal basis for defining “green projects,” enabling credit institutions and enterprises to standardize green bond issuance and capital use, rather than relying solely on international standards.

“Previously, we followed the international ICMA standard, which was difficult to apply domestically. With the Vietnam Taxonomy, banks now have a clear framework to follow, significantly streamlining green bond design and reporting,” said Mr. Nguyễn Bá Sơn, Deputy Director of Capital and Currency Business at BIDV.

However, Mr. Sơn emphasized the need for detailed State Bank guidelines tailored to the banking sector, where mobilized capital is pooled and green capital cannot be entirely segregated. “Without clear audit, reporting, and verification mechanisms, banks will struggle to implement these measures,” he noted.

Strong Public Sector Involvement Needed

The BIDV research group suggests that while many international organizations provide technical and partial financial support for SPO consulting, Vietnam requires direct financial incentives—such as 2% interest subsidies or tax breaks for issuers—as seen in Malaysia and Singapore.

Experts also advocate for enhanced training and awareness of the Taxonomy framework to help banks and enterprises understand green project criteria. Combining Vietnamese and international standards flexibly ensures integration without legal overlap.

For the sustainable bond market to thrive, Vietnam needs a comprehensive sustainable finance strategy with clear priorities for key sectors. The government should establish a national green project list, issue guidelines on emissions measurement and environmental-social impact assessments, and expand legal frameworks to encourage local governments to issue green bonds, thereby increasing market supply.

Experts emphasize the need for state involvement to drive green bond market growth

|

Internationally, strong public sector engagement is decisive. China develops green credit and bonds as twin pillars of sustainable finance, while Europe establishes public data systems for ESG impact tracking. Singapore and Malaysia lead regionally with government-backed issuance cost support, tax exemptions, and registration fee waivers.

Experts believe Vietnam can adopt these models, issuing government or local green bonds to stimulate market activity and expand capital for Net Zero 2050 projects.

According to BIDV, market growth hinges on policy implementation through coordinated efforts among the state, banks, associations, and international organizations to enhance legal frameworks, transparency, and green finance awareness.

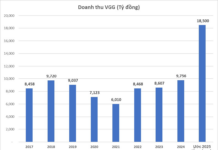

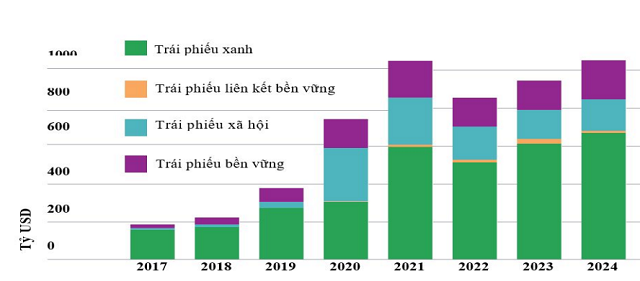

The BIDV study reveals that by year-end 2024, the global sustainable bond market reached approximately 6.9 trillion USD, with 2024 issuances exceeding 1 trillion USD—a 31% year-on-year increase. Europe accounted for 45% of total issuances, highlighting vast untapped potential for Vietnam with synchronized policy implementation.

Global sustainable bond issuances surpassed 1 trillion USD in 2024, marking three consecutive years of growth. Source: BIDV Research Group

|

– 07:07 09/10/2025

A Bumpy Ride to Brilliance: Vietnam’s Decade-Long Ascent to Emerging Market Status

Vietnam’s dream of upgrading its status has officially come true, marking a significant milestone as the nation sheds its constraints and steps into the secondary emerging market classification. This new chapter places Vietnam alongside countries renowned for their remarkable economic growth trajectories.

Sun Group and Hilton Forge Strategic Partnership to Develop Accommodation Infrastructure for APEC 2027

On the morning of October 7, 2025, Hilton’s senior leadership arrived in Phu Quoc to sign a strategic partnership with Sun Group, aiming to develop five luxury hotels with over 2,000 rooms across Quang Ninh, Da Nang, and Phu Quoc. This milestone marks the debut of Conrad Hotels & Resorts and LXR Hotels & Resorts in Vietnam, while also preparing premium accommodations to support the upcoming APEC 2027.

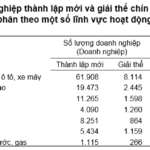

86,400 Businesses Resume Operations in the First Nine Months of 2025

In the first nine months of 2025, a remarkable 86,400 businesses resumed operations nationwide, marking a 41.3% surge compared to the same period in 2024.