Euphoria continues to ripple through the market following the upgrade of Vietnam’s stock market to secondary emerging status. The VN-Index marked its third consecutive session of robust gains, with daily ranges widening further. Closing the October 10th session, Vietnam’s benchmark index surged over 31 points, setting a new record high at 1,747.55. Liquidity remained strong, with over 1.05 billion shares traded on HOSE, corresponding to a value exceeding VND 33.5 trillion.

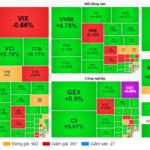

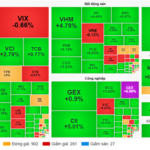

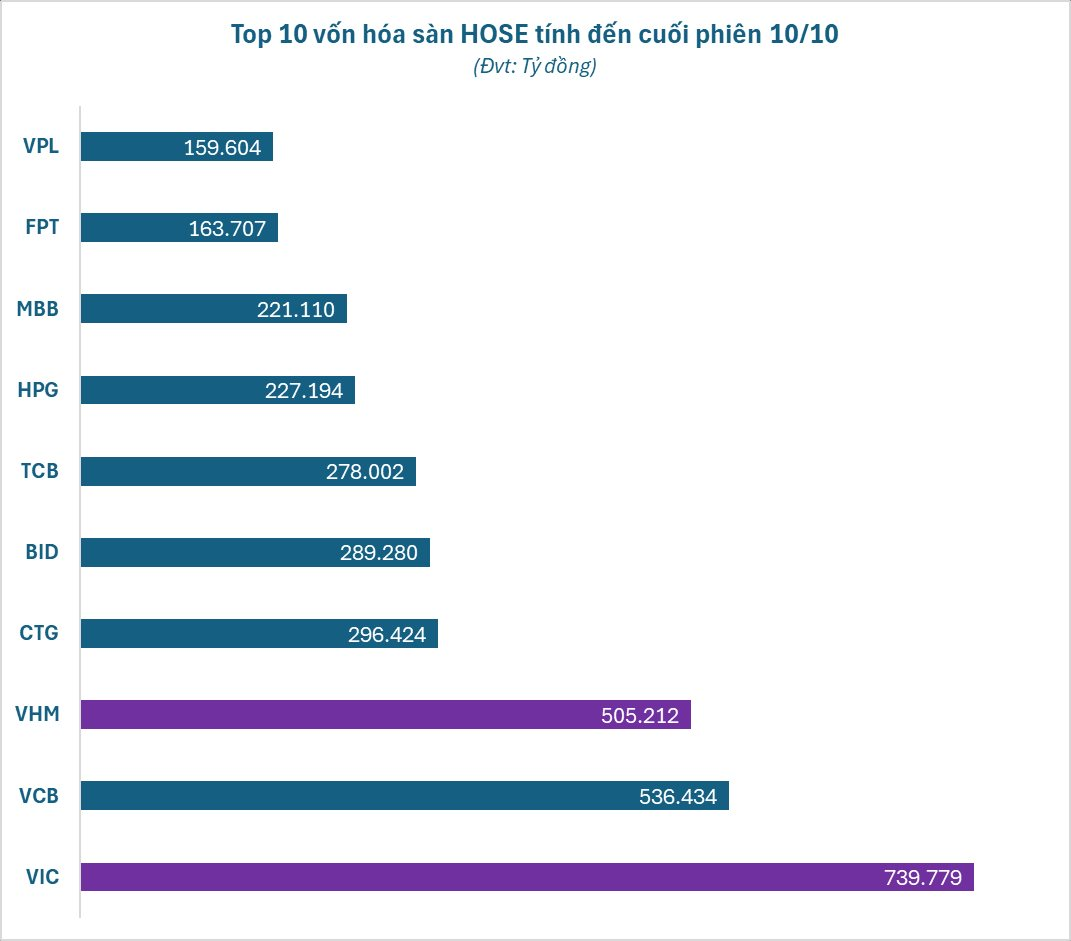

A standout performer in the session was the Vingroup stock cluster. Both VIC and VHM hit their 7% ceiling, closing at VND 192,000 and VND 123,000 per share, respectively—both marking new highs. Notably, this was Vinhomes’ second consecutive ceiling session.

As of the October 10th close, Vingroup’s market capitalization reached a record high of nearly VND 740 trillion (~USD 28.5 billion). This figure firmly places the conglomerate, led by billionaire Pham Nhat Vuong, at the top of the market, far ahead of its closest competitors. Vinhomes secured the third position with a market cap exceeding VND 505 trillion.

Other Vingroup affiliates, VPL (Vinpearl) and VRE (Vincom Retail), also closed in the green. VPL rose 2.1% to VND 89,000 per share, while VRE surged over 6% to VND 40,350 per share.

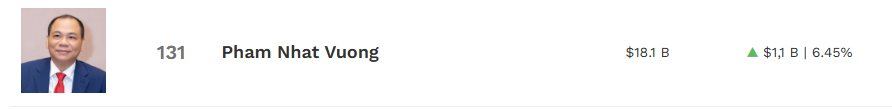

The rally in these stocks significantly boosted billionaire Pham Nhat Vuong’s wealth. His estimated holdings on the Vietnamese stock market (including direct and indirect ownership) now surpass VND 330 trillion. He stands as the individual investor with the largest asset portfolio in the history of Vietnam’s stock market, far exceeding any previous records.

According to Forbes’ latest update on October 10th, Pham Nhat Vuong’s net worth is USD 18.1 billion, ranking him 131st among the world’s wealthiest individuals. His wealth now surpasses that of Samsung Chairman Lee Jae-yong, Thai billionaire Charoen Sirivadhanabhakdi (TCC Group Chairman), Telegram founder Pavel Durov, AI billionaire Edwin Chen, Fraser and Neave (F&N) founder, Thai Beverage founder, and investment legend Ray Dalio.

Additionally, Vincom Retail is poised to receive a substantial dividend from its subsidiary, Vincom Retail Operations LLC. The total distributed profit amounts to VND 4.48 trillion, payable via bank transfer to shareholders, with completion expected in Q3/2025. This dividend could significantly enhance Vincom Retail’s Q3 financial performance.

Meanwhile, Vingroup has proposed researching the investment in a sea-crossing route connecting Can Gio and Ba Ria-Vung Tau (former) under the BT (Build-Transfer) model. According to Vingroup, this project will reduce travel time, efficiently connect functional zones within the city, and drive economic, social, and commercial development while expanding sustainable urban space.

The conglomerate, led by billionaire Pham Nhat Vuong, affirms its commitment to partnering with Ho Chi Minh City in realizing key transportation infrastructure plans, contributing to enhanced regional connectivity and sustainable coastal development.

Stock Market Hits New Highs Following Market Upgrade Boost

Today (October 9th), the stock market celebrated another milestone as the VN-Index officially surpassed the 1,700-point mark, setting a new record. The upward momentum was primarily driven by a handful of large-cap stocks, with Vingroup and banking sector shares leading the charge.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

Technical Analysis Afternoon Session 09/10: Anticipating a Break Above Previous Highs

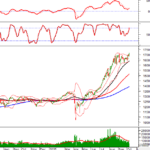

The VN-Index continues its upward trajectory, with expectations high that it will surpass its previous peak from September 2025 (equivalent to the 1,700-1,711 point range). This optimism is fueled by the emergence of buy signals from both the MACD and Stochastic Oscillator indicators. In contrast, the HNX-Index currently trades below the Middle line of the Bollinger Bands.

Technical Analysis Afternoon Session 10/10: Anticipating a Break Above Previous Highs

The VN-Index has continued its upward trajectory, surpassing its previous all-time high after decisively breaking through the September 2025 peak (equivalent to the 1,700–1,711 point range). Meanwhile, the HNX-Index remains in a state of consolidation, fluctuating around the Middle line of the Bollinger Bands.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.