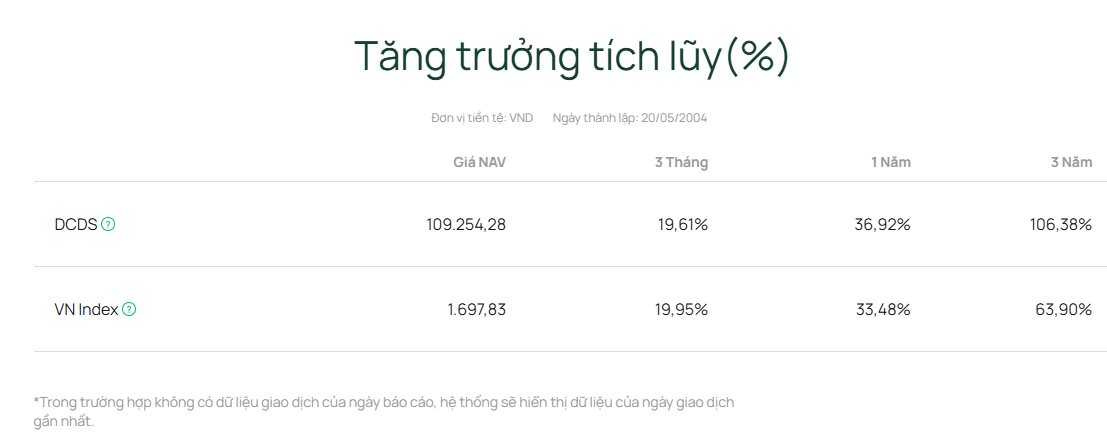

The DC Growth Stock Investment Fund (DCDS) stands as one of the most efficient open-ended funds in Vietnam’s current stock market. With a dynamic and flexible investment strategy, DCDS focuses on leading enterprises with exceptional growth potential, while actively allocating assets to manage risks across market cycles. Over the past 12 months, the fund’s investment performance has reached nearly 37%, outpacing the VN-Index’s 33% growth. Over a three-year period, the fund has achieved an impressive cumulative profit of 91.5%, leading the market.

Discussing risk management strategies, Mr. Vo Nguyen Khoa Tuan – Investment Director of DCDS, emphasized that the fund closely monitors market dynamics to take timely actions.

“When we assess that market risks are escalating, we proactively increase cash holdings before market corrections. Simultaneously, we seek opportunities to acquire undervalued stocks that have been heavily sold at attractive prices,” Mr. Tuan stated. During the recent market correction, the fund actively invested in stocks such as MWG, CTG, VHM, and VRE.

Addressing the possibility of removing Vingroup stocks from the top 10 holdings, a Dragon Capital expert noted that DCDS would only consider reducing exposure when the price growth potential of these stocks becomes less attractive compared to other investment opportunities. Specifically, when stock prices rise rapidly near target levels or when the fund re-evaluates valuations.

“DCDS’s strategy is highly flexible. Over the past three months, we have reduced holdings in VHM and VIC, but after reassessing prospects and upcoming projects, we found that the growth potential remains strong, leading us to increase our holdings again,” he explained, stressing that the fund will continuously update its strategy and make timely adjustments if market conditions change.

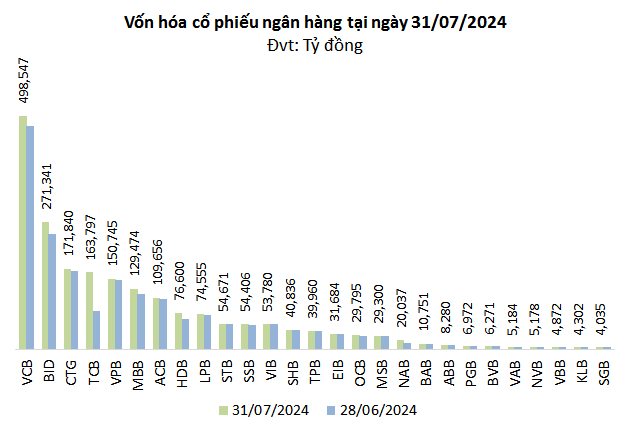

Regarding sector outlooks, Mr. Tuan believes that the banking sector still holds strong growth potential, while securities and real estate sectors also show positive signs. Despite concerns about government efforts to curb real estate prices, the expert believes this will not have a negative impact but will instead promote stable and sustainable long-term market development. Additionally, the retail sector has further growth potential due to the economic recovery.

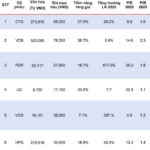

As of October, DCDS’s total net asset value reached nearly VND 4,400 billion. The top 10 largest holdings account for nearly 50% of the portfolio, including familiar stocks such as MWG (6.5%), CTG (6%), VIC (5.9%), VPB (5.8%), HPG (5.6%), TCB (5%), VHM (5%), STB (4.8%), VIX (2.8%), and GMD (2.5%). Among these, banking stocks hold the largest share at 29.6%, followed by real estate at 20.6%.

Stock Market Update October 10: Selling Pressure on Shares Remains Mild

Liquidity in the 9-10 session saw a modest uptick, signaling that market support from capital inflows remains intact. Meanwhile, selling pressure on stocks has yet to exert a significant impact.

Vietnamese Billionaire Pham Nhat Vuong Makes Unprecedented Move in Vietnam’s Stock Market History

The stock codes VIC and VHM both surged to their upper limit of 7%, setting new record highs. Notably, this marks the second consecutive session of Vinhomes hitting the ceiling price.