Specifically, the minimum initial public offering (IPO) price has been revised upward from VND 22,457 per share to VND 60,000 per share for a maximum of 202.31 million shares in the upcoming IPO.

“Considering the company’s position, financial capabilities, and sustainable growth prospects in the coming period, along with investor interest, the Board of Directors has decided to supplement and approve a minimum offering price of VND 60,000 per share for the initial public offering” – stated the VPS Board of Directors.

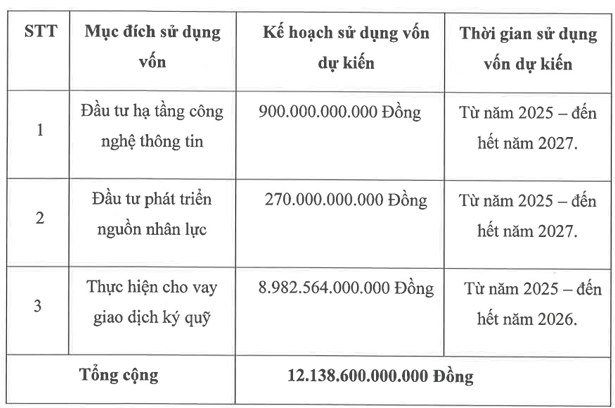

Assuming the full issuance of 202.31 million shares at the minimum price of VND 60,000 per share, VPS is projected to raise over VND 12.1 trillion. Of this amount, approximately VND 8,983 billion will be allocated for margin lending, VND 900 billion for IT infrastructure development, and VND 270 billion for human resource development. The funds are expected to be utilized from 2025 to 2027, with margin lending extending until the end of 2026.

|

VPS’s Capital Allocation Plan

Source: VPS

|

This is one of three capital increase plans approved by VPS’s second extraordinary shareholders’ meeting in 2025, including the issuance of 710 million bonus shares, IPO of up to 202.31 million shares, and a private placement of 161.85 million shares. These initiatives will increase the total number of shares from over 570 million to more than 1.64 billion, raising the chartered capital from VND 5.7 trillion to over VND 16.4 trillion, nearly tripling its size.

With the newly announced minimum price of VND 60,000 per share and a post-offering circulating share count of over 1.48 billion, VPS’s valuation stands at nearly VND 89 trillion, equivalent to approximately USD 3.4 billion (based on current exchange rates).

During the “VPS The Next Chapter” event on October 12, VPS announced its anticipated stock code as VCK.

According to the Ho Chi Minh City Stock Exchange (HOSE), VPS’s market share in equity brokerage for Q3/2025 reached 17.05%, a 1.68 percentage point increase from the previous quarter. Additionally, the company’s after-tax profit for the first nine months of the year exceeded VND 2,564 billion, a 52% year-on-year growth.

– 19:54 13/10/2025

VPS Securities Unveils New Chapter: “Excellence and Distinction” Post-IPO, with Anticipated Stock Code VCK

VPS 2.0 marks the next evolutionary phase of VPS, set to unfold following its anticipated IPO in 2025. Post-IPO, VPS is poised to secure substantial capital, fueling a robust momentum for this transformative growth stage.

Vietstock Daily October 14, 2025: Will the Uptrend Continue?

The VN-Index has formed a Three White Soldiers candlestick pattern, accompanied by trading volume consistently above the 20-session average, signaling prevailing market optimism. The index is closely tracking the Upper Band of the Bollinger Bands, while the MACD indicator continues its upward trajectory following a buy signal. This confluence of factors underscores a positive short-term growth outlook.

VN-Index Surges in Q3/2025, Boosting Open-Ended Funds

Q3/2025 marked a remarkable milestone for Vietnam’s stock market as the VN-Index surged over 20% in just three months, recording one of the most robust recoveries since the COVID-19 pandemic. This growth not only reflects an improved market sentiment but also delivers exceptional returns for many open-ended funds, particularly equity-focused portfolios.

VPBank Empowers Rikkeisoft’s Global Acceleration

On October 10, 2025, Rikkeisoft JSC and Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) officially signed a Memorandum of Understanding (MOU). This agreement marks a comprehensive partnership between a rapidly growing technology company and a leading commercial bank in Vietnam, with VPBank serving as a financial springboard to propel Rikkeisoft’s global expansion.