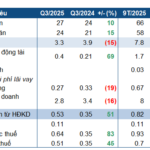

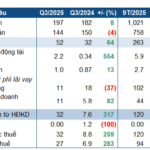

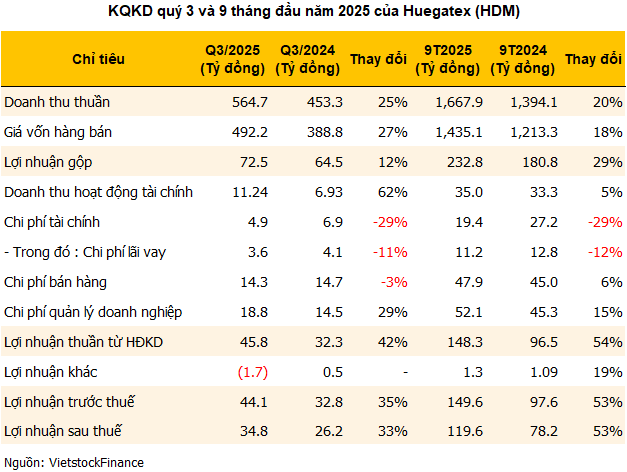

In Q3/2025, Huegatex reported net revenue of nearly VND 565 billion and net profit of approximately VND 35 billion, marking a 25% and 33% year-on-year increase, respectively.

According to Huegatex, the garment market has shown stable growth since the beginning of the year, with demand significantly improving compared to the same period last year. In Q3 specifically, customers accelerated early shipments to mitigate the impact of the U.S. countervailing duty policy implemented in August, driving a 30% rise in garment segment revenue. In the fiber segment, the average selling price increased by 4.4%, while raw material costs for cotton and fiber decreased by 16% and 13%, respectively, significantly boosting profit margins.

Financial income in Q3 surged by 62% to over VND 11 billion. As of the end of September, Huegatex had deposited more than VND 311 billion in banks, nearly triple the amount at the beginning of the year, thereby optimizing financial profits.

|

9-Month Profit Exceeds 7% of Annual Plan

For the first nine months, cumulative revenue reached nearly VND 1,668 billion, and net profit was approximately VND 120 billion, up 20% and 53% year-on-year, respectively. The company has achieved 81% of its annual revenue target but has already surpassed its annual profit goal by 7%. This result also exceeds the full-year profits of 2024 (VND 109 billion) and 2023 (VND 95 billion), setting a record for the highest 9-month profit in the company’s history.

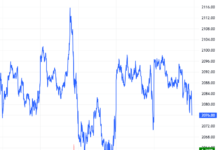

On the UPCoM market, HDM shares traded at around VND 36,900 per share on October 20, up 19% over the past year, with average liquidity of nearly 8,200 shares per session.

| HDM Share Price Performance Over the Past Year |

Fined and Back-Taxed Nearly VND 1 Billion for Tax Misdeclaration

Amidst its robust business performance, Huegatex was recently penalized by the Hue City Tax Department for misdeclaring corporate income tax in 2023. According to the decision dated October 15, the company was back-taxed VND 717.5 million, fined VND 143.5 million in administrative penalties, and charged VND 64 million for late payment, totaling over VND 925 million.

The Tax Department confirmed that Huegatex has settled the back-tax obligation but still owes approximately VND 208 million in fines and late payment charges.

– 16:27 20/10/2025

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.

Record-Breaking Profits for DDV, Surpassing Annual Targets

DAP – VINACHEM Corporation (UPCoM: DDV) soared to new heights in Q3 2025, achieving a record-breaking quarterly profit. This remarkable performance was driven by a significant surge in both revenue and selling prices of its flagship product, DAP, compared to the same period last year.