Historical low stock prices

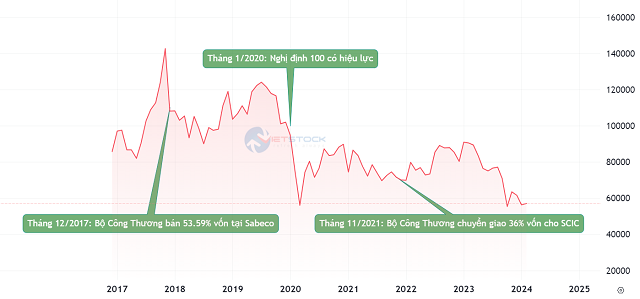

The stock price of SAB has plummeted, especially the sharp decline at the end of 2020 and the beginning of 2021, the glory of the last months of 2017 is increasingly distant.

Since the Ministry of Industry and Trade divested in December 2017 at a “shocking” price of VND 320,000 per share, equivalent to VND 160,000 per share after adjustment due to a 1:1 stock bonus in September 2023, up to now, SAB shares have not touched that historical high level, and are even trading at the lowest level since listing, around VND 58,000 per share.

Stocks hit rock bottom, with the biggest loss being those who bought at the peak, and no one else but ThaiBev. Comparing the purchase price (adjusted) of VND 160,000 per share and the current price of VND 58,000 per share, a decrease of 64%, equivalent to a temporary investment of over VND 110 trillion, now it is only about VND 40 trillion after over 6 years.

|

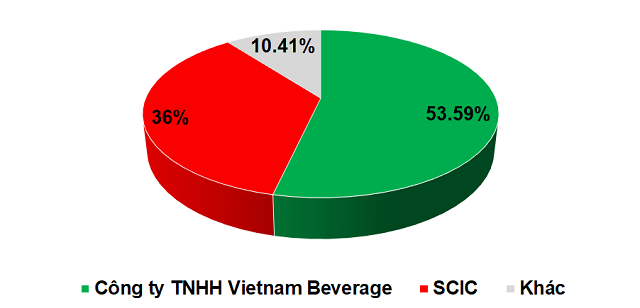

Sabeco shareholders structure as of 2023

Source: VietstockFinance

|

|

SAB stock prices at historical lows

Source: VietstockFinance

|

Decreased market share, business results through the peak

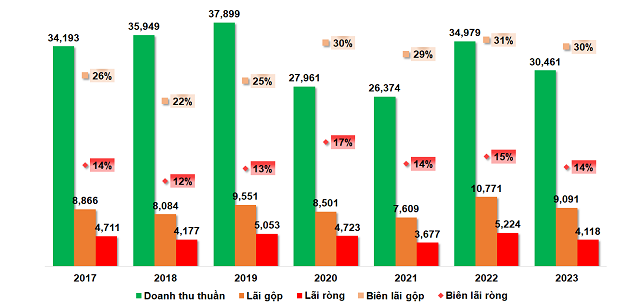

This record low price of SAB reflects the business results after the peak. In the fourth quarter of 2023, another sluggish quarter for Saigon Beer Alcohol Beverage JSC (Sabeco, HOSE: SAB) with revenue at around VND 8.5 trillion and net profit of VND 947 billion, a decrease of 15% and 9% respectively compared to the same period last year. This is also the lowest quarterly profit of the “beer giant” in the past 2 years.

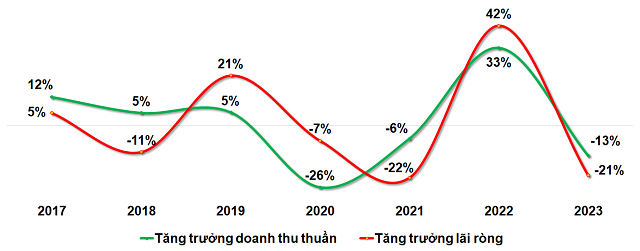

Throughout 2023, Sabeco brought in nearly VND 30.5 trillion in revenue and over VND 4.1 trillion in net profit, a decrease of 13% and 21% respectively compared to the previous year. The company stated that fierce competition, declining consumer demand, domestic economic recession, and strict implementation of Decree 100 have caused a decrease in revenue and affected profits.

Compared to the plan, SAB only achieved 76% of the revenue target and 74% of the profit target for the year.

|

The revenue and net profit of Sabeco from 2017 to 2023

|

Source: VietstockFinance

|

Looking at the entire cycle from the Thais taking over, Sabeco’s business situation has experienced many ups and downs, there were times of continuous growth to reach the peak in 2019, but then there were many changes that caused this company to gradually lose market share.

Sabeco still somewhat shows the image of a giant, able to cope with difficulties when maintaining average net profit margin of about 14%, and gross profit margin even increased to about 30%.

However, the image of Sabeco as a leading beer company, seeking new business heights, has been long gone.

The strong blows from Decree 100 and the COVID-19 pandemic

The general economic recession caused by the impact of COVID-19 has had a significant impact on the purchasing power of consumers, and the beer industry is no exception. On the other hand, the shortage of beer supply due to the pandemic, natural disasters, and the increase in raw material prices have led to high production costs, which have greatly affected the business results of beer companies.

In terms of policies, the strict regulations on alcohol concentration for drivers have made it more difficult to consume beer.

|

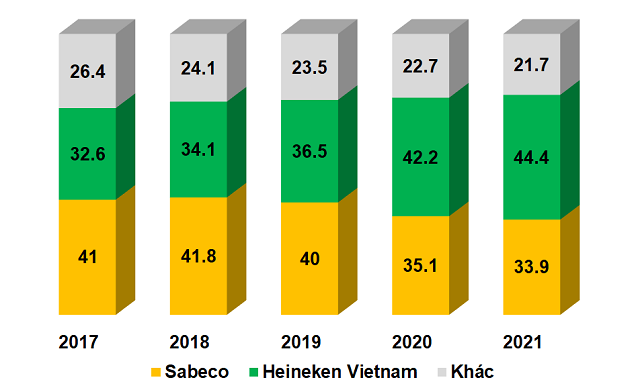

Beer market share in Vietnam from 2017 to 2021

Source: Euromoniter

|

The fact is that Sabeco, while facing all these difficulties, still shows signs of weakness compared to its competitors, as evidenced by the decreasing market share of Sabeco, no longer maintaining a level above 40%, and has been continuously overtaken by Heineken since 2020.

Sabeco beer products occupy a modest space on the shelf at a major supermarket in Ho Chi Minh City, surrounded by many products from other brands – Photo: Huy Khai

|

Returning to the period from 2018 to 2019, with the support from the Thais, Sabeco continued to grow, setting a historical peak in 2019, with revenue of nearly VND 37.9 trillion and net profit for the first time exceeding VND 5 trillion. Also in that year, Sabeco re-launched the Saigon Beer brand, including Saigon Special Beer, Saigon Lager Beer, Saigon Export Beer, and 333 canned beer products.

But the joy did not last long. In January 2020 – the time when Decree 100/2019/ND-CP officially took effect – dealt a heavy blow, causing shock to beer industry businesses. In addition, social distancing measures, closure of stores and entertainment venues, both domestic and international tourism, put great pressure on business results.

In the 2 years of 2020 and 2021, Sabeco’s revenue decreased by 7% and 22% respectively compared to the same period last year, reaching nearly VND 28 trillion and nearly VND 26.4 trillion. Net profit also decreased by 26% and 6%, to just over VND 4.7 trillion in 2020 and nearly VND 3.7 trillion in 2021.

Despite the difficult reality, it cannot be denied that Sabeco has made efforts during this period. In 2020, the Company marked its 145th anniversary with a series of activities, including organizing the “Rise with Vietnam” running program, introducing 2 new products: Lac Viet Beer and Saigon Chill Beer, and launching a new design for Saigon Gold Beer. In 2021, a number of community activities continued to be implemented, alongside the launch of the “Vietnamese Identity” collection and a limited edition of Saigon Lager Cans.

The expected recovery seemed to have returned after a year of 2022 with 42% revenue growth and 33% net profit growth, thanks to the recovery in beer consumption after the pandemic. However, the reality returned to “ground zero” as 2023 ended, with a 13% decrease in revenue and a 21% decrease in net profit, to nearly VND 30.5 trillion and over VND 4.1 trillion. Excluding 2021, this profit figure is lower than 2018 – the pre-COVID-19 level.

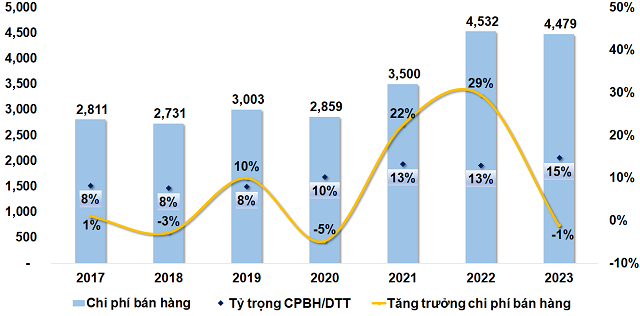

Overall, Sabeco’s revenue has shown a downward trend, resulting in increased sales costs to maintain competitiveness, especially in advertising and promotions. As a result, sales costs have continuously increased over the years, especially in 2022, which increased by 29%. Therefore, the proportion of sales costs to net revenue has also been increasing, reaching 15% in 2023.

|

The increasing trend of Sabeco’s sales costs

Source: VietstockFinance

|

Besides facing many difficulties, Sabeco is also affected as its main business line is not eligible for a 2% reduction in Value-added Tax in the second half of 2023, according to Decree 44/2023/ND-CP, as it is a Special Consumption Tax item.

In the future, in addition to existing pressures, Sabeco, specifically, and the beer and alcohol industry in general, will face additional challenges, including staying on the list of items not eligible for a 2% reduction in Value-added Tax until the end of June 2024, according to Decree 94/2023/ND-CP.

Another notable issue is the ban on driving vehicles while having alcohol concentration levels in the blood and/or breath. This is one of the regulations in the draft Law on Road Traffic Safety that the Government submitted to the National Assembly for comments during the 6th session held on November 29, 2023 in Hanoi.

Major changes in the global beer and alcohol industry

According to a report on the beer market segment revenue in Vietnam from 2014 to 2027 conducted by Statista, although the revenue of the beer market in Vietnam is expected to recover to reach $7.1 billion, it still cannot return to the pre-COVID-19 level.

According to Nguyen Van Viet – Chairman of the Vietnam Beer Alcohol Beverage Association (VBA), the sharp decline in domestic consumption is a clear signal of the decline in alcohol consumption globally.

In fact, not only in Vietnam, the beer and alcohol industry worldwide is also going through a difficult period due to changes in consumption trends and increasingly strict regulations of countries.

According to a report by Forbes, beer consumption in the United States has dropped below 200 million barrels for the first time since 1999. Even in 2022, for the first time, beer market share dropped to second place after wine – something that has never happened before in the United States.

Forbes states that Generation Z (those born from 1997 to 2012) currently consumes about 20% less alcohol than Generation Y (those born from 1981 to 1996); at the same time, the trend of consuming NoLo (No and Low Alcohol) drinks is becoming popular, leading to a decline in demand for alcoholic beverages.

This trend is not only about changing consumer views, but regulatory agencies in many countries have long tightened the management of alcohol products.

In neighboring countries to Vietnam, alcohol can only be sold within the hours of 11:00 – 14:00 and 17:00 – 24:00 in Thailand; otherwise, it is only allowed to be sold at international airports and legally registered entertainment venues. Violators will face corresponding penalties depending on the severity, including fines and even imprisonment. In addition, stores within 300m of universities and vocational schools have been banned from selling alcohol since 2016.

Some other countries in Asia also have strict age limits for alcohol consumption. For example, it must be at least 21 years old in the United Arab Emirates (UAE); 18 or 21 years old, depending on the state, in India. In China, the regulation banning the sale of alcohol to people under 18 years old has been in effect since 2006.

In the United States, alcohol buyers must present their identification (ID) and only those over 21 years old are allowed to buy alcohol. Similar regulations also apply in EU countries, but the age limit varies, averaging from 16 to 18 years old.

The bans are also based on blood alcohol concentration. Except for some countries that apply a common level for all, most countries divide the alcohol concentration limits by subject, including standard level, commercial drivers (taxi, bus, rental drivers), and new drivers.

Tightening regulations on alcoholic products, the trend of non-alcoholic beverages may be a reasonable choice. Many leading beverage corporations in the world have launched non-alcoholic beer products, directly competing with traditional beer and alcohol industries. An example is Anheuser Busch Inbev (AB Inbev) – the world’s largest beer company, which also stated that it has had to shift its business to non-alcoholic beverages.